Summary: The Dollar slipped against its Rivals on Friday after initially climbing ahead of a long US weekend to celebrate President’s Day today. The Euro took a hit to the chin, falling to 1.1234 November 2018 lows before recovering to close at 1.1300 on softer US capacity utilisation and import price data. Headlines across trading screens from ECB executive Board member Benoit Coeure’s speech read that the “economic slowdown is stronger than expected and inflation was shallow” weighed on the Single Currency. Strong British retail sales in January boosted the Pound despite concerns of a Brexit vote defeat in Parliament for PM Theresa May. Sterling ended up 0.68% at 1.2889 (1.2805 Friday). The Dollar Index (USD/DXY) slipped to 96.924 from 97.00.

Equity market sentiment was lifted after Chinese press headlines touted that a week of trade discussions with the US in Beijing had produced “step-by-step” progress. The DOW rallied 1.88% while the S&P 500 ended 1.29% higher (2777). US bond yields were unchanged.

- EUR/USD – slumped initially to 1.12341 overnight and over 3-month lows on Couere’s speech before an impressive bounce back to 1.1300 at the New York close. Which is basically where it started on Friday morning. The Euro’s strong bounce suggests further upside.

- GBP/USD – After falling from 1.32 to around 1.2750 on Brexit’s ongoing dramas, the Pound has come back on a combination of an overall weaker US Dollar. Robust retail sales data boosted Sterling and further gains are possible.

- AUD/USD – The Battler bounced back to finish up 0.43% at 0.7140 from 0.7105. Overnight low traded was 0.70794. The Aussie held the 0.7070 level well and looks poised to grind higher. The January monetary policy meeting minute from the RBA are released tomorrow.

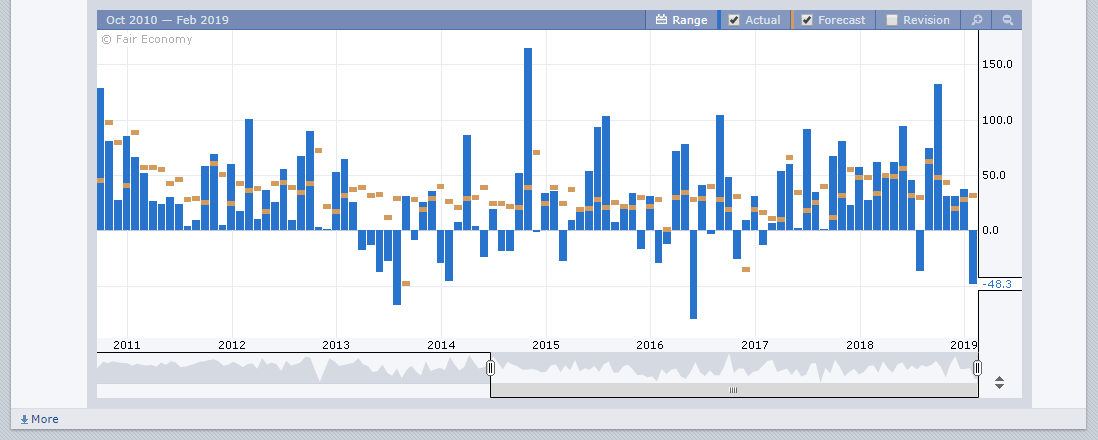

On the Lookout: With the US markets closed to mark the President’s Day holiday, we should see less headlines on the screens today. US data on Friday was mixed. Lower than forecast reads for US Capacity Utilisation and Import Prices were offset by stronger than expected University of Michigan Consumer Sentiment and Empire State Manufacturing data. US TICS Long Term Purchases for January sank to a whopping -US$ 48.3 billion from a previously revised lower figure of +US$ 32.0 billion. The balance of demands for US currency and securities fell unexpectedly, which does not auger well for the Greenback. US data disappointments could become more common.

Over the weekend, US President Trump issued an emergency along the US-Mexico border after Congress blocked his border wall funding request.

Trading Perspective: With the US on holiday today, expect a slow start to the week. Economic data is light as well. Recent ranges should remain intact although the lower broad-based US Dollar close suggests further downside correction before any rallies. Traders will keep their eyes on any news headlines across their screens from China on their trade talks with the US. Tomorrow sees the RBA latest monetary policy meeting minutes as well as UK Employment data.

- EUR/USD – The Euro recovered after making fresh 3-month lows (1.12341) following Couere’s remarks. EUR/USD closed just under 1.1300 which remains a pivot point. Expect further range trading for the Single currency with the bias likely higher following it’s strong close. Initial resistance lies at 1.1350 with the strong level at 1.1400. Expect immediate support at 1.1270 to contain any fresh selling. The next support lies at 1.1240 which is strong.

- USD/JPY – the Dollar edged lower versus the Yen, finishing at 110.45 from 110.57 on Friday. With US bond yields basically flat, trading in this currency pair was slow. USD/JPY traded to 111.13, December 27 highs before slipping lower. On the day, immediate support lies at 110.25 (overnight low), followed by 110.00. Immediate resistance can be found at 110.65, which was the overnight high. Look for a likely trading range of 110.15-65 today with the preference to sell rallies.

- GBP/USD – Robust British retail sales lifted the Pound. It was the best performer against the US Dollar among the major currencies. GBP/USD finished at 1.2889, not far from its overnight high of 1.2898. Immediate resistance can be found at 1.2910, followed by 1.2940. 1.3000 remains both psychological and strong resistance. We should see initial support emerge at 1.2870 followed by 1.2840. Tomorrow sees UK employment data. Any further strength in British economic data will further boost the Pound. Look for a likely trading range today of 1.2860-1.2920. Prefer to buy dips.

- USD/DXY – the Dollar Index finished a tad lower at 96.924 from 96.99 Friday. USD/DXY should continue to grind lower after its technical failure to break above 97.40. The initial support at 96.70/80 should contain any selling with the strong support at 96.40. Immediate resistance can be found at 97.10 and 97.40. Look to sell rallies and expect a drift lower on the Dollar Index.

Have a good week ahead, happy trading all.