As online trading companies introduce new technologies to stay on top of their game, CMC Markets announced a partnership with machine learning firm Tradefeedr to improve trading analytics and intelligence around liquidity management.

As online trading companies introduce new technologies to stay on top of their game, CMC Markets announced a partnership with machine learning firm Tradefeedr to improve trading analytics and intelligence around liquidity management.

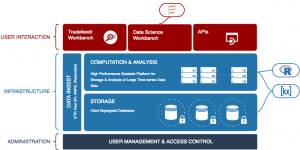

The retail foreign exchange and CFD broker, regulated by the UK Financial Conduct Authority, will be able to leverage Tradefeedr’s product for data integration, data exploration, and machine learning.

Data integration consisting of the ingestion, cleansing, and store of massive amounts of market and transactional data. Data exploration meaning high-performance computing infrastructure for inspecting, intersecting and querying massive data sets, as well as data visualization tools and APIs for extracting the results of analysis for further analysis.

The powerful analytical tools based on machine learning allow for data-driven decision making. Tradefeedr’s transparent models, pre-built frameworks, and feature engineering are capable of solving complex problems.

Balraj Bassi, co-founder at Tradefeedr, is an industry veteran with 18 years experience, including a number of years at Lehman Brothers, where he was detrimental to the rise in the electronic trading space in FX, being responsible for distribution.

At Lehman, Balraj advised institutional clients with a focus on foreign exchange within the Fixed Income Division. During his 7 years at State Street, he helped build the electronic trading franchise for State Street Global Markets. Most recently, he co-founded Blacktree Investment Partners LLP in 2009, a macro-systematic currency hedge fund. Balraj Bassi commented on the partnership:

“We work with our clients to solve complex problems and derive competitive advantages from understanding and using their data.”

Greg Niebank, Group Head of Product at CMC Markets, said:

“Applying machine learning to trading analytics gives us the insights we need to improve our liquidity and better manage our liquidity provider relationships. Partnering with Tradefeedr allows us to bring these capabilities to bear effectively”.

Tradefeedr extracts insights and information from vast quantities of market and transactional data. The company provides a purpose-built platform for supercharging data science projects within Financial Markets.

The platform is built using KX technology, a leading time series database, optimized for ingesting, analyzing and storing massive amounts of structured data. The system is complemented with R language and environment for statistical computing and graphics capabilities.

Voice Activated Skill market info on Alexa

On the side of the announcement, the CMC Markets also announced the launch of voice-activated Skill market info on Alexa. The voice-controlled CMC Markets will let users know about the latest development in the market, analyst tweets and market data. With this, CMC Markets became first Fx brokerage group to offer voice-activated insights through Alexa home assistant products. Users need to give the voice command “Alexa, open CMC Markets” to gain insight into the market. It will also let users know latest spreads and price change percentages for five of the most frequently traded instruments on CMC Market’s Next Generation platform.

David Fineberg, Group Commercial Director, commented:

“Our daily lives are becoming more and more centred on processing large volumes of information, as well as how we utilise the resources at our disposal. The CMC Markets Skill provides traders with a new and convenient method of staying informed and up to date, and crucially makes consuming large volumes of information more manageable.”

“At CMC Markets we recognise the power of technology, so we continue to invest in a range of services to be a leader in this space. This is why we have taken proactive steps to ensure that we are the first trading company to fully utilise the potential of this software. We are excited by how traders are engaging in the digital age, and the CMC Markets Skill we have developed is part of our ongoing strategy to enhance the overall experience of our clients by providing them with the information they need, when they need it.”