Some traders stick to a small exclusive list of stocks to trade while other traders are on the hunt for stocks making the news. For these traders seeking news catalysts, the best penny stocks change by the day although a successful trade can last more than one day.

Holding a stock overnight can be either lucrative or dangerous as we will see in examples below from this week. No one knows what will happen to a stock overnight because anything can happen.

To Hold Overnight Or Not To

A stock’s massive move could attract the attention of large short sellers that will push the stock lower or it could attract the attention of momentum buyers who strictly abide by the “the trend is your friend” motto.

On occasion, some penny stock traders hold a small part of their position overnight. If someone buys 1,000 shares of the stock gains 40% and the stock has a multi-day catalyst story, it might make sense on this occasion to hold 100 or 200 shares overnight.

Multi-Day Momentum

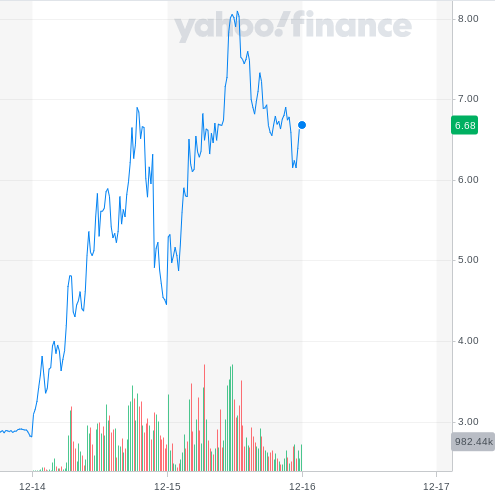

BioCardia Inc (NASDAQ: BCDA) closed Tuesday Dec. 15’s trading session at $6.70. Granted, at this price the stock is not considered a penny stock but this was not the case just one day prior.

BioCardia opened Monday Dec. 14 for trading at $3.11 and surged to a 52-week high just shy of $7 before losing some momentum and closed at $4.48.

The catalyst for Monday’s move was a company announcement that it expects to receive on Tuesday feedback on interim data from a Phase 3 trial that is currently enrolling nationwide.

On Tuesday, the stock recovered all of Monday’s reversal and hit a fresh all-time high of $8.60 before closing at $6.70.

Tuesday’s catalyst could be interpreted as an extension of Monday’s momentum. The company announced the sale of 1.89 million shares of its stock at $4.75.

Penny stock traders likely took this as a bullish indicator that management needs to raise some extra cash to proceed with its study as a favorable commentary from medical authorities was imminent.

The stock closed Tuesday at $6.70, good for another 50% return on top of Monday’s strong charge. Fast forward to the after-hours session and the short-term bull trend continued with shares up another 12%

News On Day One, Surge The Next Day

Sometimes a catalyst can present itself late in the trading session or even after the market closes. Many penny stock traders specifically hunt for late-day announcements because it is often unnoticed by many traders.

By the time all the other traders wake up and digest the news, a select few have already established a position.

A case in point is Elys Game Technology, Corp. (NASDAQ: ELYS), an interactive gaming and sports betting technology company.

On Monday afternoon, the company disclosed that its CEO Michele Ciavarella disclosed a purchase of 58,000 shares. As is always the case, traders and investors love to see insiders buying their stock. This legal and very common activity signals to investors that insider executives are confident in their company’s outlook.

The SEC Form 4 was dated Monday at 4:15 PM ET so many traders had already called it quits for the day and won’t see the news the next morning. The stock was already on many trader’s radars because it operates within the very hot, exciting, and fast-growing sports betting segment.

But traders who got in early on the action on Monday afternoon were rewarded Tuesday morning.

Elys’ stock closed Monday at $3.10 prior to the disclosure and opened Tuesday at $3.30. The opening print also represents the stock’s daily low and shares ran up to an intra-day and 52-week high of $4.47 within the first hour of trading.

Up One Day, Down The Next

The following example shows the downside risk of holding a penny stock overnight. This isn’t to say that penny stock traders should never hold a position while they are asleep at night — rather it is to demonstrate how one day of momentum doesn’t guarantee continued strength.

Synlogic, Inc. (NASDAQ: SYBX) is a clinical-stage company dedicated to creating medicines to treat diseases in new ways. On Monday, the company announced an encouraging update to a Phase 1 clinical trial of its therapy for the treatment of solid tumors and lymphoma.

Synlogic said its SYNB1891 investigational drug advanced into the combination therapy stage due to its safety profile so far in the study. Traders were buyers of the stock following the early morning press release and the stock opened 79 cents higher from Friday’s close at $3.03.

Shares ultimately ended the day at $2.54, up solidly from Friday’s close at $2.24. However, the stock ticked lower off the opening bill on Tuesday and opened at $2.34.

Experienced traders brushed off an overnight position as just a trade gone wrong while some new traders were left staring at their screen hoping for the red PNL line to turn green.

No trader can win on every trade. So when a trade moves in the wrong direction it is imperative to execute on an exit strategy to get out of the position.

By Jeff Broth.

Jeff Broth is a business writer, mentor, and financial advisor. He has been consulting for SMBs and entrepreneurs for the past seven years.