Banks Falter and the Fed Continues its Inflation Fight

By Giles Coghlan, Chief Market Analyst, HYCM

The Story So Far

Banking Uncertainty

In March, markets shifted their focus from inflation to the banking system. The collapse of several regional banks in the US, the acquisition of troubled Swiss banking giant Credit Suisse by rival UBS, and concerns surrounding Deutsche Bank dominated the headlines.

Hawkish Fed to Dovish Hike

Fed Chair Jerome Powell’s congressional testimony at the beginning of March prepared markets for a more hawkish road ahead. Following his address, there was broad consensus that the March FOMC meeting would result in a 0.5% rate increase. As solvency fears mounted, there was a great deal of uncertainty and speculation as to whether banking turmoil would force the Fed to pivot back to a looser monetary policy.

Powell announced a 0.25% increase, which was perceived by the market as a “dovish hike.” In the post-meeting Q&A he fielded questions regarding the rate path ahead and the solvency of the banking system. He spoke of continuing to fight inflation with higher rates and quantitative tightening, while shoring up the banking system with necessary liquidity.

At about the same time, Treasury Secretary Janet Yellen was testifying before congress. The disparity between Powell’s own “deposits are safe” statement, and Yellen’s “this is not something we have looked at, it’s not something we’re considering,” response, when asked about the possibility of guaranteeing all bank deposits, injected further uncertainty into markets.

ECB Remains Hawkish

In a turn of events, the ECB, whose own rate decision preceded the Fed’s, was the more hawkish of the two central banks. ECB President, Christine Lagarde announced a 0.5% hike and was unequivocal in her stance that there will be “no trade-off” between the central bank’s fight against inflation, and its support of the banking system.

Markets React

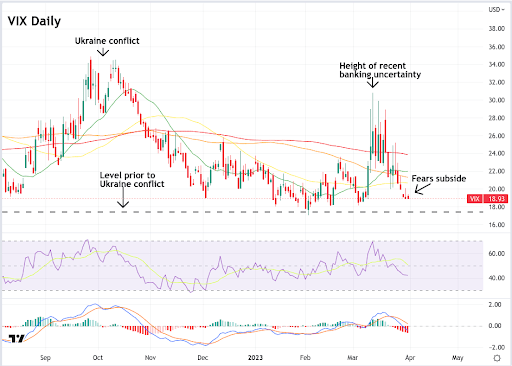

The VIX Signals Fears Easing (For Now)

The question dominating the present moment is to what degree the banking insolvencies are contained. The VIX, which had been at its lowest levels since before the Ukraine conflict last year, suddenly spiked from 18 to over 30. It has since fallen back down to around the 19 level.

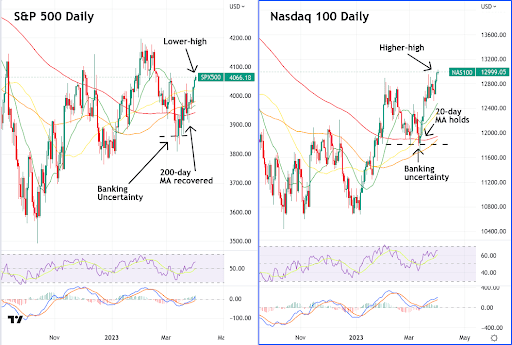

S&P 500 and Nasdaq Bounce

The fundamentals are mirrored in the broader technical picture, which saw both the S&P 500 and Nasdaq dipping to weekly lows at the height of the recent banking turmoil, and finding support as fears eased.

Both have since recovered from these local lows. The Nasdaq bounced from the 200-day moving average, and has since set a higher-high relative to February’s peak. The S&P recovered its own 200-day MA but has yet to set a higher-high relative to February.

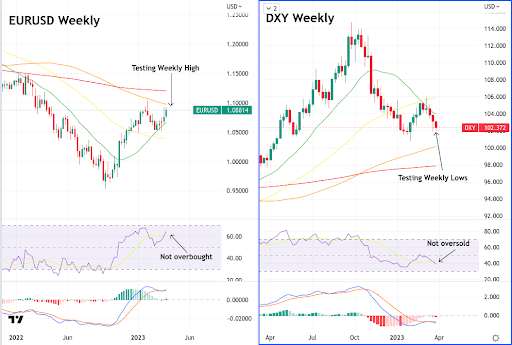

Dollar Weakness Continues

With the ECB now seemingly the only hawk left, dollar weakness continues. The DXY is currently trading below all major daily support levels at 102, with only February’s lows at around the 100 level remaining as support. Meanwhile EUR/USD has rallied to the 108-109 level, with the bulls currently making a push to 2023’s high at around 1.10.

Shifting Themes

From Landings to Banking

The conversation has now changed from the question of a hard-, soft-, and no-landing, to focusing-in on whether the recent banking uncertainty is contained, and whether the Federal Reserve is approaching a change in policy due to these signs of stress.

Recent positivity in equity markets in general, and specifically the growthier tech sector, speaks to a growing disconnection between market expectations and what the Fed has been saying it plans to do.

Tech Outperforms Cyclicals

This tension is evident in the way cyclical stocks from the financial, material, and industrial sectors have been performing relative to technology. Recent uncertainty has caused financial stocks to fall below all major moving averages. Material and Industrials, while also having recently dropped, are faring better, but technology is currently outperforming them all, showing that risk appetites are growing.

The Path Ahead

In Powell’s address following the FOMC decision, he acknowledged that recent shakiness in the financial sector could lead to a further tightening in financial conditions, and that these would have a similar effect to on-going rate hikes.

The road ahead is likely to be rocky because the narratives sustaining the current equity rally also happen to be the same things that are likely to encourage Jerome Powell to maintain a hawkish, higher-for-longer, stance. A resilient economy, stubborn inflation, a tight labour market, and banking uncertainty being contained.

Conversely, the events that could hasten a rapid pivot may be bad for everyone, at least in the short-term. Financial instability, another sudden and unexpected institutional collapse, or other areas of the economy coming under stress from higher rates.

4000 on the S&P, $2000 on gold

Gold’s recent outperformance reveals the extent of this uncertainty. While a lot of the conversation has surrounded Bitcoin’s recent spike almost to $30,000, gold is approaching all-time highs with its own stubborn round number at $2000 as psychological resistance.

As things currently stand, waiting for a confirmation of either the S&P breaking above 4000 with some meaningful volume behind it (risk-on), or gold doing the same thing with that $2000 level (risk-off), could be more prudent than allocating large amounts of capital to stocks before the above questions are answered.

HYCM investors appear to have anticipated the gold recovery. Gold was one of the most traded symbols in 2022.

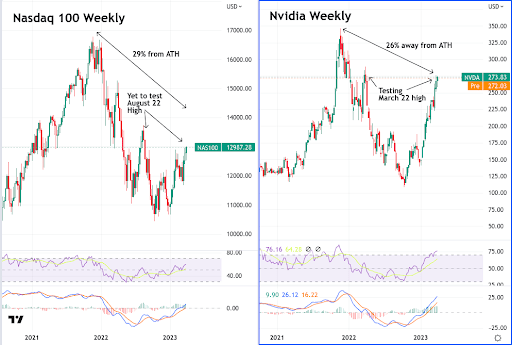

Keep an Eye on AI

Tech’s strong rebound has been driven by hype around the coming revolution in AI, as companies like Google and Microsoft compete to harness this exponential technology. Nvidia has been one of the darlings of this recent boom, its own chart is currently approaching highs last seen in March of 2022, massively outperforming the broader market.

It may be prudent to keep an eye on this sector, regardless of whether we’re still in a broader bear market that ultimately leads to new lows. When the bull market resumes, AI is likely to be one of the outperformers in the next cycle.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.