By Giles Coghlan, Chief Market Analyst, consulting for HYCM

US labour market showing continued strength

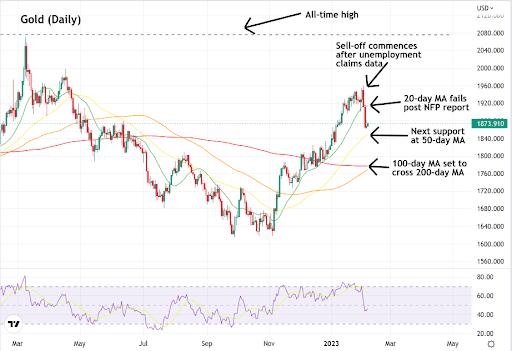

Gold’s recent rally appears to have been put on hold for the moment, with February’s non-farm payroll report shocking markets by coming in more than twice as high as expected. Analysts were forecasting February’s NFP to show a build of 185,000 non-farm payrolls for January, meanwhile, the report came in at 517,000. This was far above the maximum expectations of the 305 thousand of all economists surveyed. On top of this, the US ISM services PMI data came out 90 mins later with a stunning reading of 55.2 vs 50.4 expected. This was well above economists’ maximum expectations of 52.6.

The sell-off from gold’s recent high at around $1960 commenced a day earlier when a lower-than-expected US unemployment claims report showed 183,000 unemployment claims being filed for the prior week to the market’s expectations of 196,000.

Gold drops below its 20-day MA

The combined price action following these two reports saw gold dipping to $1910 on February 2, a price level that coincided with the commodity’s 20-day moving average. This level failed to hold on February 3 when gold sank further to a low of around $1860. Price action since this sell-off has been muted. There has been some tentative buying, but it appears that investors are still largely uncertain about committing to buying this particular dip.

Supported by central bank purchases in the latter half of 2022, gold prices surged from November onwards, rising by around 21% to the recent early February peak. This technically fulfils the criteria of a new bull market in gold, however, unexpected strength in the US labour market, coupled with growing positive sentiment around the probability of a soft landing for the US economy, have both dampened the prospects of the yellow metal.

Higher for longer and soft-landing hurt gold

The same combination of uncertainties that made gold appear attractive just a few short weeks ago when regarded as recessionary, now appear to be weighing on sentiment when viewed through the lens of a soft landing. A more robust than expected labour market, coupled with the Federal Reserve’s intention to “get the job done” by maintaining rates at a sufficiently restrictive level for the rest of 2023, has removed two of the main reasons that many investors had for getting behind gold. Namely, the possibility of a looming recession, followed either by a pause in the Federal Reserve’s hiking cycle, or a complete pivot in which they begin to cut rates.

Powell’s Comments

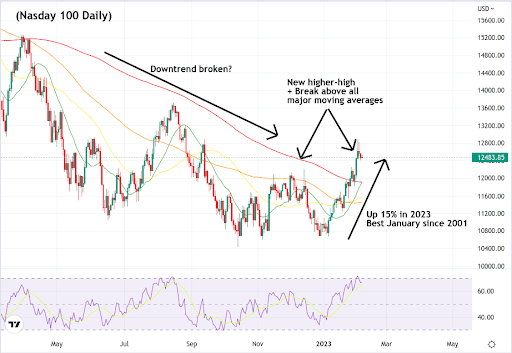

Jerome Powell’s recent post-FOMC address, while sticking to the script of higher for longer, and revealing precious little to get stock bulls animated, nevertheless seems to have reignited animal spirits due to his reluctance to push back more forcefully against the market’s expectations of an impending pivot in policy. Rather than talking markets down as he has in the recent past, Powell chose to politely disagree with both claims that financial conditions have actually loosened of late, as well as the forecasts that have the Federal Reserve cutting rates later in the year.

Best January for the Nasdaq since 2001

This has led to a surge in stock buying activity, particularly in the high-beta stocks that have suffered the most throughout this tightening cycle. The fear of missing out on buying the button, if this indeed is the bottom, is proving hard for many market participants to resist.

The Nasdaq 100 is up almost 15% since the beginning of the year, making this the index’s best January in more than a decade. Also, Cathy Wood’s Ark Innovation fund, known for its highly speculative technology investments, is on the path to having its best month ever.

Whether these impressive rallies are evidence that the worst is over for risk assets, remains to be seen. Bear market rallies are known for their powerful moves up against the prevailing trend. They are also just as well known for convincing investors that a new trend has begun, before running out of steam and eventually falling even lower than before.

Gold’s next lines of support

Whether the recent price action proves to be a bout of profit-taking after such a sustained rally depends on the next important support levels that gold must now hold. Gold’s 50-day moving average is currently sitting at around $1850, the price has yet to dip to this level, but it is an important one to hold should we see further selling.

Barring any severe downturn, the yellow metal’s 100-day moving average is set to cross its 200-day in a bullish direction within the next few days. This will see 20-day, 50-day, 100-day, and 200-day moving averages all in bullish formation.

All eyes now turn towards the next US CPI report, due on February 14, as well as the release of the Februarys FOMC meeting minutes in the next few weeks for further context on the recent 25-basis point rate hike. Either of the above could spell a change in direction for both gold and US stocks. With all the action in the gold market it’s not hard to see why gold is consistently one of the most traded instruments at HYCM.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.