by Giles Coghlan, Chief Market Analyst, consulting for HYCM

In crypto, there’s an interesting dynamic between bitcoin, bitcoin dominance (BTC’s market cap as a percentage of the overall crypto market cap), and the “altcoin” market (any crypto tokens other than bitcoin itself).

As you may know, bitcoin tends to act as a barometer for general crypto market health. When BTC confirms that it is indeed in a new bull market, liquidity floods from bitcoin into other crypto tokens that are considered riskier investments. The best performing smaller-cap names will then tend to outperform bitcoin itself in percentage terms over the course of the cycle.

On the other hand, during bear markets liquidity exits the altcoin market. Some flows back into bitcoin, but unlike during bull markets, much of this liquidity finds its way back into cash (or stablecoins). This is because investors are bearish on crypto as a whole during these periods, despite bitcoin being generally considered the safest crypto asset.

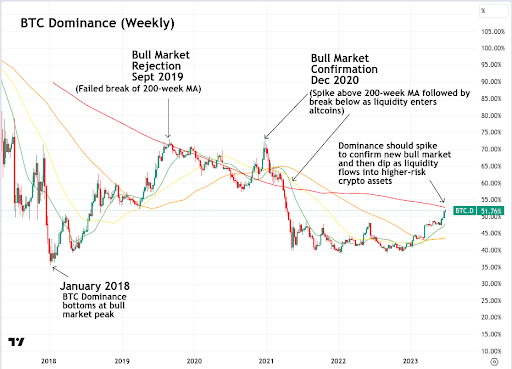

In other words, bitcoin dominance tends to spike in anticipation of a new bull market, as well as in its early stages (investment returns to BTC), only to dip as the bull market commences, and to bottom at the very peak of the bull market (maximum investment in tokens other than BTC).

The relationship is almost impossible to track prior to the 2017-2018 cycle as this was the period that saw altcoins truly coming to the fore, with Ethereum’s entry into the space making it much easier to create new crypto assets. Prior to this, bitcoin’s dominance held steady at over 95%. It is currently at 51%, having repeatedly tested lows of around 40% throughout the past two years. At the 2018 crypto market peak it got as low as 35.46%.

An interesting feature of this relationship is that when a bull market is confirmed, typically by bitcoin’s price clearing its former all-time high from the previous cycle, we see BTC dominance spiking first as capital floods in, and then plummeting back down as this capital then ventures out into more speculative crypto assets, seeking to outperform bitcoin over the course of the cycle.

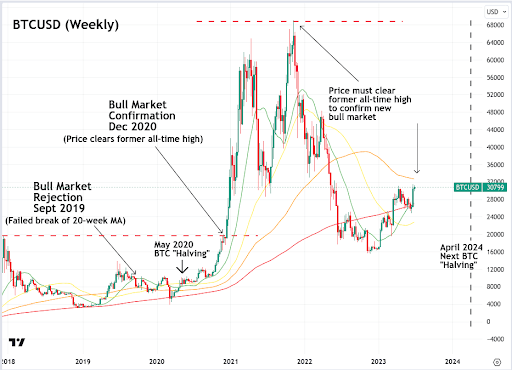

As you can see in the BTC dominance chart above, the 200-week moving average marked a failed break-out to new highs that occurred in September 2019. Capital flowed back into bitcoin following an almost 2-year-long bear market, but as is evident below in the weekly chart of BTCUSD price action, the rally stalled, and crypto investors would have to wait for more than a year for a resumption of the bullish trend.

This brings us to the present moment in which bitcoin dominance is on the rise again, buoyed by both technical and fundamental factors. Technically, we have bitcoin’s price breaking above the 20-week moving average (green line) and holding it as support, as well as setting a new weekly higher-high. Fundamentally, there is regulatory chaos in the altcoin market with the head of the SEC having recently stated that all cryptocurrencies other than bitcoin are unregistered securities, and BlackRock has recently filed an application for its own BTC ETF.

But if we look back at both the BTC dominance and BTCUSD weekly charts, there are some aspects of this bitcoin rally to be concerned about. Firstly, with BTC currently trading at around $30k, it has a long way to go if it is to even approach, let alone clear its 2021 all-time high at around $70, which is a prerequisite to the commencement of a new bitcoin cycle.

Secondly, as bitcoin dominance continues to rise it approaches its 200-week moving average, which has previously put a stop to the rise in bitcoin’s dominance. In September 2019, BTC dominance briefly broke above its 200-week MA on a dominance level of over 70%, only to grind along that line for more than a year.

Thirdly, as we’ve seen from prior bitcoin halving events, while there is a general increase in bitcoin bullishness in anticipation of the halving, the halving event itself does not lead to new highs. It actually functions more as a “buy the rumour, sell the news” event, with the break to new highs occurring months after the event itself as the shock to supply filters through the broader crypto market.

For example, in 2020 the halving took place in May, and bitcoin didn’t break to new highs until December, seven months later. With the next halving set to occur in April 2024, this would mean a break to new highs in November of next year using the previous cycle’s timing as a guide.

With these three points in mind, bitcoin still appears to have a lot of work to do if it’s to convince participants that something has changed in its underlying trend. Previous cycles also suggest that it still has a lot of time in which to do this.

Note: Cryptocurrencies are not available for trading under HYCM (Europe) Ltd and HYCM Capital Markets (UK) Limited.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances, as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information, please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.