By Giles Coghlan, Chief Market Analyst, consulting for HYCM

China’s lacklustre reopening has been one of the biggest disappointments for investors in 2023. Earlier this year, many market participants were expecting the abandonment of China’s zero Covid policy to increase demand and lead to a resurgence in global commodities.

The absence of this reopening activity, coupled with the CCP’s reluctance to stimulate the Chinese economy, has weighed on global commodity values. Copper, usually regarded as a reliable barometer of global economic health, has recently set new daily lows that go back to November of 22, and WTI is currently languishing in the low 70s

China’s growth for the year now looks as though it may be more in line with Beijing’s 5% GDP target, which global markets took to be far too conservative earlier this year. Thus, far the Chinese reopening has been led by consumer services, with its industrial sector still severely lagging. As investors come to terms with a global economy that’s still struggling with high inflation and tightening credit conditions, the implications of a deeper recession than many have been pricing-in is weighing on risk appetites.

It also looks as though it’s not all about zero Covid. The aftermath of China’s real estate bubble does appear to be weighing heavier on Chinese growth than anticipated. Real estate contributes to around a fifth of China’s GDP. With financial troubles persisting in this sector and the government unwilling to come to its rescue, investment is slowing, as is the commencement of new development projects.

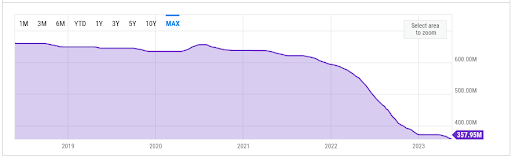

US Inventories Surprise

Last week we saw an enormous, unexpected drawdown in US crude oil inventories. The US Energy Information Administration (EIA) reported a 12.5-million-barrel drawdown versus the market’s expectation of a 900k barrel build.

When you factor in the US government tapping the country’s strategic petroleum reserve by a further 1.6 million barrels in its 8th consecutive weekly drawdown, this figure rises to 14.1 million barrels.

The end of May marks the beginning of the US summer travel season, which has refiners increasing their output in order to get ahead of the expected surge in demand. WTI prices rose by 2% on the day to over $74 per barrel but have since dropped by around 3% back down to around $71.

What we seem to be witnessing, at least in the short-term, are conditions of evident supply tightness that the market nevertheless appears to be discounting in expectation of further declines in supply.

OPEC Signals Further Cuts

Meanwhile, Saudi Arabia’s energy minister, Abdulaziz bin Salman, seems intent on artificially supporting energy prices by further constraining supply. He recently issued a warning that crude oil short sellers could be in for a shock at the next OPEC + meeting.

“Speculators, like in any market they are there to stay, I keep advising them that they will be ouching, they did ouch in April, I don’t have to show my cards I’m not a poker player… but I would just tell them watch out.”

What this almost certainly refers to, is to the possibility of further OPEC+ production cuts in the coming June 4 meeting. So far production in May has been largely in line with the surprise cuts its members agreed upon during OPEC’s April meeting.

For the moment, at least, it seems as though crude oil traders are calling the energy minister’s bluff. Whether his comments prove to be mere jawboning remains to be seen at the next meeting.

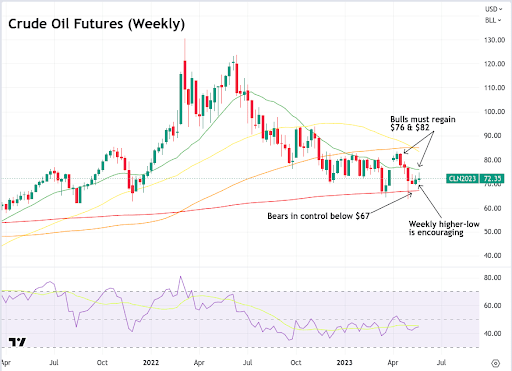

Technical Picture

The technical picture is decidedly bearish despite the above, with crude having broken below its last important daily moving average in the sell-off that followed the brief rally after the recent US inventory drawdown surprise.

On the weekly timeframe, only the 200-week moving average remains, currently sitting at just over $67. This important long-term support level previously held up during the selloff in early May, and back in mid-March. Should this fail, several weekly lows remain as support, such as the March $66 low (now below the 200-week MA), which coincides with the November 2021 low, and beyond that the August 2021 low just under $62.

Upside is likely to be capped by the 50-day moving average, currently at around $74.5, as well as both the 100-day and 20-week MAs, currently sitting at around $76.

What’s the Story?

If we look at other assets, such as gold, stocks, and crypto*, which have performed well this year, each has a strong counter-trend narrative to support its performance. Gold is attractive as a safe haven due to inflation and fears of recession. US equities have been buoyed by the AI phenomenon, and crypto has both the attraction of a hard asset during inflationary times, but also the incoming supply shock of next year’s bitcoin halving to support valuations.

Crude oil has no such narrative at the moment. China’s reopening has dissapointed, and markets are focusing more on the macro concerns of declining demand in a recessionary environment over the tightness in supply that has crude oil bulls expecting a change of trend. The trouble with that view is that it requires global demand to pick up when there’s a lot to suggest that the opposite may be the case.

Oil CFD as well as other instruments are available for trading at HYCM.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

*Note: Cryptocurrencies are not available for trading under HYCM (Europe) Ltd and HYCM Capital Markets (UK) Limited.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.