By Giles Coghlan, Chief Market Analyst, HYCM

US stock traders seem to be engaged in a dangerous game with the Federal Reserve, recently they managed to set the highest daily close for over a month despite a rather depressed earnings season on hopes that the Fed is going to start thinking about slowing rates. Just prior to the Fed’s blackout period Fed’s Daly said that the Fed would not just keep going at 75bps increments, but will step down to 50bps or 25bps increments.

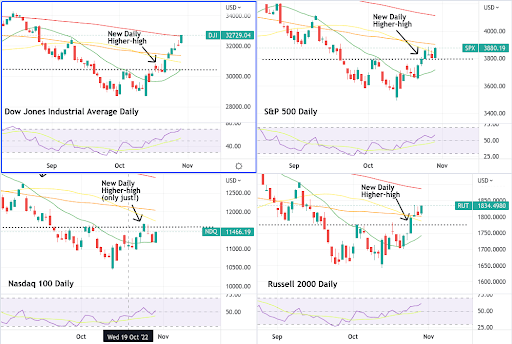

All four major US indices have staged meaningful bounces from the lows set in mid-October, with the S&P 500 up almost 9%, the Nasdaq 100 up almost 7%, the Russell 2000 up 10%, and the Dow Jones Industrial Average up more than 11.5%, at the time of writing.

Tech has been hit hardest amid a slew of disappointing earnings reports from some of the big names like Alphabet, Microsoft, Tesla, and Amazon. The Dow has proven to be the most resilient, bolstered by earnings beats from big brand components such as Caterpillar, McDonald’s, and Honeywell.

Throughout the year, there has been an abiding belief among certain investors that the Fed will eventually be forced to pivot away from its current hawkish stance. Considering how one-sidedly bearish the sentiment has gotten around US equities of late, and the extent of the downturn since the end of last year, a general atmosphere of bullish exuberance seems to be developing in certain quarters, accompanied by attempts to call for a bottom.

The Central Banks

Meanwhile, in the world of central banks, no concessions appear to be in store for market expectations. The message from the Federal Reserve is still hawkish, with Short Term Interest Rate markets pricing in a 97.9% chance of a 75-bps hike at the next meeting. The base case is that there is currently some question around whether December’s meeting will yield a 50-basis point increase.

Powell has already been blamed for getting it wrong once by misidentifying the post-pandemic inflation as transitory and not acting swiftly enough to curb it. There is real pressure on him here not to pivot too soon. A recent Bloomberg survey of economists had three-quarters of them actually expecting Powell to tighten too much rather than pivot too soon.

Lagarde is following the Fed’s lead with the ECBs second 0.75% hike in as many meetings despite Europe being in a much more economically tentative position than the United States. Kuroda recently held firm as was widely expected, Japan appearing to be playing the same waiting game as many of those aforementioned equities investors. The only surprise came from the Bank of Canada slowing the pace of its own tightening cycle by recently hiking by only half a percent rather than the expected 0.75%.

All this is to say, there does seem to be a definite element of confusion between what policymakers are saying, and what the bulls seem to have been reading into all of this. So, if the fundamentals appear to be against the bulls, what do the technicals have to say?

The Technicals

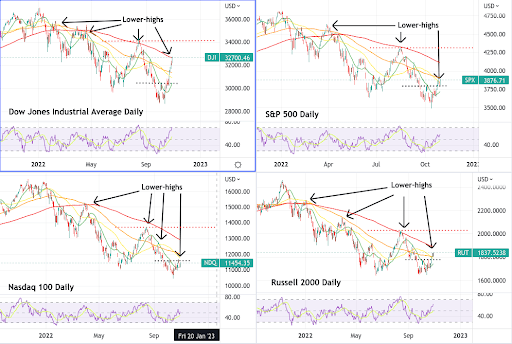

Turning to daily charts of the S&P500, the Nasdaq, the Russell 2000 and the Dow Jones, the picture doesn’t look very bullish either. Aside from the recent daily higher-highs set on all four indices (most convincingly on the Dow Jones and the Russell), the longer-term view has us in a pronounced downtrend that the recent rallies come nowhere near changing.

Furthermore, all four indices also set daily higher-highs back in March and August of this year without breaking the longer-term bearish trend. In other words, without follow-through, even what looks like a local higher-high is just a lower-high when you zoom out a little. The charts below are at the same timeframe as the charts above, just zoomed out further. As you can see, the broader view puts the current action into perspective.

Picking the bottom in a bear market is risky business because the bounces can be very convincing, but more often than not the change in trend fails to be confirmed and eventually the price breaks down to new lows, wreaking havoc with traders’ balances. It’s difficult enough to pick precise bottoms at the best of times, let alone with charts that look like these and with the world’s most powerful central bank saying that it would rather cause a recession than fail to bring down inflation.

If you are determined to get involved and are looking for some confirmation that this or any subsequent rally has some persistence to it, a convincing break above the 200-day moving average (red solid line) and a sustained period of trading above this level would be a good place to start. All attempted bounces this year have stalled at this level and gone on to set lower lows.

For a static level of support/resistance you need to look no further than those August highs (red dotted line) on each of the above indices. Any rally worth its name ought to break above the following levels on each index: 13,700 on the Nasdaq, 4300 on the S&P 500, 34,200 on the Dow Jones, and 2030 on the Russell 2000.

The Dow Jones is currently trading at its own 200-day MA while the others still have some ground to cover so this is the index to watch at the moment for any attempt to break and remain above its 200-day moving average.

Stock CFDs and indices, as well as other instruments, are available for trading at HYCM broker.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information, please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise.