Does its Unwillingness to Comment Signal a New Phase of the Game?

By Giles Coghlan, Chief Market Analyst, HYCM

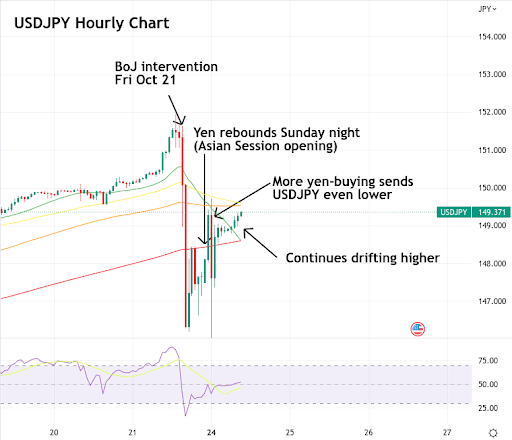

On Friday, October 21st, in a move that almost mirrored September 22nd’s price action on USDJPY, we saw another large spike down on the USDJPY pair, causing it to shed almost 4% of its value peak to trough, from 151.7 to 146.3. The move took place over a 4-hour period, the bulk of it occurring between 3pm and 5pm London time and bears the hallmarks of an intervention from the Bank of Japan to forestall the weakening of its currency in the face of what has been termed the ‘US dollar wrecking ball’.

If it was an intervention, the activity continued in the early hours of Monday morning when, having rebounded from 146.3 to around 149.7, another bout of selling took the USDJPY pair down even lower than during Friday’s trading, to reach a low of 145.5. Incidentally, this level is just off the highs that prompted September’s currency intervention. The USDJPY pair has since recovered and is currently trading just below the 150 level.

The Japanese government has not yet come out to confirm that it intervened in the yen’s exchange rate, in fact, the country’s Minister of Finance, Shunichi Suzuki explicitly declined to comment on the situation. Many are reading this reluctance as being in the interest of putting speculators off.

The last thing the BoJ wants at the moment is for traders to start expecting a coordinated series of interventions that they can front-run, or define a level at which they expect the BoJ to intervene. We saw something similar in the run up to the Swiss National Bank removing its own currency’s peg to the euro back in 2015. At the moment, it appears that the Japanese government prefers speculators to have no idea when an intervention is coming, in order to discourage shorts. Nevertheless, it certainly seems that the 150 level is one that the BoJ wants yen shorts to be wary of.

On Monday, Bloomberg published an article showing that the bulk of the BoJ’s currency interventions this year (both confirmed and suspected) have taken place outside of Japanese trading hours. The article also shows that over four-fifths of the sell-offs that have caused the yen to depreciate by over 20% against the US dollar this year have also taken place outside of the Asian trading session. This lends Japan’s offshore interventions the look and feel of a coordinated intervention aided by other global central banks despite the BoJ acting resolutely alone in 2022.

With the BoJ expected to stay its accommodative course later this week in its policy meeting, the pressure is mounting as Japanese importers and the Japanese population see their respective spending power eroded almost in real time. The BoJ apparently spent $20 billion during September’s intervention, and the Financial Times recently reported that the BoJ most likely spent $30 billion in this most recent alleged intervention.

The law of diminishing returns appears to be in effect here, owing to the fact that it’s the fundamental policy divergence between the US and Japan that’s causing the flight from the yen to the dollar. In such a scenario, interventions are only effective at slowing the pace of the general direction of the move, not averting it altogether.

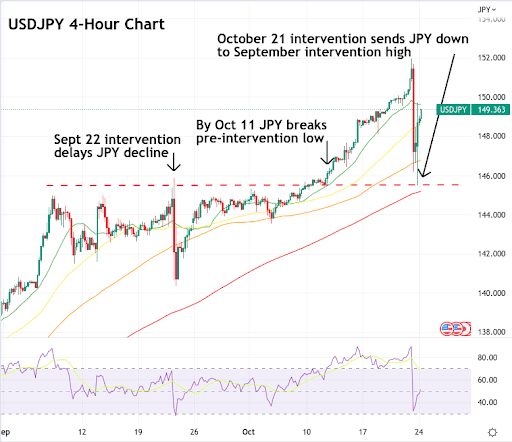

The charts certainly seem to be telling the same tale here. September’s intervention barely managed to get the yen down to where it had been trading at the beginning of that month. All it took is four trading days for it to recover above all major moving averages before continuing on its upward march.

By October 11, USDJPY had closed higher than the 145.9 level that hastened September’s intervention. As mentioned earlier, this latest bout of yen-buying has only managed to momentarily get the exchange rate down to where it was at the September peak that prompted the initial BoJ intervention. And barely a day’s worth of trading is all that’s been required for the USDJPY exchange rate to drift back up to that 150 level again.

So, what’s the BoJ’s endgame here? Surely it knows that as long as the Federal Reserve maintains its hawkish stance, this is a battle it can’t win even when factoring in its near $1.2 trillion in foreign exchange reserves (according to the Financial Times). One of the logical explanations is that the BoJ is waiting for US rates to peak early next year (or for something to occur hastening a pivot from the Fed), at which point the dollar ought to come down too. So, it could be that the report on Friday, October 21 that Fed whisperer Timiraos is suggesting the November meeting will be used to discuss a slowdown of Fed tightening is a catalyst the BoJ is hoping to capitalise on. Furthermore, on the same day, Fed’s Daly also said the Fed will not just keep going up at 75bps increments but can step down to 50 or 25 bps moves. Did the BoJ try to use these events as a catalyst to assist them with keeping USDJPY prices capped?

What’s certain in all of this uncertainty, is that FX is back to being the most exciting game in town, and the BoJ’s game of cat and mouse with traders seems to be just heating up. While exceedingly risky, 4% moves in a single day are going to prove very difficult for speculators to resist trying to time.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd, and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information, please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinion of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.