By Giles Coghlan, Chief Currency Analyst, HYCM

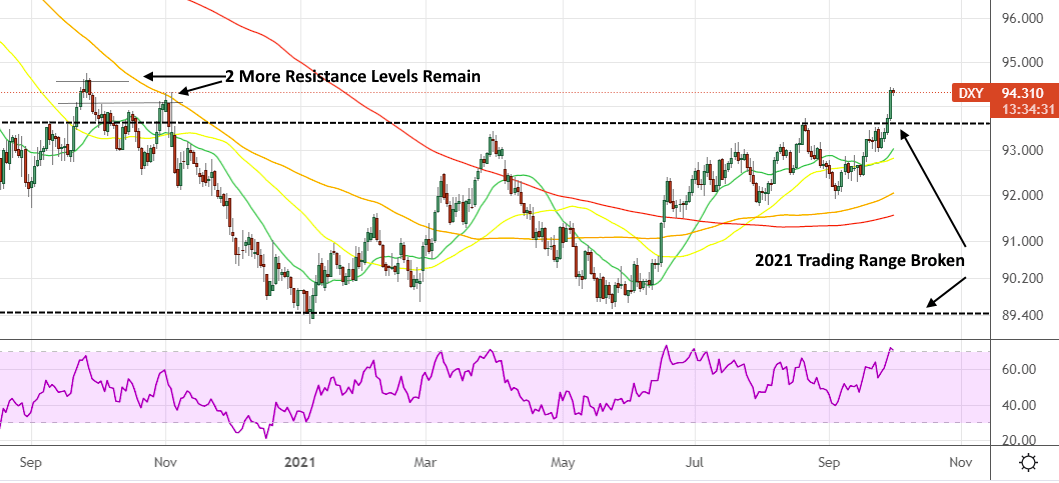

All eyes are firmly back on the US dollar with the DXY having recently broken resistance to trade at yearly highs. The index spent the bulk of 2021 trading in a range between 89.4 and 93. It opened the year at the lower end of the range and returned to re-test it in February, May, and June of this year. March saw a rally to the upper end of the range, followed by a failed re-test that fell short in July. August saw the DXY breaking its yearly high to trade briefly at the 93.7 level which has finally given way to upward pressure in the last few days of September. The recent price action has taken the DXY as high as 93.4, a prior resistance level going all the way back to November 2020.

FOMC Tone Turns Hawkish

This price action has taken place against a backdrop of risk-off sentiment in US equity markets as investors attempt to parse the rhetoric coming from the Federal Reserve. Jerome Powell’s recent FOMC statements have primed the market to expect a sooner-than-expected conclusion to the taper that is currently expected to start before the close of 2021. In a recent statement, Powell shared the belief that the Fed’s employment goals are “all but met,” and that “tapering could conclude by the middle of next year.” This evidently more hawkish stance has followed a gradual shift from dovish to less dovish, as seen in the “talking about talking about tapering” comments he made earlier this year, as well as the tone he recently struck in his Jackson Hole address. Interest rates were also in the spotlight, as 9 of 18 regional bank presidents now expect borrowing costs to rise in 2022.

US Equities Sell-Off

US Equities slid on the hawkish tone. The S&P 500 had already been in the midst of a correction to the 50-day moving average, which has held up as a reliable line of support on ten previous occasions in 2021. The change in outlook following Powell’s comments led to an extension of the sell-off, down to the 100-day moving average. Tech has been the most severely affected sector, with names like Google, Facebook, Microsoft and Apple experiencing 7-12% declines from their recent highs.

The Russell 2000 has held up reasonably well, even if only because it has essentially been trading sideways since February of this year. Of the other major US indices, the Dow Jones Industrial Average looks to be setting a daily higher low at 34,200. Meanwhile, the S&P 500 is trying to bounce from the marginally lower low it set on September 28 at around 4,350; and the Nasdaq appears to be the worst of the three, technically speaking, with July’s low at around 14,500 now in play.

Longer-Term Bonds Sell-Off, Yields Rise

Notably absent from Jerome Powell’s FOMC press conference address, was the word transitory in describing recent inflationary pressures. If anything, his statements reveal a dawning acknowledgement that the inflation we’ve been seeing will prove to be stickier than was originally thought. Comments such as: “Inflation is elevated and will likely remain so in coming months before moderating,” and: “These bottleneck effects have been larger and longer-lasting than anticipated, leading to upward revisions to participants’ inflation projections for this year,” reveal a change of attitude.

Bonds have been unequivocal in their reaction to this shifting attitude, the US 10-year sold off following the conference and 10- year yields surged by 17%. This is all but the last hold-outs in the transitory camp beginning to accept that inflation is here to stay, meaning that the Fed may have to raise interest rates to cap inflation.

US Dollar Outperforms its Peers

The US dollar has undoubtedly been the main beneficiary of all this news, sentiment and price action. Whether it is equity investors taking profits, bond investors readjusting their portfolios, or general inflation fears with energy prices at their highs and an uncertain winter ahead, all of this uncertainty is materialising as US dollar strength. Yesterday’s trading led to a close above the November 2020 high of 94.1 on the DXY. All that remains now is September 2020’s high of 94.5. Were this level to be broken, there’s not much in the way of technical resistance all the way to the 96.7 level the DXY hit in June of last year.

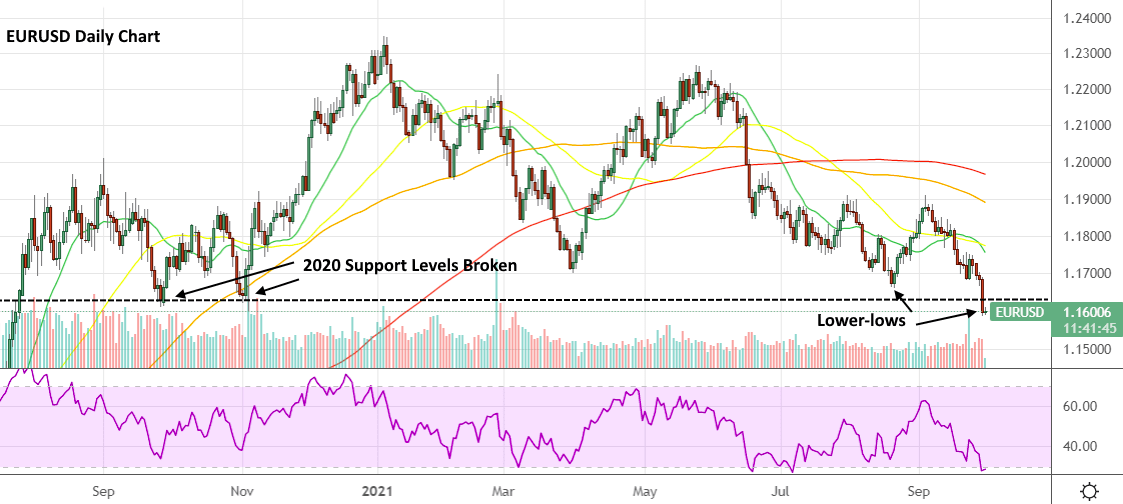

Perhaps the most compelling chart, which could be signalling further room for the dollar to rally, is EURUSD. With the euro being the most heavily weighted component of the US dollar index, euro weakness is playing a big part in the recent outperformance of the DXY. Yesterday’s EURUSD close at around 1.16, definitively breaks a long-standing line of support that goes all the way back to September of last year. Again, there is not much in the way of support now other than the March 2020 peak at 1.148 and the June 2020 lower-high at just over 1.14.

Final Thoughts

We’ve seen the Fed attempting to jawbone the market down on numerous occasions this year. Even with this most recent change of tone, details are still thin on the ground. Jerome Powell has informed us when he expects tapering to be completed, without confirming when it will actually begin and how much of a reduction in asset purchases we will see. Thus far, the market has been willing to call the Fed’s bluff, buying each dip en masse on the way to new highs. This last sell-off has been much more disorderly and fear-driven, with dip buyers yet to show up in force. Can the Fed thread the needle, taking some of the heat out of inflationary pressures without an ugly taper tantrum? It remains to be seen.

About HYCM

HYCM is the global brand name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, Henyep Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under Henyep Capital Markets Group, a global corporation founded in 1977, operating in Asia, Europe, and the Middle East.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.