Chinese Yuan stabilised causing risk aversion to ease slightly, but geo-political woes remain strong weighing down market bulls causing conflicting price action.

Summary: Global market today saw major risk assets – benchmark indices, equities trade with dovish bias, but the impact of bearish influence in market has eased a bit compared to yesterday’s trading session. The easing impact of dovish influence in the global market was influenced by Chinese Yuan which managed to contain loss at previous session lows and rebound today albeit remaining well near previous session lows. US Treasury Department has labelled China a currency manipulator which has been refuted by China, but this has erased any hope of swift resolution in trade talks with several market experts predicting that trade war is unlikely to see any resolution before US elections in 2020. This has caused market bears to gain solid fundamental support. However, European market is seeing equities trade with positive bias well in contrast to Asian equities on positive boost gained from better than expected German macro data update earlier today. In the forex market, major global currencies have gained a fresh bullish boost as Yuan stabilised today while USD continues to suffer from trade war woes.

Precious Metals: Both gold and silver are trading with positive bias in the global market today. But gains are capped as risk on investor sentiment gained a boost in European market hours. Meanwhile, safe haven demand on escalating trade war woes and weak USD continues to provide precious metals bull with strong fundamental support while gold is stabilising its foot hold near 6-yr highs.

Crude Oil: The price of liquid gold in the spot market is seeing sharp declines on major international benchmarks on both sides of Atlantic Ocean. Escalating trade war woes and cues from US Treasury department labelling China as currency manipulator dampened demand outlook for crude oil in the global market while influence from stabilising Yuan helped limit declines.

AUD/USD: The Australian Dollar today managed to lose influence from market bears and staged significant recovery action as RBA’s decision to hold back much anticipated rate cut following Lowe’s comments in recent past turned out to be a bullish factor. Weak USD on declining US T.Yields and stabilising Chinese Yuan also added support for stable run near intra-day highs but trade war woes cap further gains in immediate future.

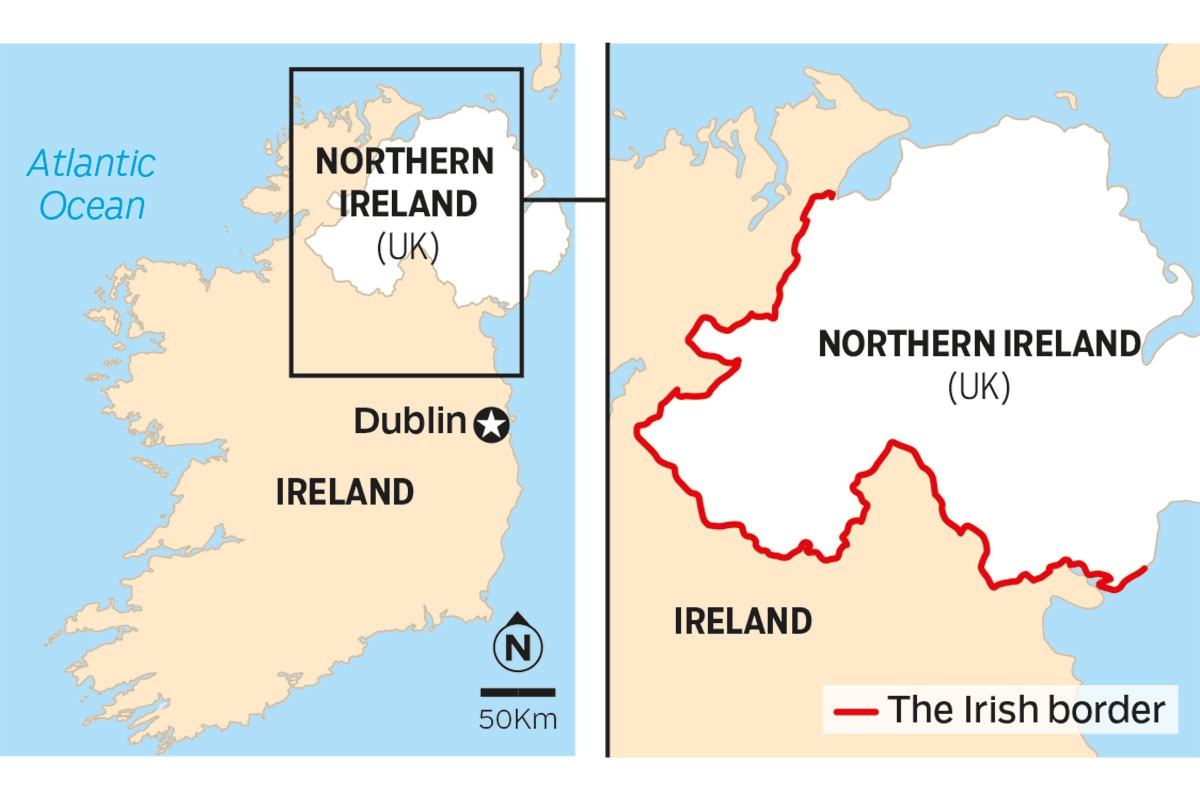

On The Lookout: Geo-political events are heating up and moving back to front seat as driving force behind the long term price momentum of risk assets across the global market. Proceedings between China and US over the last two days has made it clear that there will be no resolution of trade deal in immediate future with possibilities for further escalating in immediate future. Meanwhile on Brexit front, odds of no-deal scenario continues to increase with each passing day as EU officials have rejected all request from UK government to re-establish negotiations owing to demand from new PM Boris Johnson to remove Irish backstop agreement which was agreed upon during Theresa May’s reign as PM. In immediate future traders await US Jolts job openings data for short term profit opportunities.

Trading Perspective: Forex market is likely to see positive price action continue in North American market hours, but positive US macro data could influence a USD rebound which will cap further upside movement of major currencies. US stock and index futures trading in the international market ahead of Wall Street opening saw positive price action in the global market today suggesting Wall Street could open positive today and rebound from previous session lows. On earnings calendar, Wall Street will see financial results from Devon Energy, Discovery, Emerson, Fidelity National Info and Walt Disney.

EUR/USD: While most major global currencies are trading positive today, Euro is trading in red owing to impact of trade war woes on trade dependent European economy. But positive German data helped cap the decline. The pair is back below 1.12 handle, traders now await US JOLTS Job openings data for short term directional cues.

GBP/USD: British Pound is trading with positive bias in the global market today driven by broad based USD weakness. But hard Brexit outcome continues to loom nearby weighing down GBP bulls capping further gains. The pair is trading range bound near mid-1.21 handle as traders await US macro data for short term profit opportunities.

USD/CAD: The pair slid earlier in the day on slight boost in crude oil price, but reversed all declines as oil price pulled back weighing down crude oil price in the global market. The pair is currently trading near session tops around 1.3225/26 handle. Traders now await US macro data for directional cues and short term profit opportunities.

Please feel free to share your thoughts with us in the comments below.