The Basel leverage ratio has caused banks to reduce their clearing activity for E S&P 500 E-mini futures.

In April 2019, the Commodities Futures Trading Commission’s (CFTC) Office of the Chief Economist (OCE) put out a white paper entitled, “When the Leverage Ratio Meets Derivatives: Running Out Of Options?”

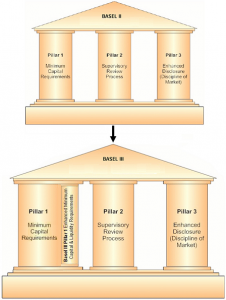

In the paper they described the Basel rules and the effect, “In the wake of the global financial crisis of 2008–2009, Basel III introduced a more comprehensive set of capital and liquidity requirements for banks in order to address shortcomings in the pre-crisis capital framework and improve the resilience of the financial system. In addition to higher standards for the risk-based capital ratios and the credit quality of capital, the Basel committee also issued the Basel III leverage ratio framework as a simple, transparent, non-risk based approach to pair with the risk-based standards.” The paper stated, “Though US banks have long been subject to a less comprehensive leverage ratio that requires capital only against on-balance-sheet assets, Basel III expands it by including off-balance-sheet exposure for derivatives and a few other businesses in the leverage calculation. Therefore, the Basel III leverage ratio can significantly increase the capital requirement for banks’ derivatives activities.”

Richard Haynes and Liphong McPhail, who headed the research for CFTC, were the latest featured guests on CFTC Talks where they discussed their findings.

In the show, McPhail and Haynes specifically talked about the E-mini product.

The E-mini is, “An electronically traded futures contract one fifth the size of standard S&P futures, E-mini S&P 500 futures and options are based on the underlying Standard & Poor’s 500 stock index. Made up of 500 individual stocks representing the market capitalizations of large companies, the S&P 500 Index is a leading indicator of large-cap U.S. equities,” according to its description on the CME, where it is traded.

“Our analysis shows that clearing E-mini futures options has shifted in the way we anticipated from institutions more constrained by capital rules to those less constrained.” Haynes said on the show.

He said US banks have seen their clearing business drop from 46% to 36% of the total business recently.

“For example, before January 2015, 46% of all E-mini futures option positions were held in customer accounts at US banks; after the date, this number declines to an average of 36.5%.” The paper stated. “By contrast, during that same period, customer positions in E-mini futures options cleared through EU banks, which are subject to a lower leverage ratio, increased from 38.6% to 47.9% of the total.”

The paper further noted, “Using daily positions of clearing members and their customers on S&P500 E-mini futures options, we test the following four hypotheses when the public disclosure of the leverage ratio became mandatory in January 2015: (1)banks lose market share to nonbanks; (2) US banks lose market share to European banks; (3) banks’ clearing activities shift away from customer accounts to house accounts; (4) low-delta options are affected most by the leverage ratio,”