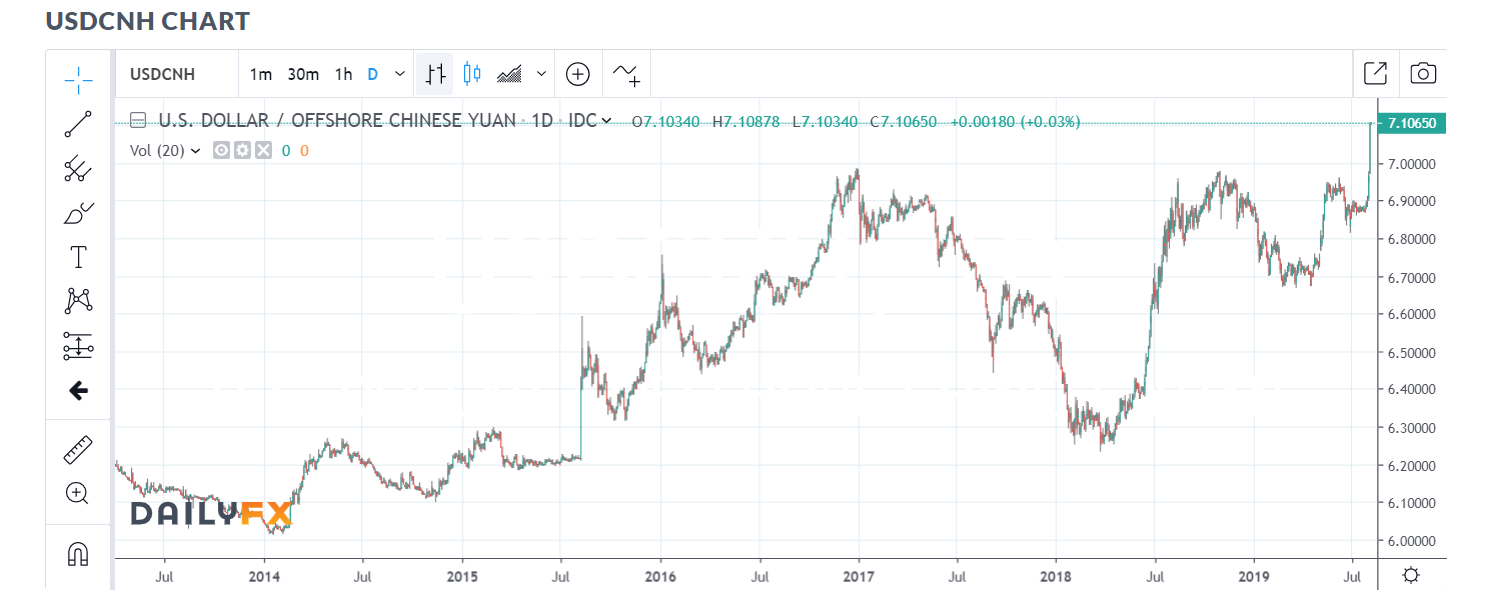

Summary: China chose to use their currency as a weapon of choice to retaliate in their trade war with the US. Yesterday morning, the offshore Chinese Yuan (CNH) plummeted beyond the USD 7.00 level for the first time since 2008, trading up to 7.1083 before settling at 7.0980. The Chinese government also asked state-owned companies to suspend imports of US agricultural products. Currency volatility, dormant for some time, sprang to life while global asset markets plummeted.

US President Trump accused China of “currency manipulation” in one of his tweets, adding that he would like the Federal Reserve to act as a counter. In breaking news this morning, the US Treasury designated China as a currency manipulator. Traditional havens, Yen and Swiss Franc soared against the US Dollar. The Dollar hit a 7-month low against the Yen trading to 105.53 in early Sydney trade. The Swiss Franc surged to 0.9715 (0.9825 yesterday) against the Greenback. The Euro rallied 1% to 1.1215 from 1.1105 as US bond yields extended their slump. The Dollar Index (USD/DXY) fell 0.75% to 97.380. The Australian Dollar slumped, going against the trend of the weaker Greenback, to 0.6760 (0.6800). Fears of an all-out trade war involving China, Australia’s largest customer has weighed on the Battler. Emerging Market currencies plunged. The Russian Rouble lost 3.6%%, trading to 65.80 from 65.10 yesterday.

US Treasury prices soared while yields slumped. The 10-year US bond yield closed at 1.72% from 1.85% yesterday. Stock markets plunged in response with the DOW losing 3.5%, the S&P down 3.7%.

Euro area Services PMI’s mostly matched forecast. The US ISM Non-Manufacturing PMI for July plunged to 53.7, missing forecasts of 55.5 and its lowest since October 2016.

- USD/JPY – The traditional haven darling Yen did not disappoint soaring past the 106.00 USD level to 105.523 in early Sydney, the Greenback’s lowest since the flash crash in January this year. USD/JPY opened at 106.60 yesterday. Japan’s top currency diplomat, Yoshiki Takeuchi warned that Tokyo was ready to intervene if Yen gains threatened the export reliant economy.

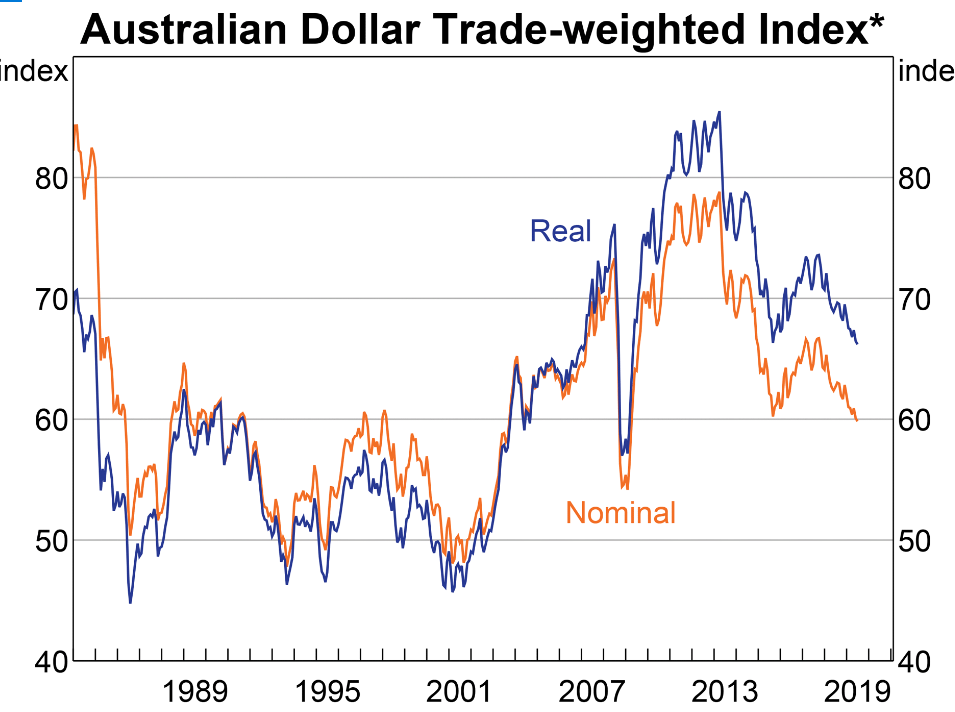

- AUD/USD – The Australian Dollar slumped to 0.67481, 7-month lows as the trade clash involving China, the country’s largest customer weighed on the currency. The RBA monetary policy meeting today will keep traders cautious. The Australian Dollar has also plummeted against other currencies with the Trade Weighted Index down to a low of 59. From 65.7 in January 2018. The RBA will keep rates unchanged at their meeting with the AUD TWI so low.

- EUR/USD – The Euro rallied against the Dollar to 1.1226 highs in early Sydney this morning. The slump in the US 10-year bond yield to 1.72%, from 1.85% was not matched by Germany’s 10-year Bund yield, down 2 basis points to -0.52%. The narrowing rate differential has seen traders covering Euro shorts.

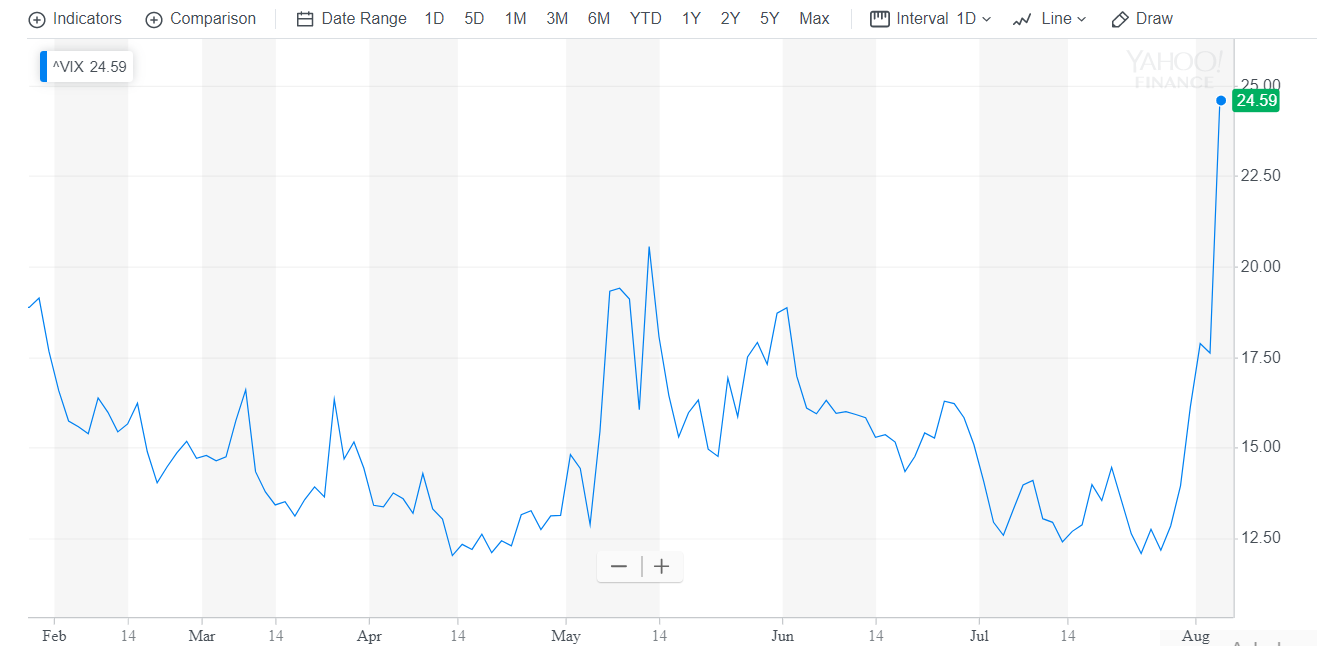

On the Lookout: Indeed, the currency wars have begun, get ready for some good old-fashioned currency volatility. THE CBOE VIX Volatility Index soared 39.6% to 24.6 from 18 yesterday and 12.16 on July 26.

Today sees first tier economic data and while they will have less of an impact in current markets, they should not be ignored. New Zealand’s Q2 Employment beat forecasts to 0.8% against a median forecast of 0.3% and Q1’s -0.2%. The Unemployment Rate improved to 3.9% from 4.2% while Labour Costs climbed to 0.8% from 0.3%. The New Zealand Dollar popped to 0.6565 from 0.6535 on the release. Japan releases its Household Spending and Averaged Cash Earnings report for July. Australian data released today are the July Trade Balance as well as ANZ Bank’s Job Ads.

The RBA is expected to maintain its cash rate at 1.00% and keep policy unchanged at its meeting later today (2.30 pm Sydney time). With the AUD Twi so low, authorities will not want any further sustained weakness.

Other data released today are Germany’s July Factory Orders and US JOLTS Job Openings. FOMC member and St Louis Fed President James Bullard speaks at a function in Washington, DC.

Trading Perspective: The Dollar Index (USD/DXY), which basically mirrors the Euro lost ground as US bond yields extended their slump. Other global bond rates slipped but not to the extent of those in the US. This will continue to weigh on the US Dollar against the Majors. Net currency market positioning is still long of US Dollars, which will continue to correct itself in the current environment. The Emerging Market currencies will continue to trade in tandem with the Chinese Yuan. We can expect a reaction today from the Chinese monetary authorities. The People’s Bank of China could fix the currency higher (ie USD/CNH lower) in order to put some stability back into the markets.

Traders will watch for verbal intervention from other Asian and regional central banks led by the Bank of Japan.

- USD/JPY – The Dollar continued to stay under pressure against the haven darling Yen. In the Asian time zone, we can expect further Japanese verbal support for the Dollar given the speed and extent of the Yen appreciation. The Yen has also appreciated against the Australian Dollar and its Asian counterparts. All of which are to the detriment of Japanese exports. Japanese corporations, mainly importers will look for ideal levels to buy USD/JPY. The slump in the US 10-year bond yield will keep a top to USD/JPY. The Dollar has immediate support at 105.50 followed by 105.00. Immediate resistance lies at 106.00 and 106.50. A prominent US Investment Bank has issued a call for USD/JPY to hit 103.00. This is often a good reverse indicator in this writer’s trading experience. Look to buy dips in a likely 105.40-106.40 range today. Expect a volatile ride.

- AUD/USD – The Australian Dollar has continued its slide since the Battler broke though 0.69 cents on July 31. Early this morning, the currency traded to a 7-month low at 0.67481 before settling at 0.6763 currently. The slide in the Yuan above the USD 7 mark and weaker EM currencies has weighed on the Aussie. The Aussie has also fallen against its Rivals and the Australian Dollar Trade Weighted Index is at its lowest since the GFC in 2008. While the RBA has desired a lower currency, the speed and extent of the TWI fall is not ideal. And the RBA will not ease interest rates in this environment. Immediate support can be found at 0.6750 and 0.6720. Immediate resistance lies at 0.6780 and 0.6820. Look to buy dips in a likely 0.7650-0.6850 range.

- EUR/USD – The Euro grinded its way up against the US Dollar which weakened against all of its Major Rivals. EUR/USD closed up 1% at 1.1210 further climbing to 1.1245 high in early Sydney. The Single currency recorded its largest daily advance against the Greenback since January 2019. The slump in US bond yields has boosted the Single Currency which has seen a massive bout of short covering in the past 24 hours. EUR/USD has immediate resistance at 1.1250 and 1.1270. Immediate support can be found at 1.1200 and 1.1170. Markets have ignored the ECB for now. Look to sell rallies with a likely range today of 1.1190-1.1250 today.

Tin helmets on, we are in for a ride. Enjoy. Happy trading all.