Summary: US Payroll growth steadied to 164,000 in July matching expectations of 165,000. While Wages grew, the Unemployment rate rose above forecasts at 3.7%. June’s Job gains were revised lower (193,000 from 220,000). Trade tensions with China remained high, extending the market’s risk-off stance. The Dollar weakened broadly as expectations grew that the Federal Reserve would trim interest rates again in September. Global bond yields tumbled as markets prepared for further stimulus from monetary authorities. The Dollar plummeted to 106.50 against the Yen, its lowest since the flash crash in January 3. Versus the Swiss Franc, the other safe-haven currency, the Greenback fell 0.65% to 0.9825 (0.9905 Friday). The Euro gained 0.10% to 1.1108 (1.1088) while Sterling rallied to 1.2160 from 1.2125 on short covering. The Australian Dollar finished little changed at 0.6798 (0.6800 Friday).

The yield on the US 10-year bond fell 5 basis points to 1.85%. Germany’s 10-year Bund yield was down to -0.50%, a new record low. Australian 10-year notes were yielding 1.08% from 1.21% Friday.

Wall Street stocks extended loses, the Dow was down 0.24% to 26,479. The S&P 500 fell 0.57% to 2,932.00.

Other data released Friday saw Australian Retail Sales for July beat forecasts at 0.4% (vs 0.3%) while Q2 PPI rose to 0.4%, beating forecasts (0.2%) while matching the previous month’s 0.4%. Eurozone July Retail Sales beat expectations, climbing 1.1% (vs 0.3%) while June Sales were revised down to

-0.6% from -0.3%.

- USD/JPY – slid to January 3 lows at 106.508 from 107.39 Friday. The fall in the US 10-year yield to 1.85% and the risk-off stance due to trade tensions weighed heavily on the Greenback. USD/JPY closed at 106.63.

- EUR/USD – The Euro rallied on broad-based US Dollar weakness to 1.1108 (1.1088 Friday). The Single currency extended its rebound off May 2017 lows at 1.10268.

- AUD/USD – The Aussie remained under pressure weighed by the trade uncertainty between China and the US after Trump imposed more tariffs on Chinese goods. Australian Retail Sales and PPI reports both beat forecasts. The RBA is expected to keep rates unchanged at their policy meeting tomorrow after cutting them twice in the last two months.

- USD/DXY (Dollar Index) – The Dollar Index slipped to close at 98.096 from 98.374 on Friday, down 0.28%. Increased bets for a Fed rate cut in September saw a 5-basis point drop in US 10-year rates to 1.85%, last seen in late 2016.

On the Lookout: The week ahead presents a relatively light data and events calendar. Today sees the release of global Services PMI’s which begin with China’s Caixin Services report. Euro area (Spain, Italy, France, Germany) and the Eurozone Services PMI’s follow. The Eurozone Sentix Investor Confidence report for July is released shortly after. UK Services PMI, US Final Services PMI and US ISM Non-Manufacturing PMI’s round up today’s reports.

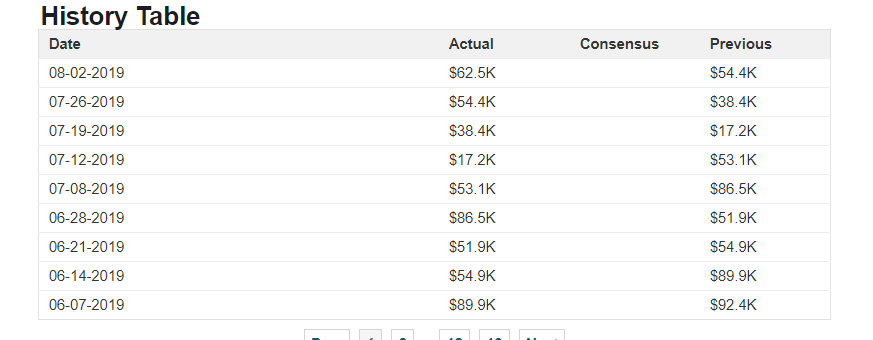

Trading Perspective: Technically the Dollar is poised to trade lower after testing recent highs against most of it’s Rivals. The Dollar Index climbed to 98.93 on Thursday from 95.95 in late June. USD/DXY closed at 98.096 on Friday. The Federal Reserve cut rates for the first time in a decade last month. After the tariff truce ended and July’s Payrolls report failed to impress, expectations for a September rate cut have increased. While monetary authorities are all expected to provide stimulus, US rates have the farthest to fall as they have been the highest. Market positioning has seen a move back into Dollar longs which are overdue for a correction. The latest COT/CFTC report for the week ended 30 July saw total net speculative USD longs increase to +USD 62,500 contracts from the previous week’s -USD 54,400. This is the highest total in a month. We look further in the breakdowns in a following report.

- EUR/USD – The Euro, which closely mirrors the Dollar Index, fell to multi-year lows on Thursday to 1.10268. The Single currency closed 0.10% higher at 1.1108. The overnight high traded was 1.11164. Immediate resistance can be found at 1.1120/30 followed by 1.1170. Strong resistance lies at 1.1210, a clean break above the level could see a higher range develop. Immediate support lies at 1.1080 followed by 1.1050. Look for a likely trading range today of 1.1085-1.1155. Prefer to buy dips. The latest COT/CFTC report (week ended 30 July) saw Net Euro short bets increased by a large 15,000 contracts to -EUR 54,000 contracts from the previous week’s -EUR 39,000.

- USD/JPY – The Dollar fell furthest against the Yen, given the drop in US 10-year yields and the market’s risk-off stance. USD/JPY traded to an overnight and yearly low at 106.508. The Dollar rallied in early Sydney to 106.68 before settling at 106.57 currently. Immediate support lies at 106.50 followed by 106.20 and 105.80. Immediate resistance can be found at 106.80 and 107.30. Expect Japanese corporates to put a bid in the USD/JPY near the overnight lows at 106.50. Any rallies will be limited to 107.20 with a likely range today of 106.50-107.20. Prefer to buy dips from current levels. Against the Yen, long US Dollar positioning continued to fall, unlike the rest of its peers. Net speculative JPY shorts were pared further to -JPY 4,200 contracts from the previous week’s -JPY 9,400. That’s close to square.

- AUD/USD – the Australian Dollar has fallen for 10 consecutive trading days from 0.6915 (July 26) to 0.6763 on Friday. The RBA is expected to keep interest rates on hold at its August meeting. AUD/USD is due for a correction. Immediate resistance can be found at 0.6820 (overnight high 0.68188) followed by 0.6850. Immediate support lies at 0.6790 and 0.6760. The latest COT/CFTC report (week ended 30 July) saw speculative Aussie short bets increased to -AUD 53,400 contracts from the previous week’s -AUD 48,000. Look to buy dips with today’s range likely 0.6790-0.6860.