Summary: The Dollar Index (USD/DXY) ended with moderate gains to 97.289 (97.074) in quiet trade as markets waited for the ECB policy announcement on Thursday. Traders also await next week’s US Fed meet (July 30-31) to gauge how much and how fast both central banks would reduce interest rates. The Euro, under pressure since last week, steadied to close at 1.1210, just above 1.1206 lows and above the 1.1200 support level. Analysts are expecting the ECB to tweak their language and signal a 10 bp cut for September. Sterling slipped anew to 1.2475, down 0.14% as the UK prepared for Eurosceptic Boris Johnson to lead the country. The Dollar edged higher against the Yen to 107.88 (107.78). Bank of Japan Governor Haruhiko Kuroda, in a speech at an IMF meeting in Washington DC, said that officials were monitoring the outlook for economic growth amidst a heightening of uncertainties. The BOJ has its policy meeting on July 30, a day ahead of the Fed decision. The Aussie (0.7035 vs 0.7045) and Kiwi (0.6762 vs 0.6782) were both mildly lower against the Greenback.

Global treasury yields were a touch lower with the benchmark US 10-year rate at 2.05% (2.06%). Germany’s 10-year Bund yield was 2 basis points lower at -0.35%.

Stocks saw modest gains. The DOW closed at 27,187 (27,145). The S&P 500 rose 0.4% to 2,987.

- EUR/USD – The Euro edged up above overnight lows at 1.1206 to close at 1.1208. With most traders expecting Mario Draghi and his colleagues to reintroduce an easing bias, the Single currency trades heavy.

- USD/JPY – the Dollar extended it’s gains versus the Yen, climbing to 107.88 from 107.78 yesterday. USD/JPY recovered from near 3-week low at 107.22 on Monday.

- GBP/USD – The British Pound slipped under broad-based US Dollar strength. Eurosceptic Conservative Boris Johnson is expected to be Britain’s next prime minister.

- AUD/USD – The Aussie was mildly lower against the Dollar to 0.7035 from 0.7045 yesterday. Traders were waiting for the outcome of RBA Vice-Governor Kent’s speech, currently going on at a Bloomberg conference in Sydney.

On the Lookout: Economic data reports out today are light. The RBA’s Assistant Governor in charge of Financial Markets, Christopher Kent is currently delivering a speech on “The Committed Liquidity Facility” at a Bloomberg sponsored event in Sydney. Traders will look for monetary policy tips.

Asia sees Japan’s BOJ Annual Core CPI report. European data sees the Confederation of British Industry’s Industrial Order Expectations Index. US House Price Index, Existing Home Sales and Richmond Manufacturing Index finish off the day’s reports.

The US and China are headed closer to a trade deal according to the South China Morning Post. The report said US delegates will visit Beijing next week for further trade talks.

Elsewhere, the UK Telegraph reported that several ministers, including Chancellor Phil Hammond will hand resignations if Boris Johnson is confirmed as Tory leader tomorrow.

Trading Perspective: As traders prepare for the ECB, BOJ and Fed monetary policy meeting and announcements, we look at the market’s latest speculative positioning.

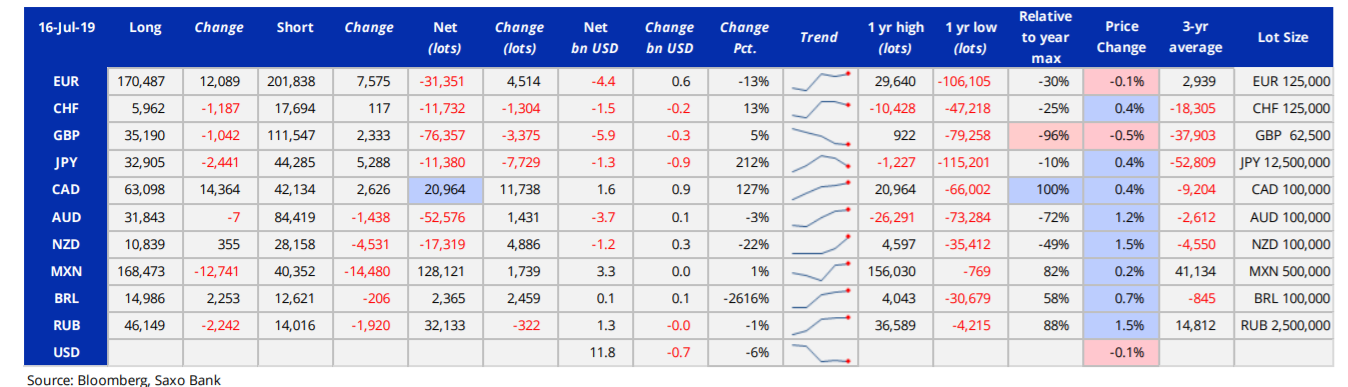

The latest Commitment of Traders/CFTC report for the week ended 16 July, 2019 saw total net speculative US Dollar long bets to their lowest level in a year. There were reductions in Euro shorts while in the Canadian Dollar, long CAD bets increased. Speculators added to increasingly crowded short GBP short bets. Net short Aussie and Kiwi positions were little changed.

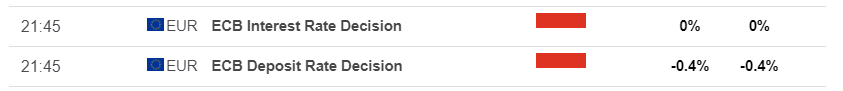

- EUR/USD – The Euro held just above it’s support at 1.1200 closing a few pips above its overnight lows at 1.1206. Traders are expecting the ECB to signal an easing bias with some forecasts pointing to a 10-basis point cut to -0.50% in a key deposit rate based on the current local interest rate market. Speculators further trimmed their net short Euro bets to -EUR 31,351 (week ended 16 July) from the previous week’s -EUR 35,865. The net total is down to 30% relative to the year’s maximum level. Immediate support lies at 1.1200 followed by 1.1180. Immediate resistance can be found at 1.1230 and 1.1260. Look for a likely trading range today of 1.1200-1.1250. Prefer to buy dips.

- GBP/USD – slip-sliding away to 1.2475 (1.2505 yesterday), the Pound also trades heavy against the overall stronger US Dollar and the added weight of increased chances of a no-deal Brexit. With Boris Johnson expected to be announced as the UK’s new Tory leader tomorrow, more Conservative ministers are either resigning or intending to resign. Meantime, short GBP market positioning is increasing. Speculators added to their net short GBP bets to total -GBP 76,357 contracts (week ended 16 July) from -GBP 72,982. The net short total amounts to 96% of the year’s maximum level. Which is risky for GBP shorts at current levels. GBP/USD has immediate support at 1.2450 (overnight low 1.2455) followed by 1.2425 (last week’s low). Immediate resistance can be found at 1.2505 and 1.2535. Look to trade a likely range today of 1.2450-1.2550. Just trade the range shag on this one.

- USD/JPY – The Dollar closed at 107.88 against the Yen. The overnight low traded was 107.699. Immediate support lies at 107.70 followed by 107.50. Immediate resistance can be found at 108.10 (overnight high 108.07). The next resistance level is at 108.40. The latest COT report (week ended 16 July) saw net speculative JPY shorts increased to -JPY 11,380 contracts from the previous week’s -JPY 3,651. The net total is 10% relative to its total short high for the year. Look for a likely range today of 107.50-108.00. Prefer to buy dips.

- AUD/USD – The Australian Dollar closed mildly lower versus the Greenback at 0.7035. Immediate support lies at 0.7025 (overnight low was 0.70309). The next support level can be found at 0.70 cents. Immediate resistance lies at 0.7055 followed by 0.7085. The latest COT report saw net speculative Aussie short bets trimmed to -AUD 52,576 from -AUD 54,007 the previous week. Look for a likely trading range today of 0.7025-0.7075. Prefer to buy dips.

Happy trading all.