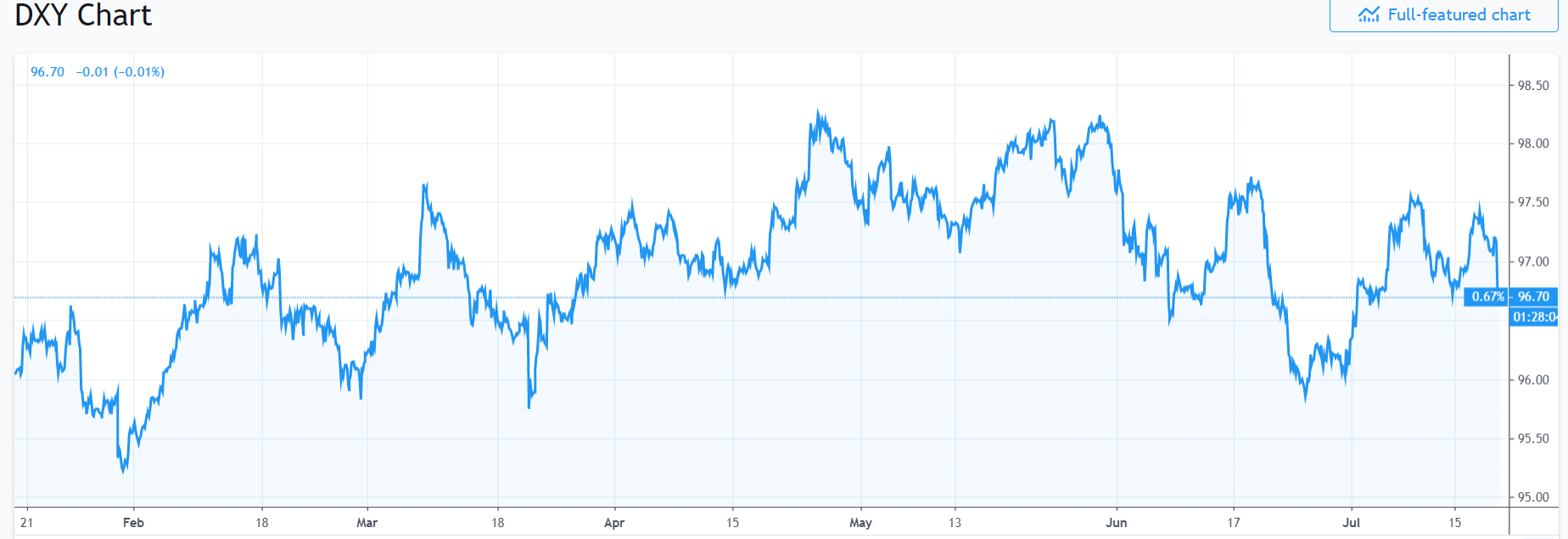

Summary: Dovish comments by FOMC member John Williams (NY) and Fed Vice-Chair Richard Clarida increased chances of a deeper Fed rate cut this month. Williams, speaking at research conference in New York said that “central bankers needed to act quickly and forcefully when rates are low and economic growth is slowing”. Which was later echoed by Fed Vice-Chairman Clarida. The Dollar Index, a measure of the US currency against a basket of six rivals slumped 0.53% to 96.709. Sterling rebounded off a 27-month low, boosted by a strong rise in June Retail Sales to 1.2546 (1.2430 yesterday). The Australian Dollar jumped 0.94% to 0.7075 from 0.7012 despite a weaker-than-forecast Australia June Employment gain. The rise in full-time jobs offset a fall in part-time employment. The Euro underwhelmed, up 0.44% against the Greenback to 1.1275 (1.1225) after a report that the ECB was studying a revamp of its inflation goal. This would allow the European Central Bank to extend monetary stimulus efforts for longer. USD/JPY slid to 107.32 (107.99) weighed by broad-based Dollar weakness and lower US yields.

US Bond yields dipped. The benchmark 10-year rate was down 2.4 basis points to 2.026% (2.05%).

Wall Street stocks rallied. The Dow finished at 27,308. (27,208). The S&P 500 closed at 3,000 (2,980).

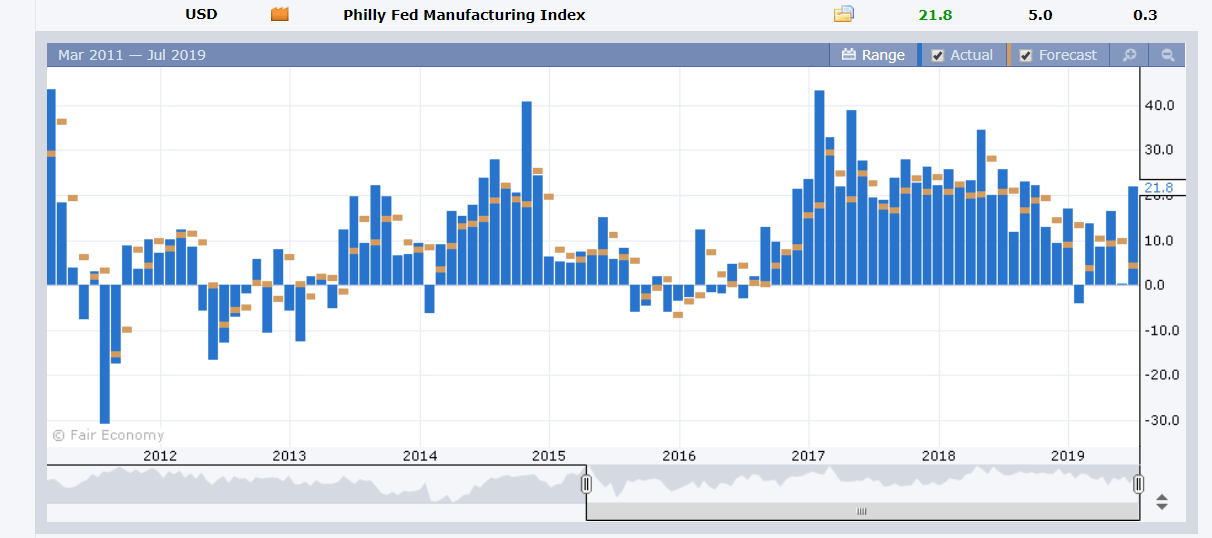

Australia’s Employment in June gained 0.5K missing forecasts of 9,100. Full time employment rose 21,100 while part-time jobs were down 21,600. The Jobless rate was unchanged at 5.2%. UK June Retail Sales climbed 1.0% against forecasts for a fall of 0.3% and a previous -0.5%. US Philly Fed Manufacturing Index rebounded sharply to 21.8 from May’s 0.3 and a forecast of 5.0. US Weekly Unemployment Claims were steady at 218,000 (f/c 216,000).

- EUR/USD – The Euro rallied 0.44% to 1.1275 against the overall weaker US Dollar (1.1225 yesterday). Earlier in European trade, the Single currency dipped to 1.12053 on the report that the ECB is studying a revamp of its inflation goal.

- GBP/USD – Sterling soared outperformed soaring 0.94% to 1.2547 from 1.2429 yesterday. Upbeat UK retail sales boosted the British Pound off 27-month lows forcing shorts to run for cover.

- AUD/USD – The Aussie rallied to finish among the top performers against the Greenback, up 0.9% to 0.7075. The rise in full-time employment lifted the Aussie Dollar as bets increased that the RBA will now shift to a more neutral stance.

- USD/DXY – The Dollar Index slid to 96.709 at the New close, down 0.53%, near its overnight low. The Dollar Index broke through the 97.00 support level, which is now short-term resistance.

On the Lookout: Yesterday’s FX markets were jolted by dovish Fedspeak. We have more Federal Reserve heads speaking later today (early Saturday morning Sydney time). St Louis President James Bullard (noted dove) is addressing the Central Bank Research Association meeting in New York. Eric Rosengren, Boston Fed President speaks later in the same conference. Both are FOMC members. Look for more fireworks.

Economic data releases today begin with Japan’s National Core CPI (annual), and June All-Industries Activity. Euro area data sees German PP (June) and Eurozone Current Account reports. The UK reports on its Public Sector Net Borrowing data for June. Canada reports on its June Headline and Core Retail Sales. US Preliminary University of Michigan Consumer Sentiment Index report rounds up today’s economic calendar releases.

Trading Perspective: “When it rains, it pours.” Apart from the dovish Fedspeak from Williams and Clarida, US Treasury Secretary Steve Mnuchin was on the wires defending the US “official” currency stance. Mnuchin said that there is no change in US FX policy “for now”. Chances of any intervention on the US Dollar are slim, despite speculation that the US treasury would intervene to weaken the Dollar.

William’s comments have raised bets for a 0.5% rate decrease at the end of this month. That remains to be seen.

The better than expected US data releases yesterday were ignored by traders. The sharp rebound in factory activity in the mid-Atlantic region of the US (Philly Fed) was the highest level reached this year. Initial Jobless Claims were in the middle of its range this year. Indicative of a strong US labour market and a rebound in manufacturing despite a slowing of overall economic activity.

Market positioning also has seen a large trimming of USD long bets. These all point to USD support.

A caution towards getting too bearish on the Greenback just yet.

- EUR/USD – The Euro underperformed but still rallied on broad-based US Dollar weakness. The Single currency traded to an overnight high at 1.12804, which is initial and immediate resistance. The next resistance level can be found at 1.1310. Immediate support can be found at 1.1250 and 1.1230. Look for a likely range today of 1.1240-1.1290. Just trade the range shag on this one.

- GBP/USD – Sterling rallied to an overnight high at 1.25583 before easing to settle at 1.2547. Immediate resistance can be found at 1.2560 followed by 1.2600. Immediate support lies at 1.2530 followed by 1.2500. The British Currency has been under pressure for most of this month as the chances of the UK leaving the EU without a transition deal increase. Despite an already short speculative market, the British currency remains vulnerable as the Brexit deadline draws near. Look to trade a likely range today of 1.2480-1.2580.

- AUD/USD – The Aussie Dollar soared to 0.70765 overnight high before settling at 0.7074 at the NY close. AUD/USD has immediate resistance at 0.7080 followed by 0.7110. Immediate support can be found at 0.7040 and 0.7010. While the rise in full-time employment lifted the Aussie, the Battler is not out of the woods yet. Both the Aussie and the Kiwi benefit from broad-based USD weakness. Any rebound in the Greenback will see these currencies falter. Look to trade a likely range of 0.7040-0.7090.

- USD/JPY – The Dollar slid against the Yen to an overnight low at 107.212 before settling at 107.30. The fall in the US 10-year yield to 2.02% weighed on this currency pair. Japan’s 10-year JGB yield was down one basis point to -0.14%. Expect Japanese corporations to be on the bid in the low 107 area today, between 107.00 and 107.20, immediate supports. Immediate resistance can be found at 107.70 and 108.00. Look to trade a likely range of 107.30-107.80. Prefer to buy dips.

Happy Friday and trading all.