Summary: The Dollar eased against most of its rivals following softer June Housing Starts and Building Permits data. Expectations that the Fed would lower interest rates led to a fall in US bond yields. Stronger-than-forecast US retail sales data had lifted the Greenback yesterday. Fears of a no-deal Brexit continued to hound the Pound, which hit fresh 27-month lows at 1.2382 before rebounding to 1.2430. UK Brexit Secretary Steve Barclay said that the risk of a no-deal split with the European Union is “under-priced.” The Euro hit a one-week low at 1.11998 before climbing back to 1.1225, at the lower end of its recent range. Expectations of an easing by the ECB has kept the Single Currency on the defensive. The Australian Dollar was little changed at 0.7010 (0.7013 yesterday). USD/JPY slipped to 107.99 from 108.27 on lower US yields. The benchmark US 10-year treasury yield was down 6 basis points to 2.05%. Japan’s 10-year JGB yield was unchanged at -0.13%.

Wall Street stocks fell on weaker than expected earnings.

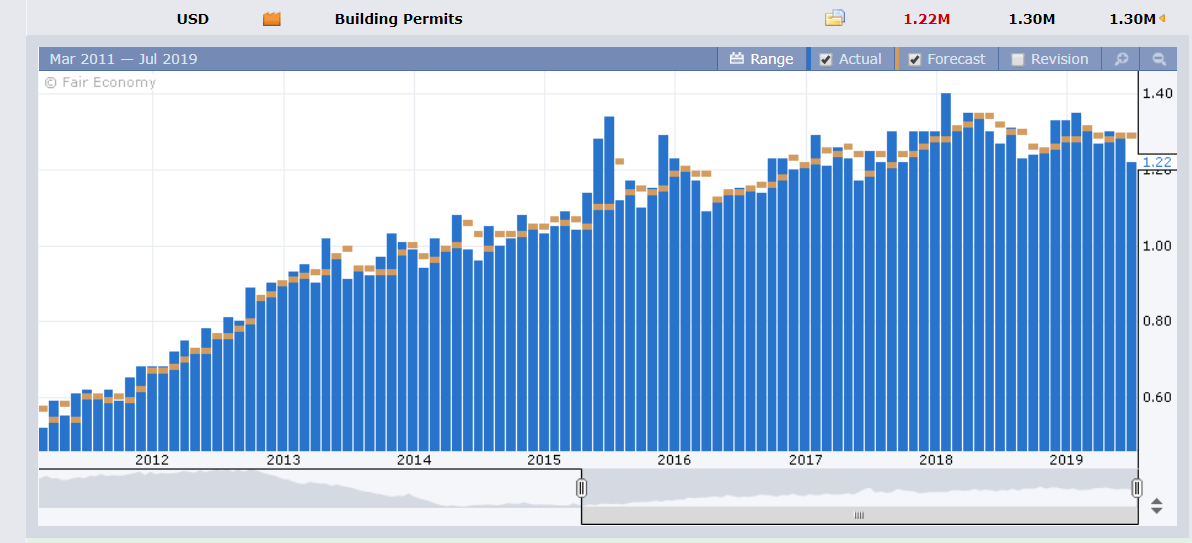

US June Housing Starts missed forecasts at 1.25 million from 1.26 million. June Building Permits fell to 1.22 million from 1.29 million, and against an expected 1.30 million.

The Fed’s Beige Book economic report saw that the longest US economic expansion remained intact amidst trade risks.

- EUR/USD – The Euro finished slightly higher at 1.1225 after trading in a narrow 1.11998 to 1.123336 range overnight. German 10-year bond yields were 4 basis points lower to -0.29%. The one week low of 1.1200 is providing solid support.

- GBP/USD – Sterling slumped to a fresh 27 week low at 1.23820 before rebounding to 1.2430. Traders continued to sell the Pound on the perception that risks are growing for the UK to leave the EU without a transition deal in place. The latest Commitment of Traders report saw speculators dump the Pound for the 4th straight week.

- USD/JPY – The Dollar eased against the Yen to 107.99 from 108.27 yesterday, down 0.22%. Lower US bond yields continue to drag the Greenback lower. Speculative JPY shorts were trimmed by a large USD 1 billion.

- AUD/USD – the Aussie Dollar was little changed at 0.7013 (0.7010 yesterday). Australia’s June Employment report is released later today. The dovish leaning RBA kept the Aussie Battler in check, while speculative Aussie short covering supported the currency.

On the Lookout: Today sees Japan’s Trade Balance and Australia’s June Employment report in Asia. The lone European report today comes from Switzerland, reporting its June trade balance.

UK data follow with June Headline and Core Retail Sales, (month and annual). Finally, US Weekly Unemployment Claims and Philadelphia Fed Manufacturing Index finish the day’s reports.

Trading Perspective: With FX trading in tight summer ranges we look at market positioning. Saxo Bank’s Bloomberg Commitment of Traders/CFTC report for the week ended July 2 (delayed due to the US 4th of July holiday) saw continued reduction of total net USD longs by speculators. According to Saxo Bank, bullish Dollar bets have now been cut by 65% from the late April peak. The bulk of these cuts have been against the Euro, Canadian Dollar and Yen. The main exception among the major currencies was Sterling (not surprising) where net GBP shorts have increased for the 4th straight week.

- EUR/USD – The Euro held the support level around 1.1200 before rallying to close at 1.1225. This morning the Single Currency opens at 1.1229. Immediate resistance lies at 1.1240 (overnight high traded 1.12336). The next resistance level can be found at 1.1280. Immediate support at 1.1200 should hold with the next support level at 1.1180. The latest COT report was net short Eur bets cut further to -EUR 31,733 from the previous week’s -EUR 56,295. Look for a likely range today of 1.1210-1.1260. Prefer to buy dips.

- GBP/USD – Sterling continues to trade heavy with the risk skewed to the downside. That said, Sterling short bets for the week ended July 2 increased to -GBP 64,244 contracts from the previous week’s -GBP 58,937. This is the 4th straight week of GBP selling. Total short GBP short contracts stand at US$5.69 billion. That is a danger sign despite risks of the Pound grinding lower. Immediate support lies at 1.2380 (overnight low at 1.2382) followed by 1.2340. Immediate resistance lies at 1.2460 and 1.2500. Look for a likely range today of 1.2385-1.2485. Prefer to buy dips.

- USD/JPY – The Dollar fell against the Yen on the lower US 10-year yield. USD/JPY closed at 108.00 after trading to 107.971 overnight. Immediate support lies at 107.80 followed by 107.60. Immediate resistance can be found at 108.30 and 108.60. The latest COT report was net speculative JPY shorts cut to -JPY 1,227 (week ended July 2) from the previous week’s -JPY 10,147. That’s virtually square. Look for a likely range today of 107.80-108.30. Just trade the range shag on this one.

- AUD/USD – The Aussie was little changed, closing at 0.7013. The dovish tone from the RBA meeting minutes failed to push the currency any lower as shorts continue to support the Battler. Australia is forecast to have created 9,000 jobs in June from May’s 42,300 while the Jobless rate is expected to remain at 5.2%. The latest COT report saw speculative Aussie shorts trimmed to -AUD 58,735 contracts (week ended July 2) from -AUD 66,320. AUD/USD has immediate support at 0.6990 (overnight low 0.69962) followed by 0.6960. Immediate resistance can be found at 0.7030 (overnight high 0.70249) and 0.7060. Look to trade a likely range of 0.6990-0.7040. Prefer to buy dips.

Happy Thursday and trading all.