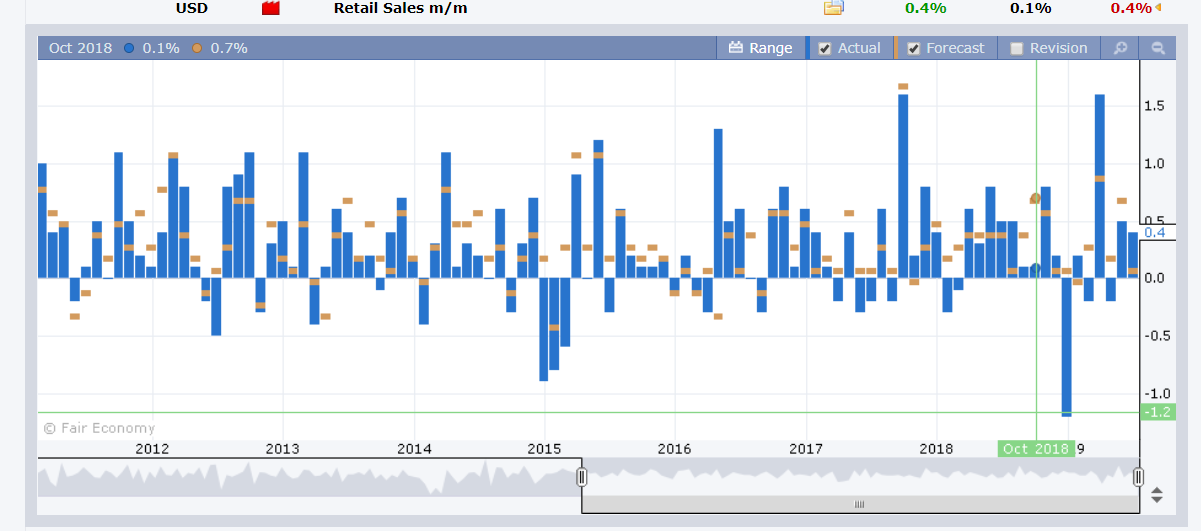

Summary: A strong rise in June US Headline and Core Retail Sales, up 0.4%, easily median forecasts of 0.1%, lifted the Dollar Index (USD/DXY) 0.47% to 97.391. The British Pound plummeted to April 2017 lows (1.23964) as risks build for a no-deal Brexit from the two top candidates for the UK prime ministership. A fall in Germany’s ZEW Economic Sentiment, due in part to the China-US trade conflict, pulled the Euro 0.44% lower against the Greenback to 1.12019, one-week lows. The Australian Dollar retreated to 0.7010 from 0.7040 yesterday, weighed by broad-based US Dollar strength and President Trump’s latest trade tariff threat. Trump said that he could impose additional tariffs on Chinese imports if he wants. And a trade agreement with China had a long way to go. USD/JPY rallied to 108.27 from 107.90 yesterday. EM currencies were mostly lower against the Greenback.

Wall Street stocks slipped at the close. The DOW was modestly lower at 27,325 (27,345) while the S&P 500 dipped 0.38% to 3,003 (3,014 yesterday). US bond yields rose with both the 2-and 10-year treasury rates up a couple of basis points.

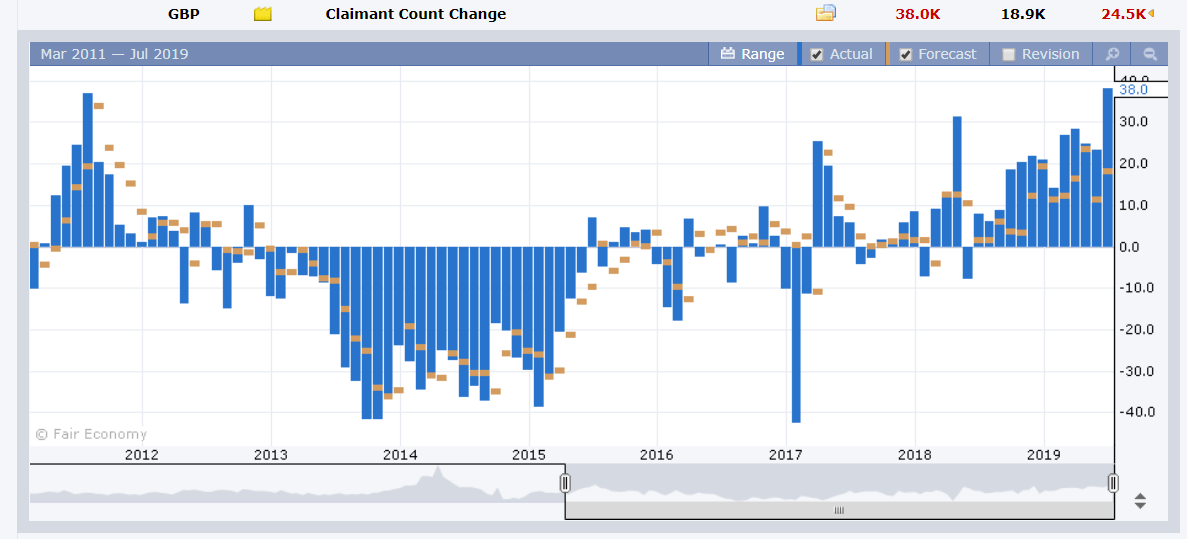

The UK’s Unemployment Rate matched expectations at 3.8% although Claims for Unemployment benefits rose to 38,000 against a median forecast of 18,900.

- EUR/USD – slip-sliding away, the Single currency dipped further to 1.1208 (NY close) after a deterioration in sentiment from German investors. Dovish expectations from the ECB have prevented the Euro from taking advantage of US Dollar weakness earlier this week.

- GBP/USD – The British Pound extended it’s decline, falling to fresh 27-month lows against the Dollar to 1.23964 before settling at 1.2410. Leading candidates for UK leadership, Boris Johnson (Conservative) and Jeremy Corbyn (Labour) are both pushing for a hard Brexit stance. Sterling also fell against the Euro to the lowest this year.

- AUD/USD – The Aussie gradually lost ground against the strengthening US Dollar, closing at 0.7010, down 0.37%. Trump’s latest tariff threat didn’t help the Australian Dollar. RBA meeting minutes released yesterday revealed that the Aussie central bank was willing to adjust policy “if needed” to support growth and inflation.

On the Lookout: Following two sets of better-than-expected US economic data, expectations of deep Fed rate cuts have been watered down. Meantime, data from Europe and the UK continue to underwhelm and pressurise their currencies. We go back to the theme that the Dollar is the best performer among an ugly bunch. Data releases and comments from officials from here on in will take on added significance. We are also in the middle of the Northern Hemisphere summer holiday break. Which leads to the lack of FX volatility. Expect that to pick up next month, after the Fed July 30-31 policy meet.

Today presents a data dump from the UK, Europe and the USA. Australia’s Westpac June Leading Index of Economic Activity is Asia’s only report. The UK reports on its June Headline and Core CPI (y/y), PPI input and output (June), and Retail Price Index. The Eurozone reports on its Final Headline and Core CPI for June (annual). Canadian Headline and Trimmed Means CPI and Manufacturing Sales kick of North American data. The US reports on its Building Permits, Housing Starts and the Fed’s Beige Book Economic Report.

Trading Perspective: The Dollar ended on a strong note, supported by both fundamental and technical factors. Market positioning has seen a chunk of Dollar long bets cut. A Fed rate cut of 0.25% at their July 30-31 meeting is virtually priced in. This lends support to further short-term Dollar strength. US bond yields have stabilised with the 10-year yield around 2.10%. Overlooked last night were comments by Chicago Fed President and FOMC member Charles Evans. Evans said that there was an argument for a 0.50 basis point decrease in interest rates before the end of the year to get inflation up. While Evans is a noted bear, and his view run contrary to another regional Fed head (Dallas’s Robert Kaplan), Fedspeak should also be monitored.

The latest COT/CFTC report (week ended 9 July) saw total net long Dollar bets much unchanged. The stronger-than-expected US Jobs (5 July) report renewed selling of EUR, GBP and JPY. We look at the breakdown in tomorrow’s commentary.

- EUR/USD – The Euro slid back to an overnight and one week low at 1.12019 before a slight bounce to 1.1210 in early Asia. Immediate support can be found at 1.1200 followed by 1.1180. Immediate resistance lies at 1.1230 and 1.1260. Apart from overall US Dollar strength, the Euro has been pulled lower by the British Pound. Traders are also expecting the ECB to push rates, already in negative territory lower later this year. Overnight German 10-year Bund yields stood at -0.25%, unchanged from yesterday. While US 10-year rates climbed 2 basis points. Expect the Euro to stay under pressure with a likely range of 1.1200-1.1240. Prefer to buy dips.

- GBP/USD – “The Pound is sinking”, sang Paul McCartney in 1982. Sterling slumped to lows not seen since April 2017, lower than its flash-crash earlier this year. And the move has been more of a slower grind this time round. The British Pound crumpled under the building risk of the UK leaving the EU without a trade deal. Both leading candidates in the leadership race seem to be vying for who has a harder Brexit stance. Which traders see as leading the BOE to have to lower interest rates to stave off an economic disaster. GBP/USD has immediate support at 1.2390 (overnight low of 1.23964). The next support level can be found at 1.2360 followed by 1.2320. Look for a likely range of 1.2385-1.2485 today. Prefer to buy dips with a tight stop near current levels.

- AUD/USD – The Australian Dollar retreated to just above 0.70 cents on the overall stronger US Dollar. RBA meeting minutes revealed the Australian central bank as dovish leaning. Trump’s latest tariff threats also weighed on the Battler. AUD/USD closed at 0.7010. Immediate support can be found at 0.7000 followed by 0.6970. Immediate resistance can be found at 0.7030 and 0.7050. The latest COT/CFTC report saw a further trimming of AUD shorts by speculators to -AUD 54,007 in the week ended 9 July from -AUD 58,735 the previous week. Look to trade a likely range today of 0.6990-0.7030. Prefer to sell rallies.

Happy trading all.