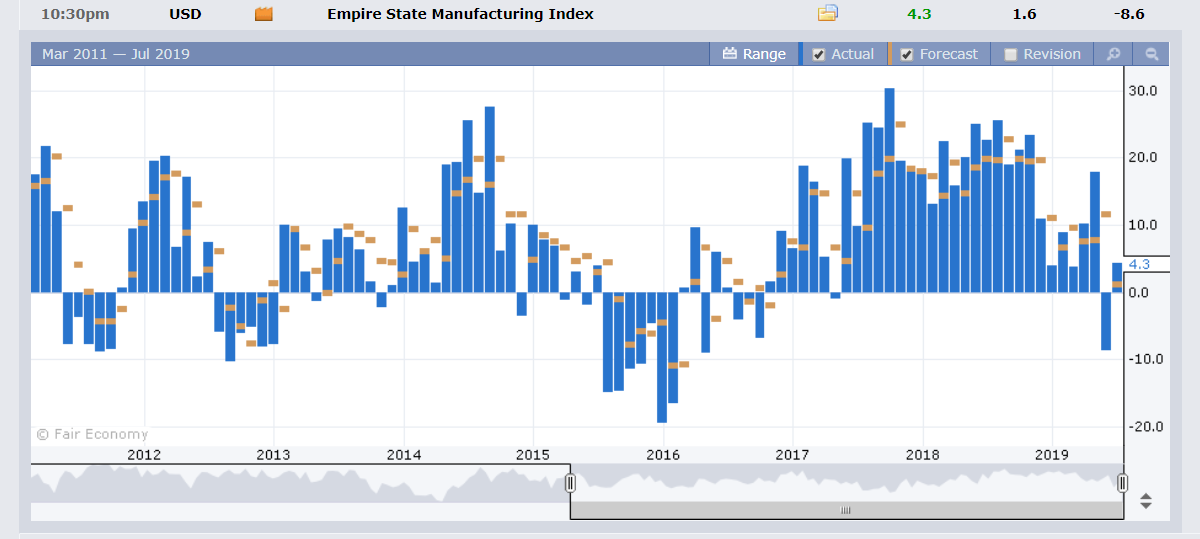

Summary: The Dollar steadied in slow, featureless trading supported by upbeat US Empire State Manufacturing report that bettered forecasts. Expectations of a Fed interest rate cut next week plus another reduction in September continued to weigh on the Greenback. The Dollar Index (USD/DXY) a popular measure of the currency’s value against a basket of foreign currencies, advanced a modest 0.15% to 96.947 (96.722 yesterday). Sterling slid 0.40% to 1.2516 from 1.2576 as prospects of lower interest rates and a new leader weighed on the currency. The Euro retreated to 1.1258 (1.1270). The ECB also meets on interest rates on July 25 and markets expect a dovish statement.

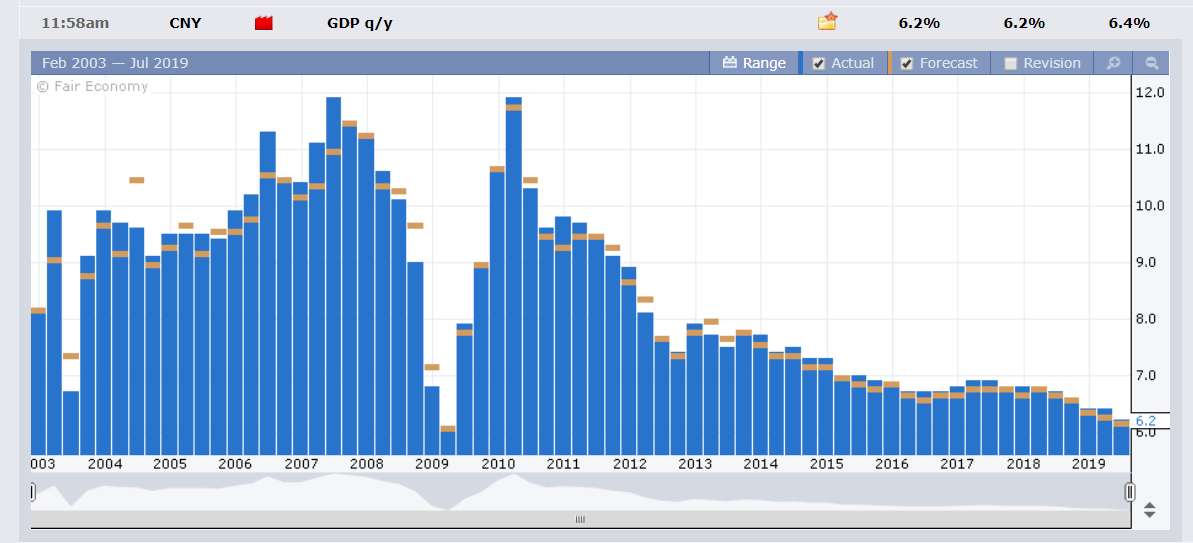

USD/JPY was little changed at 107.90 (107.88 yesterday). The Australian Dollar rose to near two-week highs at 0.7038 from 0.7022. Earlier, China’s GDP grew 6.2%, the slowest in nearly 3 decades, partially driven by the country’s trade war with the US. Chinese Retail Sales beat forecasts, up 9.8% in June from May’s 8.6%, offsetting the slow growth report. Domestic sales of consumer items (cosmetics) lifted the retail number.

Global bond yields eased. The US 10-year treasury yield closed at 2.09% from 2.12% yesterday. Germany’s 10-year Bund yield fell 5 basis points to -0.26%.

The DOW finished up 0.14% (27,344) while the S&P 500 closed at 3,014, up a modest 0.08%.

- EUR/USD – slip-sliding away, the Euro retreated to 1.1258 after failing to clear above 1.1280. The Single currency has not been able to benefit from the overall US Dollar weakness as dovish expectations from the ECB are matching those of the Fed.

- USD/JPY – the Dollar was little changed against the Yen, closing at 107.90 after trading in a narrow 107.798-108.109 overnight range. Japan’s 10-year JGB yield was unchanged at -0.13%. Traditional summer thin trading affects this currency most.

- AUD/USD – The Aussie, as well as the Kiwi continued to benefit most from US Dollar weakness. AUD/USD was up at 0.7038 from 0.7022 yesterday, near 2-week highs. Both antipodean currencies fell the most from the Dollar’s ascent. Previous Aussie sellers have turned buyers.

On the Lookout: Economic reports pick up today and the data dump may see attempts to break out of these low volatility summer trading.

New Zealand’s Q2 CPI just released matched expectations at 0.6%, higher than Q1’s 0.1% and kept a bid on the Kiwi (0.6722 from 0.6718). Aussie traders will be looking out for the release of the RBA’s latest meeting minutes (11.30 am Sydney). Italy reports its June Trade Balance. The UK reports its Average Earnings Index (Wages), Claimant Count Change (Unemployment benefits) and Unemployment Rate. Germany’s ZEW Economic Sentiment Index and Eurozone Trade Balance round up Europe’s data. Bank of England Mark Carney speaks at the France G7 Presidency meeting in Paris.

The US reports on Headline and Core Retail Sales, Import Prices, Capacity Utilisation Rate, Industrial Production. Finally, Fed Chairman Jerome Powell addresses the France G7 Presidency meeting in Paris with a speech on “Aspects of Monetary Policy in the Post-Crisis Era”.

Trading Perspective: The Dollar should hold the support levels as the yield differentials slightly in favour of the Greenback. While the US 10-year yield slipped 3 basis points, those of its global counterparts either matched (UK) or fell further (Germany). A fed rate cut of 0.25% at the end of this month is widely expected and looking like a done deal. However, another interest rate reduction by the Fed in September is far from certain, and still a bit away. Data released today could excite with the spotlight on US Retail Sales.

- EUR/USD – The Euro traded to an overnight high at 1.12839 before easing back to 1.12533. With the yield differentials still in favour of the Greenback, the Euro has struggled to take advantage of overall USD weakness. The Single currency is plagued by its own inherent weakness which is due to the dovish ECB. Market positioning has also seen a large reduction in Euro shorts which constrains the Euro’s topside. Immediate resistance lies at 1.1280 followed by 1.1310. EUR/USD has immediate support at 1.1250 (overnight low 1.12533) and 1.1220. Look for a likely trading range today of 1.1250-1.1290. Just trade the range shag on this one.

- AUD/USD – The Aussie continues to benefit most from broad-based US Dollar weakness. Today’s RBA meeting minutes release will determine the next short term moves in the Aussie. AUD/USD has immediate resistance at 0.7050 followed by 0.7080. Immediate support can be found at 0.7020 and 0.7000. Mostly upbeat Chinese retail sales and industrial production data were offset by continued weak GDP growth due in part to the trade war. Unless a trade deal is done, China’s economic growth will suffer. And so will Australia and the Aussie. Look for a likely trading range today of 0.7010-0.7050. Prefer to sell rallies above 0.7050.

- USD/JPY – The Dollar closed little-changed against the Yen at 107.90. Immediate support can be found at 107.70/80 followed by 107.40. Immediate resistance lies at 108.00 and 108.30. Expect Japanese corporations to be on the bid lower down as Tokyo returns today (holiday yesterday). Look to trade a likely range of 107.70-108.20 today. Prefer to buy dips.

- GBP/USD – Sterling emerged as worst-performing currency after climbing to an overnight high at 1.25778 and slumping to 1.25103 before settling at 1.2517. Sentiment remains bearish on the British Pound. Although market positioning is currently short, having increased from the last COT report, sentiment remains overwhelming bearish. The Pound has lost value against other currencies, the Euro, Yen and Aussie. Recent UK data have missed forecasts (Manufacturing and Industrial Production) and the next likely move in interest rates is not up but down. Politically the country remains hamstrung with a new Prime Minister expected to be announced at the end of this month. GBP/USD has immediate support at 1.2500/10 followed by 1.2460. Immediate resistance can be found at 1.2550 followed by 1.2580. UK data released later today will see how the British Jobs market is holding up. Look to trade a likely range of 1.2490-1.2590. Prefer to buy dips as shorts GBP bets build.

Happy trading all.