Summary: Federal Reserve Chairman Jerome Powell boosted expectations of a near-term rate cut, saying the US central bank was “ready to act” to sustain the decade long economic expansion. The FOMC’s June meeting minutes confirmed Powell’s outlook struck at his testimony before Congress.

Traders sold the US Dollar across the board, expecting the Fed to deliver a 0.25% cut at their July meeting. The Euro advanced 0.43% to 1.1252, while Sterling rallied to 1.2505 from 1.2465. USD/JPY fell to 108.47 from 108.87. The Aussie climbed 0.43% to 0.6960. New Zealand’s Kiwi jumped 0.62% to 0.6645 from 0.6608, finishing as best-performing currency among the majors. Emerging Market currencies saw the biggest gains with South Africa’s Rand soaring 1.5% against the Greenback (USD/ZAR 13.9885 from 14.1850). The Dollar dropped to 6.8720 Chinese Yuan from 6.8920.

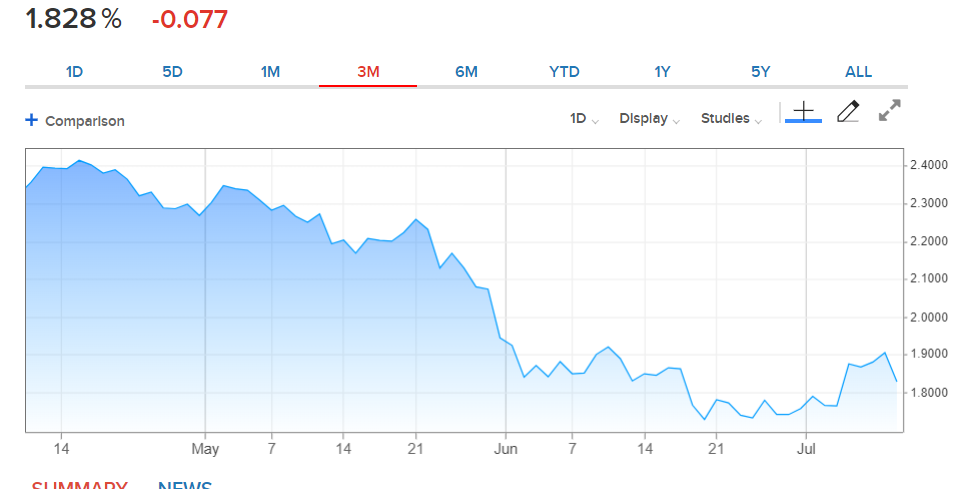

Short-dated US treasury yields sank with the 2-year yield down 8 basis points to 1.83%. The yield curve widened as 10-year rates were unchanged at 2.06%. Wall Street stocks rallied with the S&P 500 trading above 3,000 before easing to 2,993 at the close. The Dow was up 0.26% to 26,860.

China’s Annual CPI in June was unchanged at 2.7% while annual PPI was lower than forecast at 0.0% from 0.3%. French and German Industrial Production data both bettered expectations. UK June GDP matched forecasts while Manufacturing and Industrial Production underwhelmed.

The Bank of Canada left its key interest rate unchanged at 1.75%, as expected.

- EUR/USD – the Euro advanced to 1.12643 before settling at 1.1252 in New York late afternoon. Broad-based US Dollar weakness boosted the Single Currency.

- USD/JPY – The Dollar retreated against the Yen after failing to trade above 109.00. USD/JPY settled at 108.47 from 108.87, 0.48% lower. The lower short-dated US bond yields weighed on the Dollar.

- AUD/USD – The Aussie Battler jumped off it’s low at 0.69105 to 0.6969 before settling at 0.6960, up 0.43%. The overall weaker Greenback lifted the Aussie off it’s base as the buyers came in full force.

- GBP/USD – Sterling rallied 0.31% to finish just above 1.2500 at 1.2505. The British currency also benefitted from overall USD weakness although the rally was limited with the miss in both Manufacturing and Industrial Production data yesterday.

On the Lookout: Jerome Powell delivers the second instalment of his testimony before the US Senate Banking Committee (12 am Sydney, 12 July). RBA Assistant Governor Guy Debelle speaks at the FX Week USA event in New York (11.10 pm Sydney time). Prior to that, the US reports it’s June Headline and Core CPI. Markets will focus on the data after Powell cited weak inflation as one of his concerns.

Australia starts off today’s reports with second tier M1 Inflation expectations and June Home Loans reports. Euro area Final CPI (France and Germany) data follow. The Bank of England Financial Stability Report and ECB’s latest Monetary Policy Meeting Accounts are due to be released. US Weekly Unemployment Claims round up today’s data releases.

On the trade front, Dow Jones reported that the US blacklisting of Chinese tech giant Huawei has become a stumbling block in talks. And according to the Wall Street Journal, US Treasury Secretary Mnuchin has urged US suppliers of Huawei Technologies to seek licenses to resume sales to the blacklisted company.

Trading Perspective: The Dollar fell across the board after Powell boosted expectations of a rate cut which was backed by Fed minutes. The Dollar Index (USD/DXY), which is really a mirror of the Euro, fell to 97.127 (97.50 yesterday). Which is still higher than last week, just prior to the release of the US Payrolls report. FX ranges are still intact, but a likely downside USD break is in the making.

Benchmark US 10-year bond yields were unchanged at 2.06%. However, rival yields climbed. Germany’s 10-year Bund yield was up 5 basis points to -0.31%. Japan’s 10-Year JGB yield was at -0.13% from -0.15%. UK ten-year gilt rates were up 4 basis points to 0.76%. As the yield differentials between the US and its Rivals narrow, the Greenback will retreat.

- EUR/USD – The Euro bounced off the 1.1200 support level after trading briefly to 3-week lows at 1.1193 earlier this week. The Single currency was also boosted by better-than-expected Euro area Industrial Production data yesterday. EUR/USD traded to an overnight high at 1.12643 before settling at 1.1252. Immediate resistance lies at 1.1270 followed by 1.1300. Immediate support can be found at 1.1240 and 1.1210. Look to buy dips with a likely range today of 1.1240-1.1290.

- USD/JPY – The Dollar eased against the Yen after trading to 108.991 last night. USD/JPY closed at 108.47 before easing further in early Sydney to 108.34. While the US 10-year bond yield was unchanged at 2.06%, Japanese ten-year rates were higher. USD/JPY has immediate support at 108.40 followed by 108.00. The next support level lies at 107.70 (strong). Immediate resistance can be found at 108.60 and 108.90. Look to sell rallies with a likely range today of 108.20-108.70.

- AUD/USD – The Aussie came back in true Battler fashion, climbing to 0.69691 overnight highs before settling at 0.6961 currently. Immediate resistance can be found at 0.6970, a break of which would yield 0.7000. Immediate support lies at 0.6940 followed by 0.6910. Assistant Governor Guy Debelle speaks tonight in New York at the FX Week USA conference. Look to buy dips with a likely range of 0.6950-0.7000.

- GBP/USD – Sterling managed to edge higher against the broad-based weaker US Dollar. The British Pound remains constrained by Brexit jitters and recently disappointing UK economic data. Which could see the Bank of England turn dovish on rates. However, short GBP market positioning continues to grow. Speculators extended their GBP short bets in the latest COT/CFTC report to -GBP 64,244 contracts from -GBP 58,937. The short bets are near the biggest they’ve been in a year. Immediate support can be found at 1.2470 and 1.2440. Immediate resistance lies at 1.2540 and 1.2590. Look to buy dips with a likely range today of 1.2485-1.2585.

Happy trading all.