Summary: US bond yields and the Dollar grinded higher to three-week highs ahead of Jerome Powell’s two days of testimony to Congress. Traders will determine the chances of deep-rate cuts even as futures markets see a 95% probability of rate decrease at the Fed’s July meeting. The benchmark US 10-year treasury yield climbed to 2.06% (2.05%) while the Dollar Index (USD/DXY) rose to 97.499 (97.392), both three-week highs. Sterling slumped to 1.2465 from 1.2515, 6-month lows on Brexit worries and growing expectations of a rate cut from the Bank of England. The Australian Dollar dropped to 0.6930 from 0.6974, near two-week lows after a fall in NAB’s Business Confidence Index in May. The Euro edged further toward 1.1200, closing at 1.1208, down 0.07%. The Dollar grinded higher to 108.87 from 108.77 Japanese Yen, up 0.08%.

A late burst in technology stocks pulled Wall Street higher following two days of decline. The DOW finished flat (25,787) while the S&P 500 was up 0.11% (2,979).

Australia’s National Australia Bank Business Confidence Index fell to 2 in May from 7 previously.

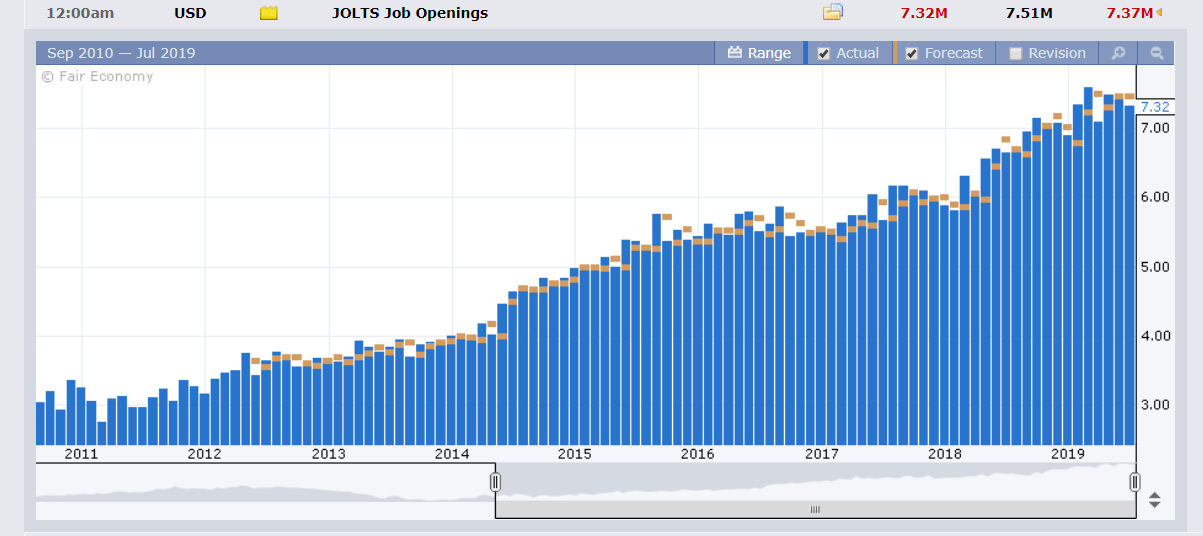

US JOLTS (Job Openings and Labour Turnover Survey) declined to 7.32 million in May while April’s Job Openings were revised down to 7.32 million from 7.45 million.

- EUR/USD – The Single Currency slid further toward 1.1200, closing at 1.1213 after trading to an overnight and fresh 3-week low at 1.11934. The overall stronger US Dollar continues to weigh on the Euro.

- AUD/USD – After trading to May 2019 highs just days ago, the Aussie has turned down to 0.6920 overnight and 2-week lows. AUD/USD closed at 0.6930 ahead of Powell’s testimony.

- USD/JPY – The Dollar extended its gains versus the Japanese currency to 108.964 highs before settling to close at 108.87, up 0.08%. US bond yields continued to climb with the 10-year up one basis point to 2.06%.

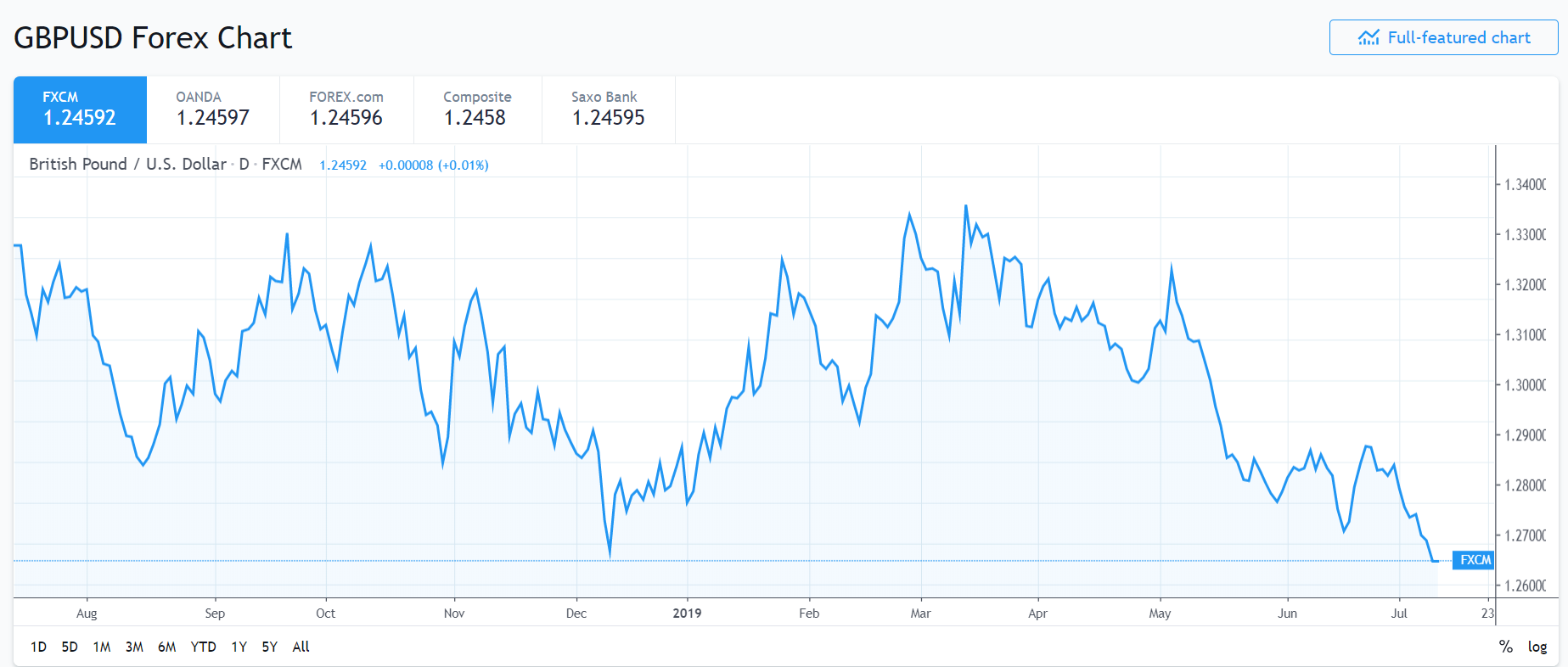

- GBP/USD – The British Pound slumped to an overnight and 6-month low at 1.24395 before bouncing to settle at 1.2165, 0.51% lower. Disappointing UK economic data of late (manufacturing and services PMI’s) have highlighted downward pressures in the economy. The BOE’s latest guidance suggested rates could go either way. Crucial May GDP and other primary data are released today.

On the Lookout: While markets await Powell’s testimony (midnight Sydney), primary economic data reports are in full swing today. The Bank of Canada is expected to keep its interest rate policy and overnight cash rate unchanged at 1.75% at the conclusion of its meeting today.

Asian data releases start off with New Zealand’s Food Price Index, Australia’s Westpac Consumer Sentiment Index, Japanese Producer Prices and Chinese CPI and PPI (annual).

European data reports start off with French and Italian Industrial Production followed by UK GDP, Manufacturing Production, Construction Output, Industrial Production and Goods Trade Balance.

Jerome Powell’s semi-annual testimony to the US House Financial Committee in Washington DC will have a question-and-answer session. FOMC member and St Louis Federal President speaks at a Fed function in St. Louis, Missouri. The release of the Fed’s FOMC latest meeting minutes (4 am Sydney, 11 July) round up the day’s events and reports.

Trading Perspective: FX markets are expecting Friday’s strong US Jobs report to influence Jerome Powell in his testimony with the Fed leaning to deliver no more than an insurance cut. Is it enough? The Fed made it clear that any interest rate easing would be data dependent. China and the US have agreed to re-start their trade talks. Although nothing concrete yet has been discussed.

Markets also know that Powell will not bow down to pressures from President Trump who has stepped up his criticism of the Fed and the stronger US Dollar.

The drop in US JOLTS Job Openings report last night was largely ignored from the FX price action. US Payrolls is a lagging economic indicator while the JOLTS is more forward looking.

The FOMC meeting minutes are most likely to be dovish leaning. The strong Jobs report will see a cautiously optimistic Powell, and his testimony will determine whether further interest rate cuts are in the offing.

- EUR/USD – The Euro managed to rebound off its lows and hold just above the 1.12 level. After grinding lower for 3 straight days, EUR/USD looks poised to test yearly lows. The election of Christine Lagarde as new ECB President are building expectations of a more dovish leaning central bank. The latest COT/CFTC report saw speculative EUR short bets increase following a string of cuts. FX markets risk disappointment if Powell is less optimistic in his testimony. Immediate support lies at 1.1190 followed by 1.1160. Immediate resistance can be found at 1.1220 and 1.1250. Look for a likely range of 1.1190-1.1230 today with the preference to buy any Euro dips.

- AUD/USD – The Aussie grinded to two-week lows after its failure last week to break above 0.7040. Broad-based US Dollar strength has weighed on the Aussie. Yesterday’s NAB Business Confidence report saw the Aussie slump 0.64% and finish as worst performing currency. AUD/USD has immediate support at 0.6920, 0.6900 and 0.6880. Immediate resistance can be found at 0.6950, 0.6980 and 0.7000. Market positioning also saw an increase in Aussie Dollar short bets in the latest COT/CFTC report. The RBA has cut rates twice in June and July. The Chinese economy has slowed down as a result of the trade war between the US and China. Market sentiment is bearish on the Aussie Battler and any US Dollar weakness will see the Aussie turn back up. Look for a likely range of 0.6920-0.6950 ahead of Powell. Prefer to buy dips.

- USD/JPY – traded to just under 109 at 108.964 before settling at 108.87 at the NY close. US 10-year bond yields steadied to finish at 2.06% from 2.05% yesterday. USD/JPY has immediate resistance at 109.00 followed by 109.30. Immediate support can be found at 108.70 and 108.40. Look for a likely range of 108.60-109.10 into Powell’s testimony.

- GBP/USD – Disappointing UK economic data released last week, and the overall stronger US Dollar have weighed on the British currency. GBP/USD traded to 6-month lows at 1.24395 before settling a touch higher at 1.2465 from 1.2515 yesterday. Brexit jitters continue to dog the Pound. UK GDP, Manufacturing, Construction and Trade data are released later today.

The latest COT/CFTC report saw a build in GBP shorts to -GBP 58,900 bets from -GBP 52,600. Which is the biggest number of speculative short bets this year. Immediate support for the Pound lies at 1.2440 followed by 1.2400 and 1.2370. Immediate resistance can be found at 1.2500 and 1.2560. Much will depend on the US Dollar and Powell. Meantime look for a likely range today of 1.2440-1.2540.

Happy trading all.