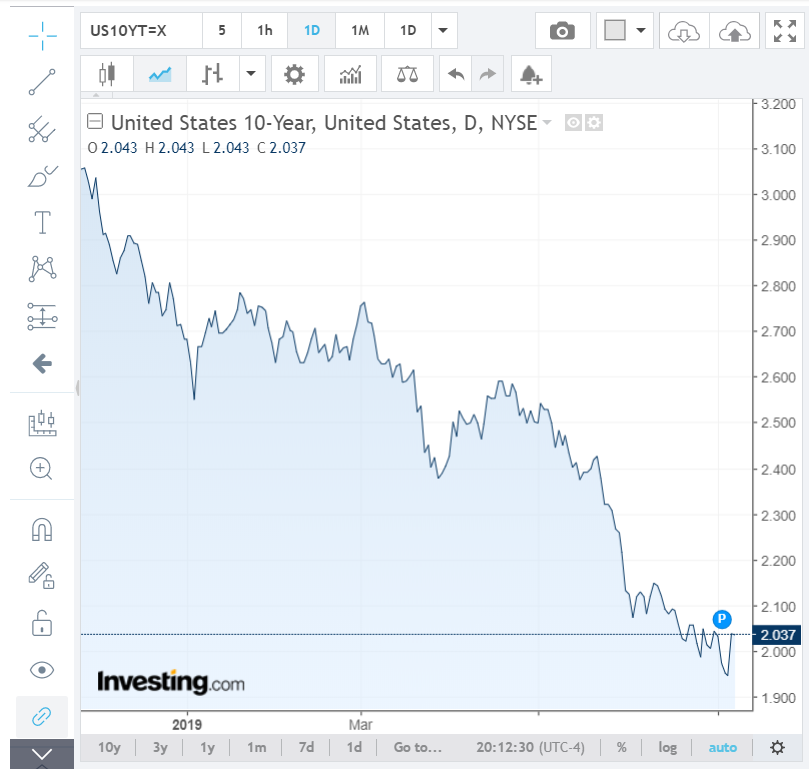

Summary: A strong US Jobs gain of 224,000 in June boosted the Dollar Index to more than two-week highs at 97.443 before settling at 97.174. The increase in Non-Farms Payrolls was the highest in 5 months and beat median analysts forecasts of +160,000. The Unemployment Rate rose to 3.7% from 3.6%, still near a 50-year low. Wages slowed to 0.2% from 0.3%, still running at an annual pace of 3.1%. May’s Payrolls gain was revised slightly lower to +72,000 from +75,000. US bond yields surged. The benchmark 10-year rate was up 9 basis points to 2.04%, the biggest one-day rise since early January. The Euro dropped 0.57% to end at 1.1227 after German Factory Orders fell more than expected. Sterling closed 0.54% lower at 1.2527 after hitting fresh 2019 lows at 1.2481. The Aussie fell to 0.6980 (0.7025), while the Kiwi slumped 1.1% to 0.6625 from 0.6691. USD/TRY (Dollar/Turkish Lira) gapped 2.1% higher to 5.78 from 5.62 after Turkish President Erdogan sacked the head of the central bank for refusing to cut rates.

German Factory Orders fell 2.2% against a forecast fall of 0.1% and a previous rise of 0.4%. Canada created a total of 27,700 jobs in June while the Jobless rate was unchanged at 5.5%. Japanese Core Machinery Orders released this morning saw order fall to -7.8% more than forecasts of -3.6%. Bank Lending in Japan was also lower at 2.3% from 2.6%.

- EUR/USD – The Euro closed at 1.1227 after trading to an overnight and over 2-week low at 1.25074. Weaker-than-expected German factory output and a broad-based US Dollar rally pressurised the Single currency.

- AUD/USD – The Aussie reversed gains after failing to break above 0.7050, closing 0.83% lower to 0.6980. The Australian Dollar was still above it’s weekly low at 0.6960.

- USD/JPY – the Dollar rallied to 108.50 from 107.80 on Friday boosted by the surge in the US 10-year treasury yield.

- GBP/USD – finished lower on overall US Dollar strength to 1.2527 from 1.2577. The British Pound hit January 2019 lows at 1.24813 before rallying at the close.

On the Lookout: Markets will now fix their eyes on a series of Fed speakers which start and finish with speeches to different audiences from Jerome Powell. The Federal Reserve President starts off with a speech tomorrow at a Fed Reserve Boston function. FOMC members Bullard and Quarles are also scheduled to speak mid-week. Powell’s testimony on Wednesday and Thursday before the US House Financial Services and Senate Banking Committee in Washington DC are this week’s highlights given Friday’s strong labour report.

Stocks futures were modestly lower on Friday due to the US fourth of July holiday trade. However, they managed to hold up well as markets still see a high probability of a Fed rate cut this month.

Today sees Australian ANZ Job Ads, and Japanese Current Account data for Asia. Europe starts off with German Industrial Production and Trade Balance. Eurozone Sentix Investor Confidence rounds up the Euro area reports. The US reports on its Consumer Credit for June.

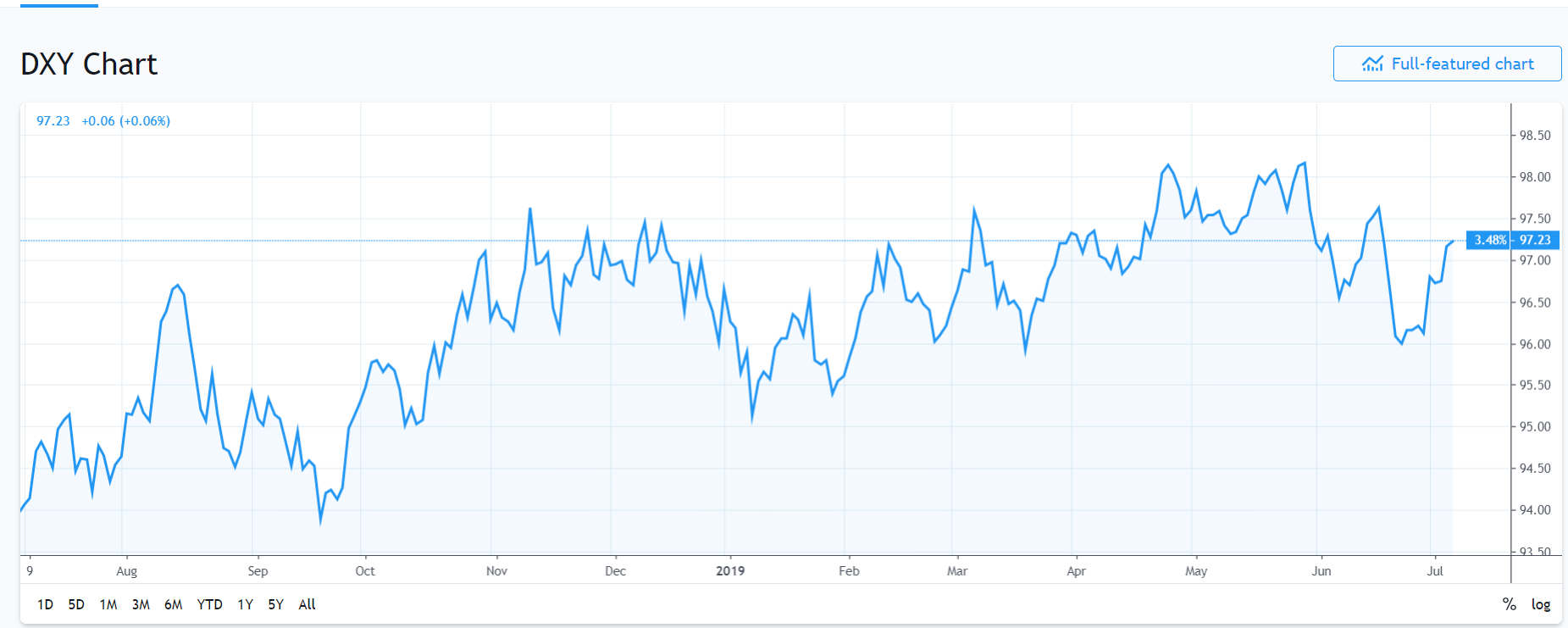

Trading Perspective: The headline driven jobs report and thin markets boosted the Dollar Index to more than two-week highs. Moderate wage gains and downward revisions to April and May payrolls added to evidence of a slowing US economy.

Market positioning for the week ended 02 July saw total net speculative US Dollar long bets climb back to +USD 86,500 contracts from +USD 51,900. Net USD longs rose against the Pound, Euro and Aussie. Against the Japanese Yen, Dollar longs fell.

The strong one day rise in US bond yields also occurred in thin markets. The 10-year yield was up 9 basis points to 2.04%. This is still lower than March’s 2.42%.

- EUR/USD – The Euro slumped to an overnight low at 1.12074 before rallying to close at 1.1227. Broad based USD strength, weaker German factory output, and the appointment of the dovish-leaning Lagarde to the ECB have all weighed on the Single currency. Immediate support at 1.1200 held on Friday. If that is broken convincingly, the next support lies at 1.1180. Immediate resistance can be found at 1.1260 and 1.1280. Look for a likely range today of 1.1200-50. Prefer to buy dips.

- AUD/USD – the Aussie fell back to 0.69574 before rallying to 0.6980 at the close. The Aussie’s failure to break above 0.7050 and broad-based US Dollar strength pushed the Battler lower. Net speculative Aussie short bets increased to -AUD 66,300 contracts from -AUD 64,900 in the latest COT/CFTC report (week ended July 2). AUD/USD has immediate support at 0.6960 followed by 0.6920. Immediate resistance can be found at 0.7000 and 0.7030. Look to trade a likely range today of 0.6965-0.7015. Prefer to buy dips.

- USD/JPY – The Dollar bounced against the Japanese Yen to finish at 108.50 after an overnight high to 108.637. The strong US jobs report and surge in the US 10-year yield boosted this currency pair. USD/JPY has immediate resistance at 108.60 followed by 108.80 and 109.00. Immediate support can be found at 108.10 and 107.80. The latest COT/CFTC report saw speculative short JPY bets pared further to -JPY 10,100 from the previous week’s -JPY 16,600. Which is practically near square. Look to trade a likely range of 108.25-108.85.

Happy trading all.