Summary: The Dollar Index (USD/DXY) finished little changed (96.786) in light volume ahead of the US Independence Day celebrations today. Global and US bond yields extended their fall on growing bets for further monetary easing from major central banks. The Australian Dollar again led all gainers, climbing 0.49% to 0.7032, its highest since early May. Sterling slipped 0.25% to 1.2574 after a lacklustre UK Services PMI report. The Euro was unchanged (1.1278) after an initial rally failed with new ECB President Christine Lagarde perceived a policy dove. USD/JPY slumped to a one week low before settling at 107.85, little changed from yesterday.

President Trump accused China and Europe of “playing a big currency manipulation game”. Trump tweeted that the US should “match, rather than watch” other countries play their currency games.

The 10-year US bond yield fell to 1.95% from 1.98% yesterday. Germany’s 10-year Bund was down 2 basis points to -0.39%. UK 10-year Gilt yields dropped to 0.69% from 0.72%.

Wall Street stocks closed at record highs in an early finish. The S&P 500 climbed 0.73% to 2,998. (2,975).

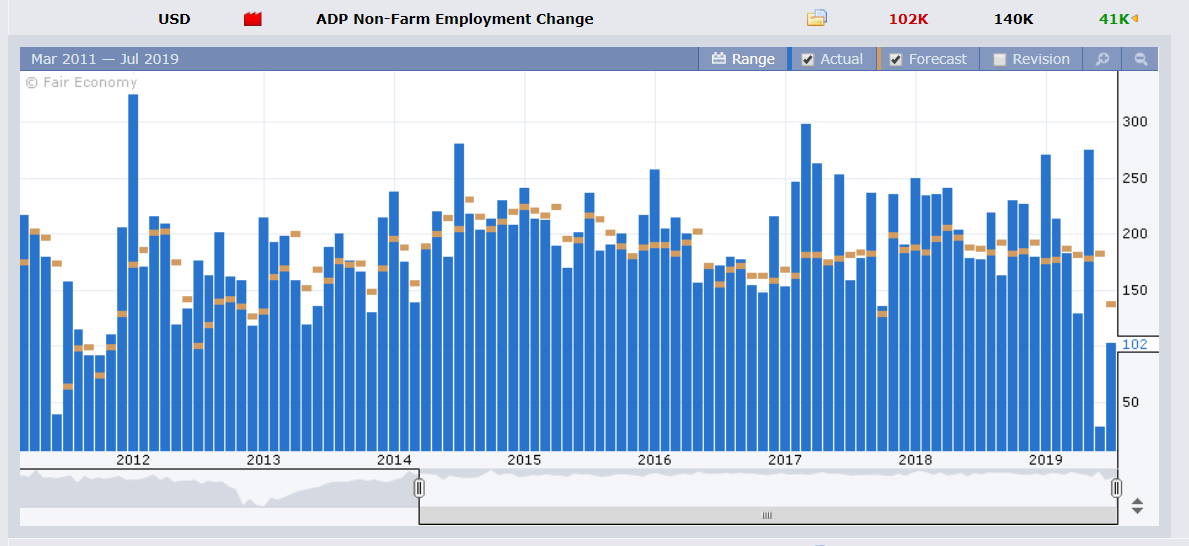

US data was mostly lower with ISM Services PMI’s missing forecasts at 55.1 against expected 56.1. Ahead of tomorrow’s NFP Employment report, US ADP Private Jobs climbed to 102,000 from an upwardly revised 41,000 but below forecasts of 140,000. Australia’s Building Approvals and Trade Surplus for June both beat expectations.

- AUD/USD – the Aussie Battler continued to climb after the RBA cut rates for the second meeting in a row yesterday. AUD/USD finished at0.7032 from 0.6995, up 0.49%. Governor Philip Lowe suggested policy makers were done for now.

- EUR/USD – the Euro ended modestly lower at 1.1278, but little changed for the week. Euro area Services PMI’s mostly matched forecasts.

- USD/JPY – The extended drop in the US 10-year bond yield to late 2016 lows pushed the Dollar to an overnight and one week low at 107.534 before settling at 107.85.

- GBP/USD – Sterling slipped further following weaker-than-forecast UK Services PMI’s. The British Pound ended at 1.2575 (1.2595 yesterday). UK PM hopeful Jeremy Hunt warned MP’s they may be forced to cancel their summer holidays to allow Britain to leave the EU without a deal in October. If he gets elected.

On the Lookout: Expect light volume trading to dominate Asia and Europe today ahead of the US Independence Day holiday (4th of July). Which will extend over the weekend with many big companies, including bank traders taking off. Volatility into tomorrow’s US Non-Farms Payrolls report, traditionally a big mover of the US Dollar, could take off. Much depends on the number.

June Payrolls are forecast to climb to between +160-165K from May’s +75k gain. The Unemployment rate is forecast unchanged at 3.6% while Earnings are expected to climb to 0.3% from 0.2%. We will look at a few scenarios in our report tomorrow.

Data releases are light today. Australian June Retail Sales, Swiss CPI and Eurozone Retail Sales are the reports due for release. US markets will be closed for the Independence Day holiday.

Trading Perspective: Given the fall in US 10-year yields to 2.1/2-year lows, the Dollar should be lower. Global yields have also dropped which has cushioned the Dollar’s fall somewhat. The rest depends on tomorrow’s number which should be instrumental in determining a more sustainable trend.

Trump’s tweets on currency manipulation have been for the most part, ignored. However, they are becoming more frequent. Saxo Bank Chief Economist and CIO Steen Jakobsen Foreign Exchange in his commentary said that Foreign Exchange is headed to be the next trade war frontier. Indeed.

- AUD/USD – The Australian Dollar traded to an overnight and early May high at 0.7039 before slipping to close at 0.7032. Immediate resistance lies at 0.7040 followed by 0.7070. Immediate support can be found at 0.7000 and 0.6980. Australian Retail Sales are due today with expectations of a small increase. Much will depend on the US Payrolls number tomorrow. Look for a likely trading range today of 0.7015-0.7045. Prefer to buy dips.

- USD/JPY – The Dollar bounced off overnight and one-week lows at 107.534. Immediate support can be found at 107.50 followed by 107.20. Immediate resistance lies at 107.90 and 108.20. We can expect the downside to be supported by Japanese corporations who normally pick highs or lows for their entry levels. The lower US 10-year yield will keep a lid on this currency pair with a likely range today of 107.50-108.00. Just trade the range shag on this one.

- EUR/USD – The Single Currency settled at 1.1278, modestly lower but little changed from the past two trading days. EUR/USD traded to an overnight high at 1.13124 before falling to a low at 1.12686. The Euro has immediate support at 1.1260 which should hold into tomorrow’s US Payrolls number. Immediate resistance can be found at 1.1300 and 1.1330.

Look for a likely trade today of 1.1265-1.1315. Look to buy dips.

- GBP/USD – slip-sliding away, the British Pound continues its grind lower. Weaker-than-forecast UK Services PMI and growing prospects of a no-deal Brexit continue to pressure Sterling. GBP/USD traded to 1.25572, overnight and 3-week lows. The latest Commitment of Traders/CFTC report saw large speculators at their most bearish on the Pound since January 2019. A lower US Payrolls number could see a big short squeeze on the currency. Immediate support can be found at 1.2550 and 1.2520. Immediate resistance lies at 1.2600 and 1.2640. Look to trade a likely range today of 1.2560-1.2620. Prefer to buy dips.

Happy trading all.