Summary: The US Dollar climbed to 2-week highs as US bond yields rose while rival yields fell. Yield differentials widened in favour of the Greenback. Global factory outputs underwhelmed while US manufacturing PMI slightly beat forecasts. The Australian Dollar slumped 0.70% to 0.6965 from 0.7025. The RBA is widely expected to cut its key rate by 0.25% today. Tensions continued to ease following the China-US trade truce lifting the Dollar against the Yen to 108.45. The Dollar climbed against the Swiss Franc to 0.9877. The Euro fell to 1.1285 from 1.1370. Sterling finished 0.31% lower to 1.2638. The Dollar Index (USD/DXY) rallied 0.55% to 96.834 from yesterday’s 96.13.

Wall Street stocks erased gains with the DOW ending flat at 26,670. The S&P 500 was little changed at 2,959 (2,955).

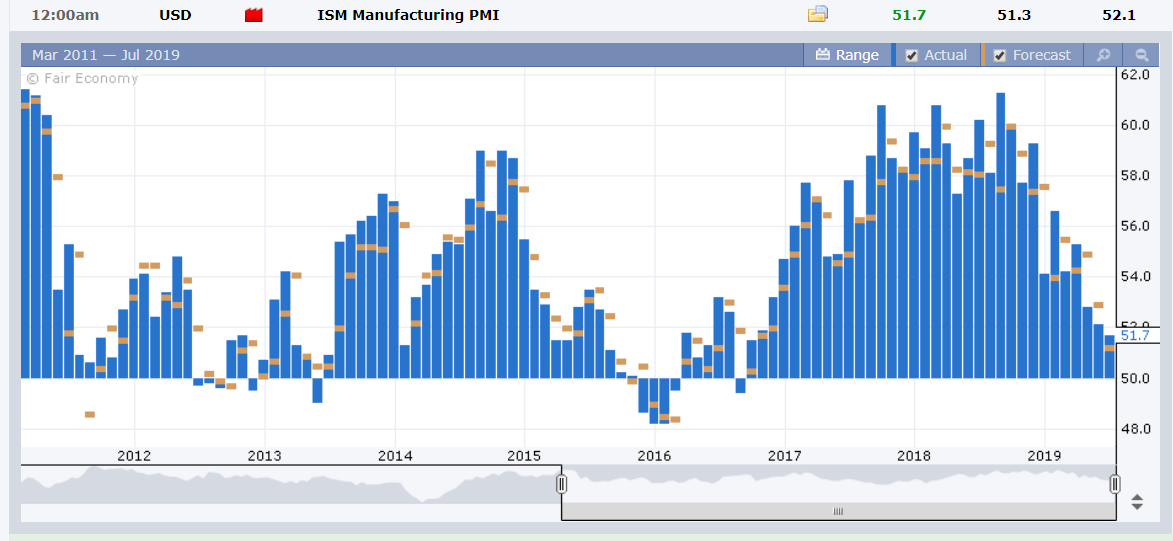

China’s Caixin Manufacturing PMI disappointed, missing expectations (49.4 vs 50.1). Japan’s Tankan Manufacturing Index slipped, missing forecasts. Spanish and German, Swiss and UK Manufacturing PMI’s missed forecasts. US ISM factory production slightly beat forecasts, although prices paid underwhelmed.

The benchmark 10-year yield was up 2 basis points to 2.03% while US 2-year yields rose to 1.78% from 1.74%. Global yields slipped on the weaker-than-forecast PMI’s. Germany’s 10-year Bund yielded -0.36% (-0.33%). UK 10-year yields were 2 basis points lower to 0.81%.

- AUD/USD – the Australian Dollar fell below 0.70 cents to 0.6965 as markets awaited today’s RBA policy meet. The Aussie Battler has risen for 9 straight trading days before yesterday’s drop. The Australian central bank is widely expected to trim its cash rate to 1% from 1.25%.

- EUR/USD – The Single currency fell after disappointing Euro area factory output pushed European yields lower. EUR/USD closed at 1.1285 from 1.1370 yesterday.

- USD/JPY – closed at 108.45 after touching 108.53 highs following the announcement of a trade truce between China and the US at their bilateral meeting in Japan. Higher US yields also pushed this currency pair higher.

On the Lookout: Yesterday’s moves put back the focus on economic data which will clearly have a more important role this week.

The RBA meeting kicks off today’s events with the Australian central bank widely expected to cut its key interest rate by 0.25%. The question is what next? Will the RBA look to cut rates further? Markets will look to their forward guidance in the rate statement.

Data releases today start with New Zealand’s Building Consents and NZIER Business Confidence. European data releases see Germany’s Retail Sales (June) and Spanish Unemployment Change.

The UK report its Construction PMI and Nationwide HPI (House Prices) for June. Canada’s Manufacturing PMI rounds up the day’s economic reports.

US New York Fed President and FOMC member John Williams speaks on global economic and monetary policy in Zurich at a Union Bank of Switzerland conference.

Trading Perspective: The widening yield differentials between US and its global peers will continue to be Dollar supportive. The US Payrolls report at the end of this week is crucial to interest rates and will help determine whether the Fed will cut interest rates later this month. It was the US Payrolls last month which got initiated the US Dollar slide.

Market positioning (week ended June 25) has seen speculators further reduce their long USD bets. Total net USD longs were cut by USD 1.1 billion to a total of +USD 19.6 billion.

- AUD/USD – After climbing for 9 straight days, the Aussie dropped 0.70% to 0.6965 as traders prepared for the RBA meeting outcome today. With the RBA widely expected to cut its cash rate by 0.25 basis points the question remains what happens next. A dovish RBA statement, where the central bank opens the door to another ease will see the Aussie slump below 0.69 cents. A neutral outlook following a 0.25 bp cut will see the Aussie back above 0.70 cents to 0.7025, where it opened yesterday. If the RBA leave rates unchanged, we could see 0.7060 tested first before settling. AUD/USD has immediate resistance at 0.7000, 0.7030 and 0.7060. Immediate support can be found at 0.6940 followed by 0.6900. The next support lies at 0.6870. Look for a level to buy Aussie, depending on what the RBA do. The next rate cut will come from the US Federal Reserve.

- EUR/USD – The Euro fell after failing to climb much above 1.1370. The weaker Euro area factory output pushed Euro yields lower which weighed on the Single currency. Broad based US Dollar strength saw Dollar demand push the Euro down. EUR/USD closed at 1.1285, two-week lows. EUR/USD has immediate support at 1.1280 followed by 1.1240. Immediate resistance can be found at 1.1300 and 1.1340. Look to buy dips with a likely range today of 1.12370-1.1320.

- USD/JPY – The Dollar jumped to a 2-week high at 108.532 in early Asian trade following the announcement of a trade truce between the US and China. USD/JPY settled to close at 108.45 in New York, slipping further to 108.35 in early Asia. Kathy Lien currency strategist at BK Asset Management in New York rightly pointed out that a trade truce is not the same as a trade deal. USD/JPY has immediate resistance at 108.55 followed by 108.85. Immediate support can be found at 108.10 (overnight low) followed by 107.80. Look to trade a likely range of 108.10-108.70. Just trade the range shag on this one.

Happy trading all.