Summary: The Dollar Index (USD/DXY) closed little changed for the week at 96.13 (96.20 Friday) as traders awaited the bilateral meeting between Presidents Trump and Xi in the G20 Osaka summit. Both leaders agreed to resume trade talks and hold off on any new tariffs after 6 weeks of stalemate and escalating tensions. US President Trump said he would allow US companies to sell products to Chinese tech giant Huawei, considered a notable breakthrough. The Dollar gapped against the Yen to 108.50 from Friday’s close of 107.97. USD/CNH, the Offshore US Dollar/Chinese Yuan pair fell to 6.8300 from Friday’s close of 6.8700. Risk currencies the Aussie and Kiwi, already bid following the widely expected ceasefire, gapped 10 points up in early Asia. The Australian Dollar was at 0.7035 from 0.7022 while New Zealand’s Bird opened at 0.6725 from 0.6716. Sterling and the Euro did not budge from Friday’s close of 1.2697 and 1.1369 respectively.

Stock futures gapped higher with the Dow up 0.67% to 26,850. (26,665 Friday). The S&P 500 rose 0.67% to 2,970 from 2,952 Friday.

While the ceasefire lifted risk in thin early trade, Chinese state media predicted a long road ahead before a trade deal can be reached. The G20 summit yielded little, agreeing to work towards improving the global trade system, but without any breakthrough decisions.

Data on Friday saw a rise in US Personal Income offset by a fall in Chicago’s Manufacturing Index from expectations. China’s Manufacturing PMI for June just missed forecasts at 49.4 against 49.5.

- USD/JPY – The Dollar closed at 107.95 in New York on Friday from 107.80. USD/JPY gapped to an early Asian high at 108.36 on the trade ceasefire news between the world’s two largest economies. US bond yields were unchanged on Friday, but a trade truce could see a delay in an immediate Fed interest rate reduction and lift US bond yields.

- AUD/USD – The Australian Battler rose against the Dollar to 0.70345, fresh 7-week high before settling at 0.7028 currently. The Aussie gapped higher versus the Yen to 76.15 from Friday’s close of 75.80. The Aussie was last at these levels in early May.

- EUR/USD – The Euro closed around 1.1370 for the fourth straight session. Still the Single Currency was on track for its biggest monthly gain in nearly 2 years on broad-based US Dollar weakness. EUIR/USD began the month at 1.1170 rising to a high of 1.1404 before settling at its current 1.1370.

On the Lookout: The impact of the trade outcome saw risk currencies and assets lifted in thin early trade. The outcome was generally expected by the markets and the impact should be short-lived. Expect US bond yields to rally as well because less trade tension will see expectations of a near-term Federal Reserve rate cut pared. Which should enable the US Dollar to regain better footing against its main Rivals. The warning from official Chinese media that both countries face a long road before they can reach a deal to end their bitter trade war should be heeded.

What lies ahead? Today sees a heavy data calendar which culminates in Friday’s US Payrolls.

Asia kicks off with Australia’s AIG Manufacturing Index, Japan’s Tankan Manufacturing and Non-Manufacturing Index, Consumer Confidence and Chinese Caixin Manufacturing PMI for June.

European data sees Euro-area Manufacturing PMI’s (Spain, Italy, France and Germany) as well as the Eurozone’s Final Manufacturing PMI and Eurozone Unemployment rate for June. The UK reports on its Net Lending to Individuals and Manufacturing PMI. US data rounds up the day’s report with its ISM Manufacturing PMI and Construction Spending.

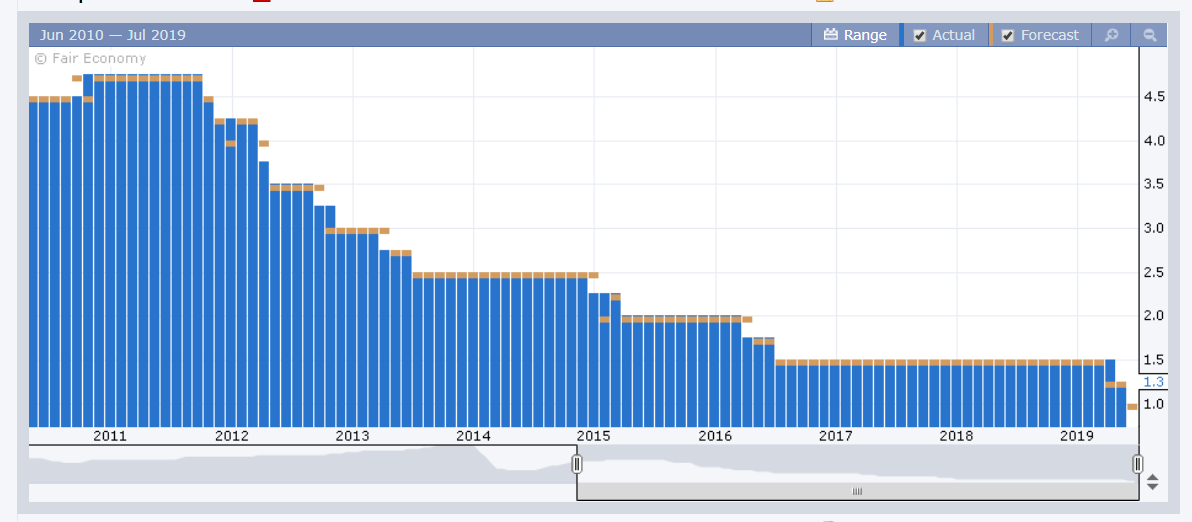

The RBA is expected to trim its Cash rate to 1.0% from 1.25% at its policy meet tomorrow (Tuesday). The RBA’s Statement will be closely watched. RBA Governor Lowe is due to deliver a speech at an RBA Board dinner in Darwin. The week’s big event is Friday’s US Payrolls is expected to climb in June after May’s poor number.

Trading Perspective: On a technical basis, the Dollar Index survived another probe on the downside, holding above 96.00 for most of this week. The Greenback will regain it’s footing as US bond yields climb. US Non-farm Payrolls are widely expected to see a bounce in employment to between 155,0000 to 160,000. In June from May’s weak 75,000 increase. A rise in US yields which is expected after the resumption of trade talks between the US and China. A rebound in the benchmark US 10-year yield should stop between 2.10% and 2.15% before resuming its decline.

Market positioning would have seen further trimming of USD longs last week. The latest COT/CFTC report is released tomorrow.

- EUR/USD – The Euro’s rally was mostly the result of broad-based Dollar weakness. A short-term rally in the Greenback will see the Single currency ease first. The Euro closed at 1.1370 after trading between 1.13506 and 1.13936. Immediate resistance lies at 1.1400 and 1.1420. Immediate support can be found at 1.1350 followed by 1.1320. Expect a likely trading range of 1.1350-1.1400 for today. Prefer to buy dips near 1.1350.

- AUD/USD – The Australian Dollar rallied to a near two-month high at 0.7035 earlier this morning. Immediate resistance for the Battler lies at 0.7040 followed by 0.7070. Immediate support can be found at 0.7000 and 0.6970. The RBA is expected to trim its cash rate by 0.25% to 1.00% at the conclusion of its meeting tomorrow. Traders will scrutinise the RBA Statement following the meeting to gauge when the next cut may occur. RBA Governor Philip Lowe speaks later in the day at an RBA Board dinner in Darwin. A 0.25% cut is already built into the currency. If the RBA keep interest rates unchanged, the Aussie will soar. Look for a trading range of 0.6990-0.7040.

- USD/JPY – The Dollar gapped against the Yen to a high earlier today at 108.50 following a close in New York at 107.97. USD/JPY currently trades at 108.35. The trade talk resumption news had the biggest impact on this currency pair, with US yields expected to climb. USD/JPY faces immediate resistance at 108.50 followed by 108.80. Immediate support can be found at 108.20 and 107.90. Look to trade a likely range of 108.00-108.60. Prefer to sell rallies.