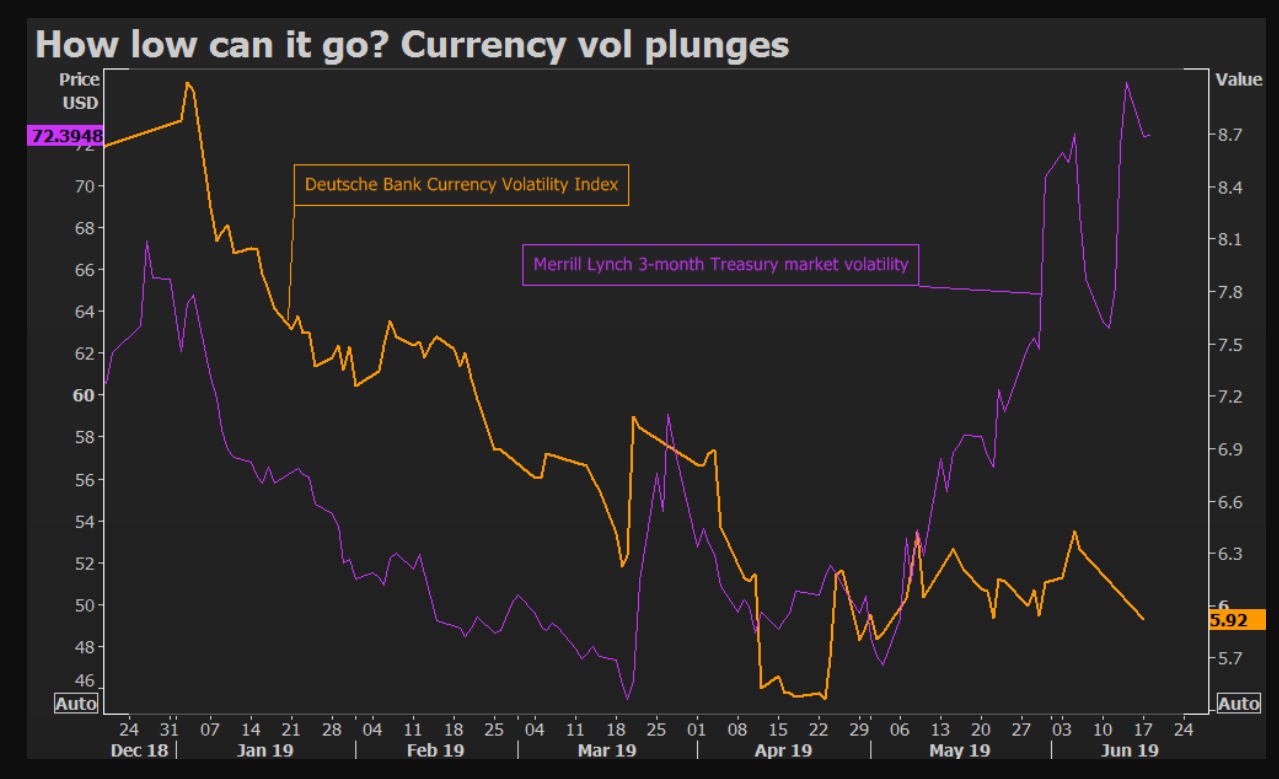

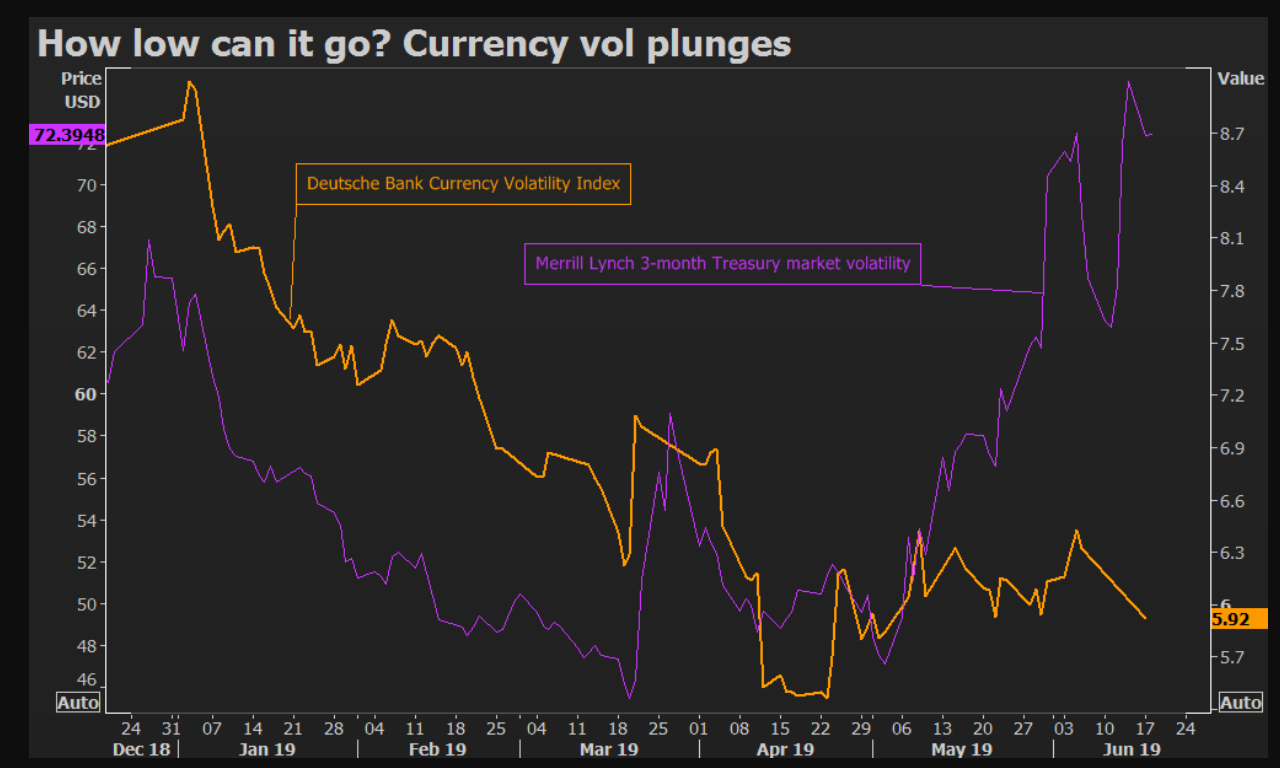

Summary: The Dollar Index (USD/DXY) was unchanged at 96.214 as traders retreated to the sidelines ahead of this weekend’s G20 summit. Month and quarter end rebalancing, falling on a Friday kept currency vols low. Global treasury prices retreated. The US ten-year bond yield slipped to 2.01% from 2.05%. The Aussie (0.7007) and its southern cousin, the Kiwi (0.6700) extended gains as risk sentiment stayed optimistic for a China-US trade settlement. The Euro was unchanged at 1.1370. The Dollar climbed against the Yen above 108 for the first time this week before settling to close flat at 107.80. A Reuters report highlighted the plight of FX volatility in 2019 which remained in the doldrums close to 4.1/2-year lows.

US data releases were mixed. US Pending Home Sales beat forecasts while Weekly Unemployment Claims were bigger than expected. US Q1 Final GDP matched analyst’s expectations.

- EUR/USD – The Euro was largely unmoved, trading within a relatively tight 1.13476 to 1.13913 range. Germany’s Preliminary CPI rose slightly higher than forecast but this was offset by a slight fall in Eurozone confidence. The Euro closed unchanged at 1.1370 for the second day running.

- USD/JPY – edged higher to trade above 108 for the first time this week boosted by the rebound in the US 10-year yield to 2.05% and positive risk sentiment. However, the Dollar slipped back to close at 107.80, matching yesterday’s finish.

- AUD/USD – in true Aussie Battler form, the antipodean currency grinded higher to finish near it’s overnight and near 3-week high at 0.7007. The Aussie Dollar’s bearish sentiment has eased somewhat given the Greenback’s broad-based fall in June.

On the Lookout: Today’s economic data releases are the heaviest for the week. Which adds to a potential lively Friday, given the month and quarter finish as well as G20 summit start. Traders will hope that FX volatility picks up.

Japan starts off with reports on it’s Tokyo CPI, June Unemployment Rate, Preliminary Industrial Production, and Housing Starts for June. The BOJ Summary of Opinions (on the economy) is also released. Australian Private Sector Credit for June is reported next. Euro-area data include German Import Prices, French Consumer Spending and Eurozone Flash Headline and Core Q1 CPI. The UK releases its June Current Account and Final Q1 GDP reports. Canadian June GDP and Raw Material Price Index data follow. Lastly, US Core PCE Spending and Personal Income, Chicago PMI and Revised University of Michigan’s Consumer Sentiment Index round up Friday’s data releases.

Trading Perspective: The Dollar Index (USD/DXY) finished at 96.214, just above its trendline support around 96.00. US 10-year bond yield are hovering just above 2.0%. The much anticipated G20 meeting starts today with Xi-Jinping meeting Donald Trump on Saturday. Markets remain optimistic for a trade deal that will prevent further tariffs. Until then, it’s all speculative chatter.

The Reuters report on the low FX volatility remaining in the doldrums will not remain that way given the current political and economic uncertainties that abound. Get ready for a potential lively Friday FX trade.

Without yield support, the Dollar will remain vulnerable to further falls.

- EUR/USD – stayed within its 1.1340-1.1420 range this week, closing at 1.1370 for the second day running. EUR/USD has immediate support at 1.1340 which if broken could see 1.1310. Immediate resistance lies at 1.1385 followed by 1.1410. A break above 1.1420 should see 1.1450 tested. Look for a likely trading range today of 1.1355-1.1415. Prefer to buy dips.

- USD/JPY – The Dollar traded to an overnight and weekly high at 108.162 before settling to finish flat at 107.80. Immediate resistance can be found at 107.85 and 108.15. Immediate support lies at 107.55 and 107.25. With US 10-year yields close to 2.0%, look to sell rallies with a likely range today of 107.35-107.85

- AUD/USD – the Australian Battler grinded higher in true fashion, closing above 0.70 cents for the first time in 3 weeks. A week ago, AUD/USD was hovering around 0.6840. The latest COT/CFTC report saw an increase in Aussie short bets despite the overall US Dollar decline. Sentiment has been overwhelmingly bearish, and we have seen some of those shorts scrambling to cover. There are more to come. Look to buy dips with a likely trading range of 0.6975-0.7025.

Happy trading and Friday all.