Summary: US bond yields rebounded with the benchmark 10-year rate up 3 basis points to 2.06%. FOMC member and NY Fed President John Williams watered down his dovish comments, saying they were “academic”. Williams, on Friday, had called for pre-emptive measures to deal with ultra-low rates and slowing economic growth. Which spawned speculation of an aggressive interest rate cut at the end of this month. Boston Fed President Eric Rosengren said the US economy does not need an interest rate reduction. The Dollar Index (USD/DXY) fell initially on Friday to 96.709 but rebounded to close at 97.074 on Williams’s clarification. Traders are also betting on rate cuts from other central banks. The Euro retreated 0.39% to 1.1220 from 1.1275 while Sterling slipped to 1.2508 (1.2548). USD/JPY climbed 0.25% to 107.75 (107.32). The Aussie, which together with the Pound, gained the most against the overall weaker Greenback, dropped back to 0.7045 from 0.7075.

Wall Street stocks slipped. The DOW finished 0.61% to 27,142 (27,307) while the S&P 500 lost 0.85% to 2,975. (3,002). Two-year US bond yields were up 6 basis points to 1.82% from 1.76% Friday.

Economic data releases on Friday were mostly second tier and had no impact on FX.

- USD/DXY – The Dollar Index, a popular measure of the Greenback’s value relative to a basket of 6 foreign currencies, rallied off its base at 96.756 to 97.074 at the New York close. The Dollar Index held the 96.50/60 immediate and strong support level.

- EUR/USD – The Euro, often a mirror of the Dollar Index (EUR/USD has virtually 60% for the weight in the Index), retreated to 1.1222 from 1.1275. The ECB has its policy meeting and rate statement this week (Thursday, 25 July) and speculation is mounting for a dovish message and a possible rate cut.

- GBP/USD – After climbing an impressive 0.94%, its largest one-day gain in two months (from 1.2430 to 1.2548), the Pound slumped 0.4% to 1.2505 at the NY close. Traders are still wary of a no-deal Brexit as the October deadline draws near.

- AUD/USD – The Aussie fell back down to earth to 0.7045 after an equally impressive 0.94% gain to 0.7075 from 0.7010. Uncertainty still surrounds the China-US trade deal and risk-off sentiment prevailed. RBAspeak this week will impact the currency. Assistant Governor Kent speaks on Tuesday while Governor Lowe is due to deliver a speech on Thursday.

On the Lookout: Today’s economic data reports are second tier. Germany’s Bundesbank releases its monthly viewpoint report, which has clashed before with the ECB’s stance.

The ECB’s interest rate policy meeting, rate statement and press conference on Thursday (25 July) are the highlight of this week.

The RBA’s Assistant Governor, in charge of Financial Markets, Christopher Kent speaks on Tuesday (23 July) at a Bloomberg meeting while Governor Philip Lowe speaks on Thursday (25 July) on “Inflation Targeting and Economic Welfare in Sydney.

Early breaking news out today saw Japan’s ruling Coalition Party led by current PM Shinzo Abe get a solid win in Sunday’s election. However, his long-held hope of Constitutional reform remains elusive as pro-amendment forces lost seat to initiate it. USD/JPY was mildly up on the news.

Elsewhere, European Union governments and Ireland were reported to have been wooing Boris Johnson, most likely UK’s next Prime Minister, with a plan to avoid a no-deal disaster. The Euro was modestly lower to 1.1217 from 1.1222 mainly on broad-based USD strength.

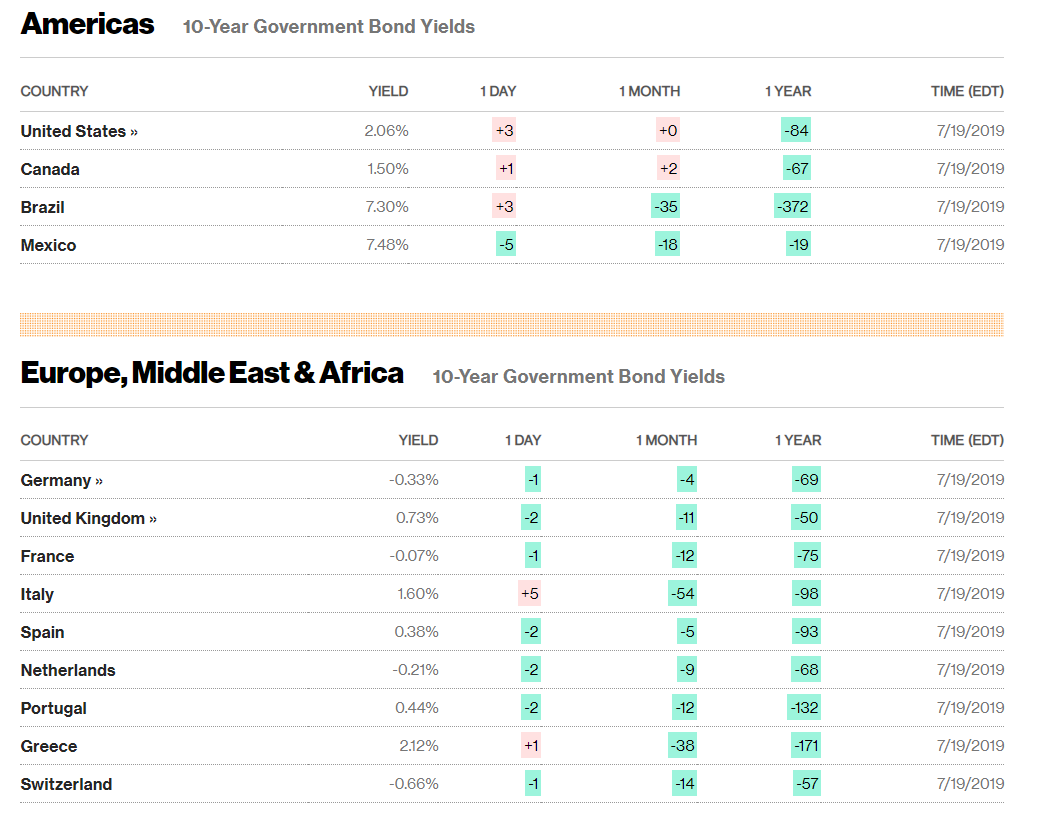

Trading Perspective: The rebound in US bond yields were not matched by its global rivals. In fact, treasury rates of Germany, the UK and Switzerland fell while the rest (Australia, Japan, Canada, New Zealand) were flat. This has widened back the differential in favour of the US Dollar. The Dollar Index held technical support level of 96.50/60 and with wider differentials in its favour, the US Dollar should consolidate its gains and remain supported in the early part of this week.

The Dollar also gained on its safe-haven support on the escalation of Iran-US tensions.

- USD/DXY – The Dollar Index closed 0.30% higher at 97.074 after trading to an overnight high at 97.292. USD/DXY opened at 96.709 on Friday morning. It held selling pressure to 96.671, Thursday’s lows, and 97.756 over the weekend. USD/DXY has immediate and strong support at 96.60 and 96.50. As traders scaled back their expectations of a deep rate cut, USD/DXY gathered support. Immediate resistance can be found at 97.30 and 97.60. Look for a likely trade today of 96.95-97.35. Just trade the range shag on this one.

- EUR/USD – The Euro failed once again to break above the resistance at 1.12820, retreating to initial supports at 1.1200 (overnight low at 1.1203). The Single currency has traded around the 1.1200-80 level for three weeks now. Overnight Germany’s 10-year Bund yield was down 1 basis points to -0.33% while US 10-year rates were up 3 basis points. With a dovish outlook on the ECB’s interest rate meeting on Thursday, EUR/USD will remain under pressure for the early part of the week. The Euro has immediate support at 1.1200 followed by 1.1180. Immediate resistance can be found at 1.1250 and 1.1280. Look for a likely trading range today of 1.1185-1.1255.

- USD/JPY – The Dollar held the 107.20 support levels well. Strong Japanese USD buying support held the level twice. USD/JPY traded to an overnight high at 107.978 before easing to settle at 107.75 in New York. Immediate resistance can be found at 108.00 followed by 108.30. Immediate support lies at 107.50 and 107.20. Look to trade a likely range today of 107.50-108.20.

- AUD/USD – the Aussie fell back to 0.7045 after failing to clear 0.7080 convincingly. The overnight high traded was 0.7082. Immediate resistance is found at 0.7080 and 0.7100. Immediate support lies at 0.7035 and 0.7005. A break of 0.7005 will see 0.6975. Traders will be focussing on RBAspeak this week, with local analysts expecting further dovish speak from the RBA. Look to trade a likely range today of 0.7000-0.7060.

Have a good week ahead all, happy trading.