Asian stocks slumped today as trade war tensions escalate after President Trump announced that the US will impose a 10.0% tariff on the remaining $300.0bn-worth of Chinese products. The Nikkei225 is down 2.21 percent lower at 20,604, the Hang Seng trading 2.85 percent lower at 26,159.

The Shanghai Composite ended 0.90 percent lower to 2,841, while in Singapore, the FTSE Straits Times index finished 1,91 percent lower to 3,199. Australian equities also trade lower, the ASX 200 is trading lower 0.93% to 6,705.

European equities started lower this week, DAX30 is giving up 1.20 percent to 11,731, CAC40 is 1.46 percent lower at 5,281 while the FTSE MIB in Milan is trading 0.97 percent lower at 20,842. The London Stock Exchange is 1,22% percent lower to 7,312.

In commodities markets, crude oil trades 1.10 percent lower at $55.05 as traders turn cautious on recent trade war escalation. Brent oil is trading 1.19% lower at $61,16 per barrel despite major oil producers have agreed to cut output. Gold is trading higher at 1,452, keeping the bullish momentum as the price holds above all the major daily moving averages. On the upside, strong resistance will be met at 1,456.6 high.

In cryptocurrencies bitcoin (BTCUSD) had a strong weekend breaking above 11,000, and trades at 11,553 hitting the daily low at 10,758 and the daily high at 11,650. Bitcoin trades above the 50-day moving average, and now the momentum is positive for the short term, the previous two times it managed to rebound from that point. Immediate support for BTC stands now at $9,439 the low from July 30, while next support stands at 9,000.

On the upside, strong resistance now stands at 13,138 recent high and then at 13,500 round figure. Ethereum (ETHUSD) adds 9 dollars at 227 with capitalization now to 24.6 billion. On the upside, the immediate resistance stands at 317 Friday’s high while the support stands at 200 round figure, Litecoin (LTCUSD) trades lower at 93.05. The crypto market cap now stands above $305.5 billion.

On the Lookout: New Zealand ANZ Commodity Price came in at -1.4% below forecasts of 0% in July, and the China Caixin Services PMI came in at 51.6 below expectations of 52.9 in July. Australia Commonwealth Bank Services PMI came up to 52.3 in July from previous 51.9, while Japan Markit Services PMI registered at 51.8, below expectations (52.3) in July. People’s Bank of China set the Yuan reference rate at 6.9225 – a historically low level.

President Trump, decided the previous week to add another 10% tariffs on the remaining USD300bn worth of US imports from China, starting September 1st.

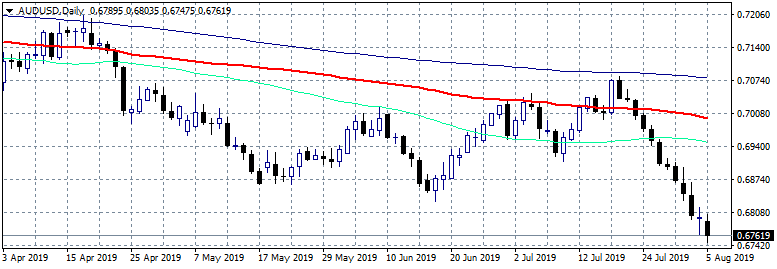

Trading Perspective: In forex markets, USD trades 0.12 percent lower at 97.98, the Aussie dollar trades 0.40 percent lower at 0.6770, while Kiwi also trades lower at 0.6517.

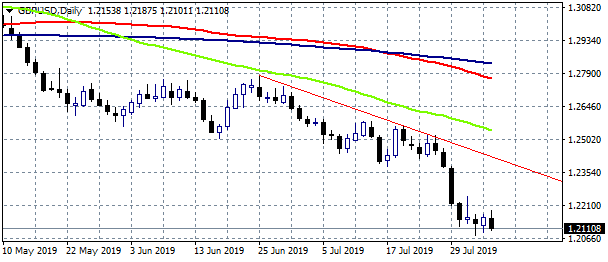

GBPUSD started the week 0.35% lower at 1.2114. Major support now stands at 1.2089, Thursday’s low which if broken might accelerate the slide further towards 1.2050. On the upside, immediate resistance now stands at 1.2129, the 50-hour moving average, while more offers will emerge at 1.2146 the 100-hour moving average.

In Pound futures markets, open interest increased by 4,400 contracts while volume decreased by 58,000 futures contracts.

EURUSD trading 0.18% higher at 1.1126, facing now the strong resistance at 1.1132 the today’s high, which if the pair manages to close above will open the way to 1.1161. On the downside, immediate support stands at 1.1103, today’s low.

Euro futures markets open interest decreased by 4,500 contracts while volume decreased by 69,400 futures contracts.

USDJPY is trading 0.54% lower at 105.95 having hit the daily low at 105.78 and the daily high at 106.67. USDJPY pair will find support around 105.50 round figure and then at 105. On the upside, immediate resistance for the pair now stands at 108.14, the 50-day moving average and then at 109.51 the 100-day moving average.

In Yen futures markets open interest increased by 6,400 contracts while volume decreased by 5,000 futures contracts.

USDCAD is trading 0.25 higher at 1.3231 and continues the rebound from the lows around 1.30 amid USD strength, and the retreat in crude oil prices, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.3242 zone before an attempt to 1.3450 high from 31st May.