Summary: The Euro outperformed, hitting fresh 2-year highs (1.17813) and leading a broad-based FX rally against the US Dollar. Gold soared to a record high (USD 1,945.63), as safe-haven flows continued to divert away from the Greenback. The USD/JPY pair, which broke its upward trend last week, slumped 0.66% to 105.38 (106.15) after bottoming out in New York at 105.115. Sterling extended its advance against the soggy Greenback, soaring to 4-month highs at 1.29028 (1.2797 yesterday). The Australian Dollar bounced back to finish at 0.7150 from 0.7105 but it was the Kiwi (NZD/USD) that led the rally against the US Dollar, up 0.71% to 0.6690 (0.6640). The US continued to lag the rest of the world in halting the spread of the coronavirus and some expect the American economy to lag others, principally Europe. FX is also anticipating a dovish FOMC with the Fed likely to keep rates near zero for years to come at the conclusion of its meeting on Wednesday (early Thursday morning in Sydney). According to a Reuters report, “a broad measure of Dollar positioning showed that net short positions in the Greenback rose to the highest level since April 2018.” Reuters also reported that US Senate Majority Leader Mitch McConnell said yesterday that Senate Republicans will shortly introduce a new coronavirus relief program to address health, economic assistance, and schools. The cost of the coronavirus response bill is expected to be around USD 1 trillion. Wall Street stocks rose.

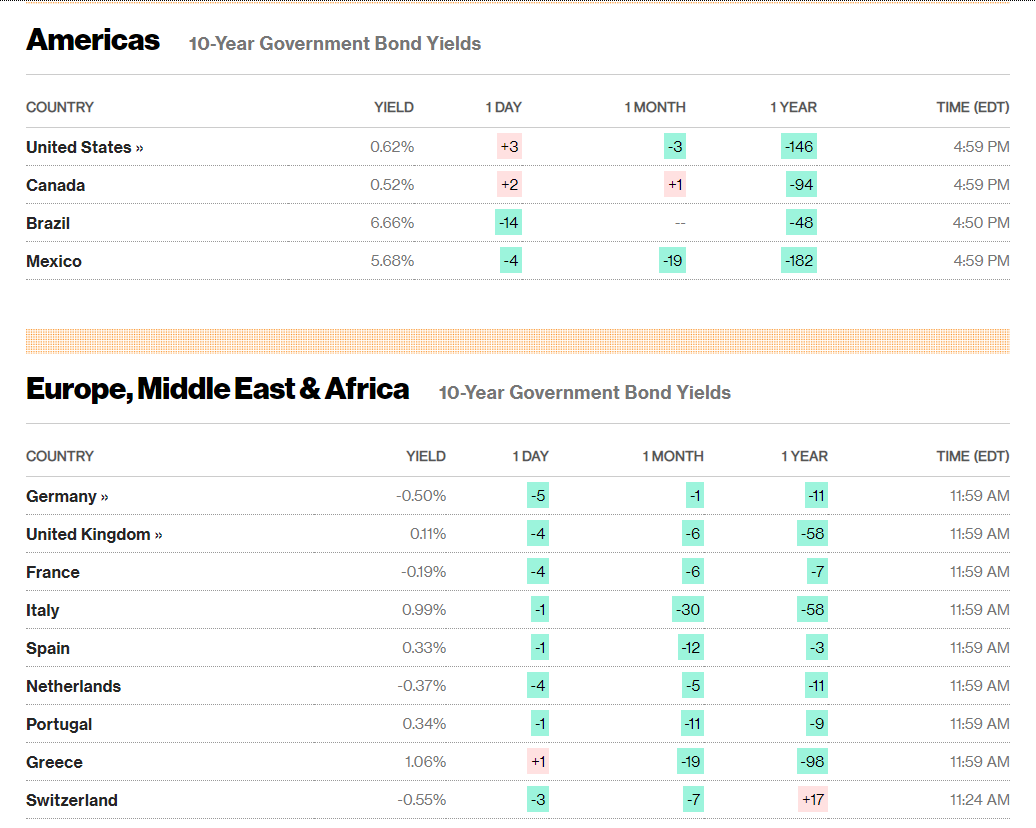

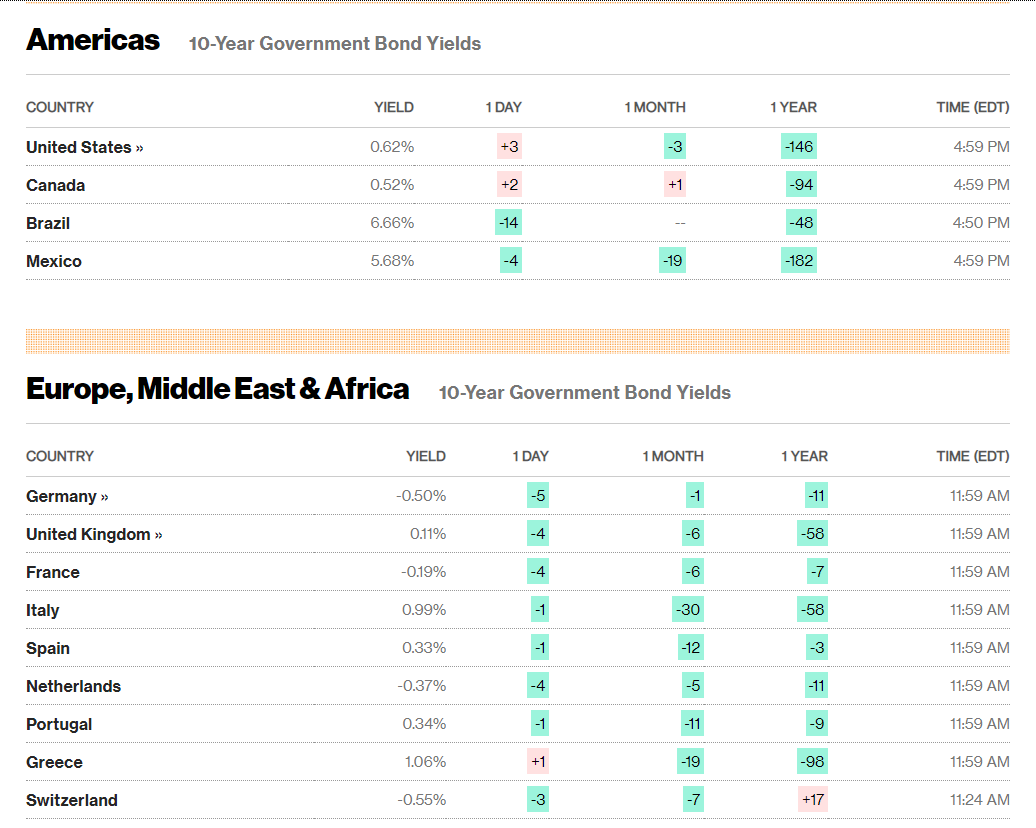

The DOW closed 0.71% higher to 26,625 while the S&P 500 was last at 3,242 (3,214), up 0.92%. Oddly, the US 10-year treasury yield finished 3 basis points higher at 0.62% while Germany’s 10-year Bund slipped to -0.50% from -0.45%. Which may just exhaust the US Dollar sell-off.

Data released yesterday saw Germany’s IFO Business Climate Index climb to 90.5 in July from June’s 86.2, beating forecasts at 89.2. US Headline Durable Goods Orders rose 7.3%, beating forecasts at 7.0%. Core Orders in July (ex-transport/aircraft orders) fell to 3.3% from 3.7% in June.

On the Lookout: Today sees a light calendar release amidst overwhelming bearish US Dollar sentiment. Japan kicks off the economic releases with its SPPI (Services Product Price Index). Europe follows with Spain’s Unemployment Rate. The UK reports its CBI (Confederation of British Industry Realized Sales. The US rounds up the day’s data with its Standard and Poor’s/Case Shiller Composite-20 metropolitan area single-family Homes report, Conference Board Consumer Confidence and Richmond Manufacturing Index.

Tomorrow sees the start of heavier data releases beginning with Australia’s CPI report.

The global coronavirus count will continue to be monitored. While the US still leads with total new cases soaring above 54,000, infections are rising in other parts of the world. Spain continues to lead Europe’s second wave of new cases with 2,120 as at this morning.

Trading Perspective: The Dollar slide continues to accelerate amidst growing bearish sentiment. Every analyst that this writer read today suggests further Greenback weakness, with good reasoning behind those calls. The medium-term trend is certainly for a weaker Greenback. However, the conditions for a corrective bounce in the Dollar are ripe. Short speculative US Dollar positioning continues to climb, hitting its highest level since April 2018. Overnight, the US 10-year bond yield climbed 3 basis points higher while those of its global rivals dropped. Germany’s 10-year rate fell 5 basis points, while the UK 10-year bond yield slipped 3 basis points. We examine a few currencies below.

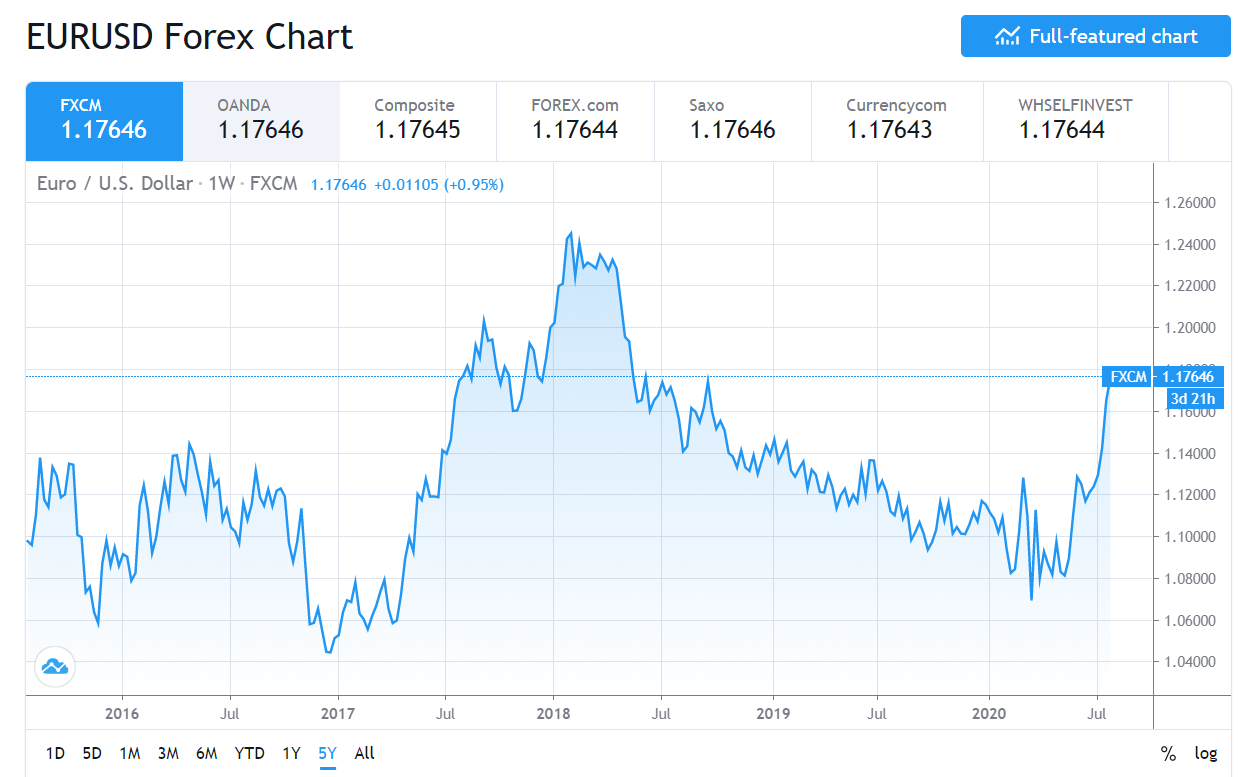

EUR/USD – Outperformance Continues, Overbought Condition Builds

The Euro led FX higher against the already soggy Greenback as more strategists saw the EU economy outpacing that of the US. Europe already leads in halting the spread of its coronavirus outbreak, although a second wave of new infections (particularly in Spain) are starting to concern. The shared currency has gained almost 5% against the US Dollar since the start of the month. Bullish Euro sentiment continues to build as does the speculative market’s long positions in the shared currency. Overnight the EUR/USD pair hit its highest since September 2018 at 1.17813 before easing to close at 1.1757 in New York.

There are signs we may see short term exhaustion of the Euro’s climb. Overnight the yield gap between the US and German 10-year Bunds widened. Germany’s 10-year rate fell 5 basis points to -0.50% while its 10-year US counterpart climbed 3 basis points to 0.62%. In the futures market, speculative long Euro bets have climbed to their largest total since April 2018.

EUR/USD has immediate resistance at 1.1780 followed by 1.1810. Immediate support can be found at 1.1710 followed by 1.1680 and 1.1650. Look for an exhaustive move up to test between 1.1780 and 1.1800 before a cAUDorrective retreat to 1.1680 first. Likely range today 1.1680 – 1.1780. Look to sell rallies.

AUD/USD – Greenback Weakness, Strong Metals Lifts Battler, CPI Next

The Australian Dollar climbed off its lows yesterday at 0.70826, boosted by the broad-based US Dollar weakness and a strong Kiwi (NZD/USD). AUD/USD rallied to an overnight high at 0.7152, edging up to 0.7160 in early Asia before settling at its current 0.7148 level. The Aussie will continue to take its lead from the Greenback ahead of tomorrow’s Australian CPI report.

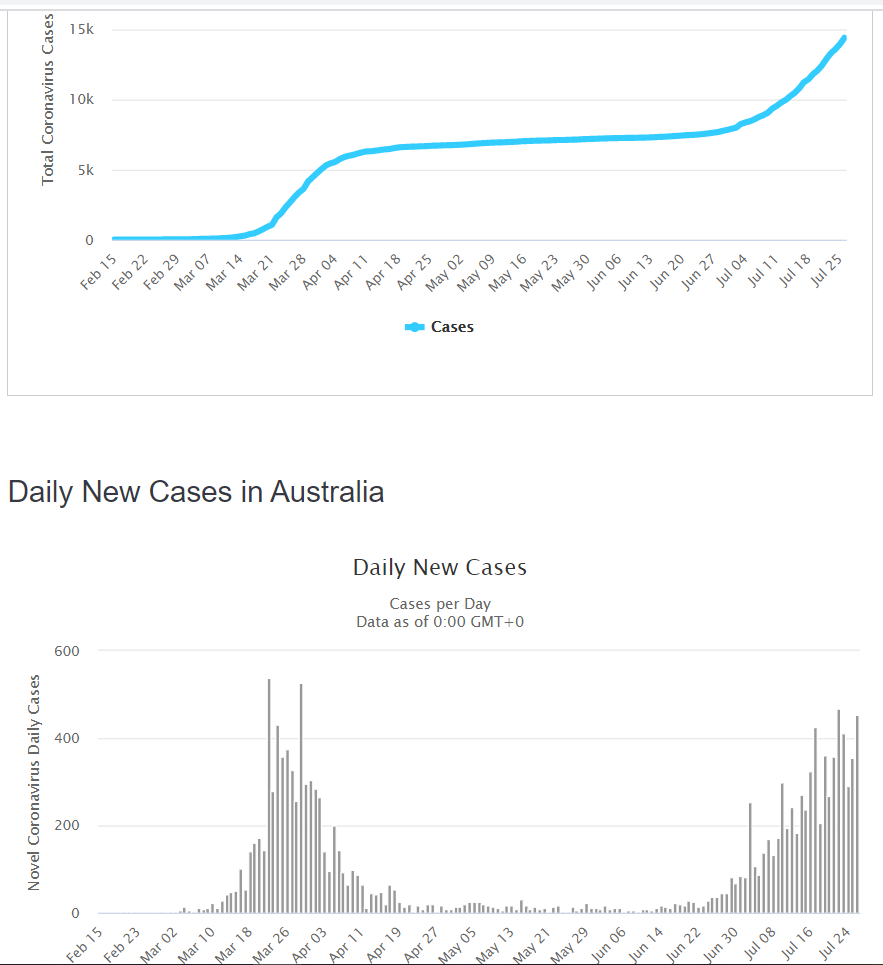

Meantime, the country’s coronavirus second wave of daily new cases continue to climb led by the second largest state, Victoria, followed by New South Wales. Total Daily New Cases climbed to 453 yesterday, the largest since July 22 which saw 468 infections. This second wave of daily new cases have been the highest since March. While these numbers pare in comparison with those in the US and other global hotspots, they will still weigh on Australia’s economy.

AUD/USD has immediate resistance today at 0.7160, Friday’s high, and 0.7183, last Thursday’s peak. Immediate support can be found at 0.7120 followed by 0.7090. A corrective up-move in the US Dollar should see the Aussie retreat back down to the mid-70’s. Look for a likely range today of 0.7070-0.7170. Look to sell rallies.