Summary: Political Uncertainty in Germany and weak Italian Industrial Output, following Friday’s record fall in German factory output pushed the Euro to a fresh 2020 and 4-month low at 1.0909. In contrast, a bullish outlook for the US economy on an acceleration of US job growth (Friday) lifted the Dollar Index (USD/DXY) to 98.88, before settling at 98.827, up 0.18%. Sterling steadied to close at 1.2918 after falling to 1.28721. The Dollar rose to 109.878 Japanese Yen, settling to a New York close at 109.68. The Australian Dollar slumped to 0.66645, 2009 lows before rebounding to 0.6679 on short covering following an upbeat Chinese CPI report. Meantime, the latest Commitment of Traders/CFTC report (week ended 4 February) saw large speculators and hedge funds continue to pile into US Dollars.

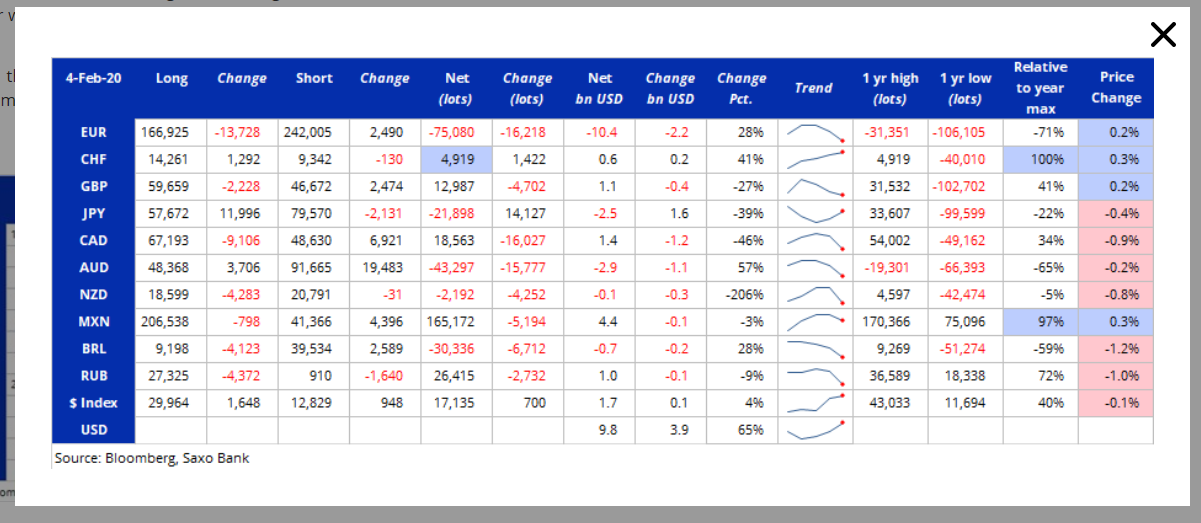

Uncertainty on global growth created by the coronavirus saw overall US Dollar longs against 10 IMM currency futures jump to total US$ 9.8 billion, a five-week high. Net Euro short contracts rose to –EUR 75,080, the biggest short since October. Emerging Market Currencies steadied on the likelihood that more solutions to slow the spread of the deadly coronavirus were in the making. Wall Street stocks rose. The DOW finished up at 29,197, up 0.41% while the S&P 500 added 0.5% to 3,345. Bond yields stayed low. The benchmark US 10-year yield was at 1.56%.

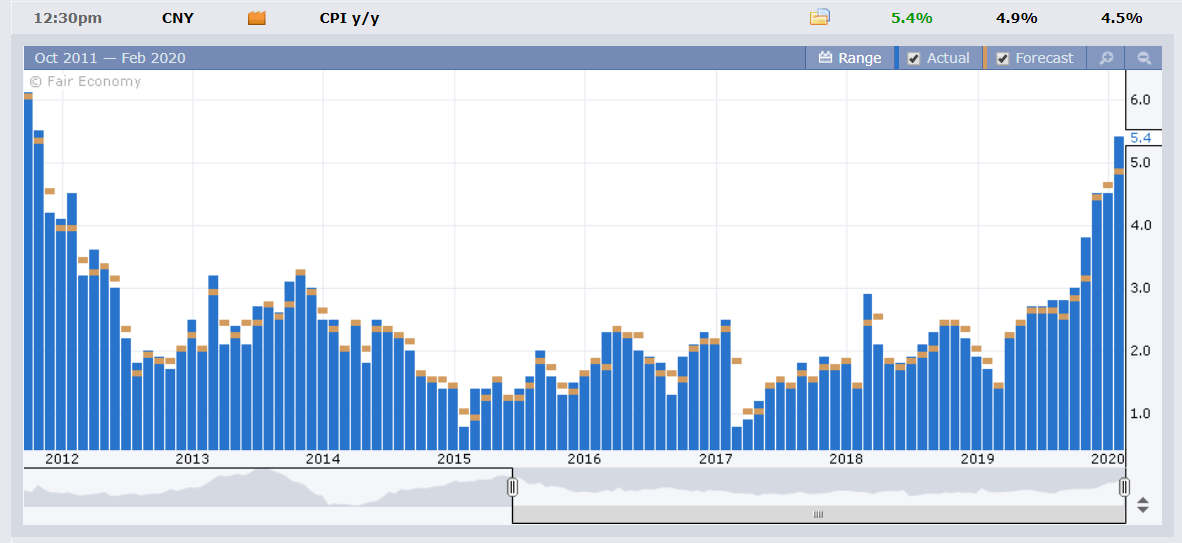

Italy’s Industrial Production slumped-2.7% in February, missing forecasts and following a revised fall in January to 0.0%. China’s Annual CPI soared to 5.4%, beating expectations of 4.9% while PPI matched forecasts at 0.1%.

- EUR/USD – The Euro slid to fresh 2020 and 4-month lows at 1.0909 following the release of weaker than forecast Italian Industrial Production data. The shared currency rallied on short covering to close at 1.0915.

- AUD/USD – The Aussie Battler recovered somewhat after hitting a 2009 low at 0.66645 as worries about the coronavirus effect on China’s economy weighed on the currency. China is Australia’s largest trading partner. The death toll of the deadly virus has claimed over 900 lives. Stronger-than-forecast Chinese CPI saw the Aussie Battler rebound to 0.6680.

- USD/JPY – The Dollar settled at 109.68 against the Yen after initially rallying to 109.878 on a generally stronger Greenback.

- GBP/USD – Sterling settled to close at 1.2918 after slumping to an overnight low at 1.2872 on the overall stronger US Dollar. Primary UK economic data are due today.

On the Lookout: The Dollar remained King of FX as US equities climbed as markets looked past reports of rising cases of coronavirus outside of China and various companies pulling back from international meetings. The latest death toll report as a result of the virus rose to 1,011 this morning. Last week’s climb in US Payrolls underscored the resilience in labour markets, underscoring the sustainability of the US economic expansion. In contrast, European data saw Italy’s Industrial Production much weaker than forecast after Germany recorded its biggest fall in industrial output in December since 2009. German political uncertainty added to the single currency’s woes. Angela Merkel confirmed she would not run for chancellor in next year’s federal election.

Today sees UK Preliminary Quarterly GDP, Monthly GDP, Manufacturing Production, Construction Output, Industrial Production, and Goods Trade Balance reports. The US reports its JOLTS Job Openings. The big event is Fed Chair Jerome Powell’s Semi-annual Monetary Policy Report before the US House Financial Services Committee in Washington DC.

Japanese markets are closed today in observance of their National Foundation Day.

Trading Perspective: While the Dollar remains FX King, the market’s speculative long US Dollar positioning is growing. This will limit any further significant Dollar gains. Last week, US Wages were lower despite the climb in Payrolls. The latest COT report (week ended 4 February) bears monitoring. Net total USD long bets climbed by 65% to a five-week high at +USD 9.8 billion. Most of the USD longs were due to a large increase in Euro and Aussie shorts.

- EUR/USD – The Euro managed to close just above it’s 2020 low at 1.0909, finishing at 1.0915 in New York. The shared currency opened in Asia at 1.0910 and looks poised for further downside probes. Immediate support can be found at 1.0900 followed by 1.0880. Immediate resistance lies at 1.0935 and 1.0965. While Euro sentiment remains weak, the speculative market is short. Net total speculative EUR shorts increased to -EUR 75,080 for the week ended 4 Feb from -EUR 58,862 the previous week. The risk is for a corrective pullback. Look for a likely trading rang today of 1.09056-55. Prefer to buy dips.

- AUD/USD – The Aussie, like the Euro, is the victim of bearish sentiment. The ongoing coronavirus threat and its climbing toll will keep the Battler on the defensive. AUD/USD fell to a 2009 low at 0.66645 before rallying to 0.6707 on the upbeat Chinese CPI report. AUD/USD settled at 0.6680 in New York. The latest COT/CFTC report was net Aussie short bets increase to -AUD 43,297 from -AUD 27,520 the previous week. Look for the Aussie to trade a likely 0.6670-0.6720 range today, prefer to buy dips at current levels.

- USD/JPY – The Dollar rallied to an overnight high at 109.878 before settling to close at 109.68. Overnight low traded was 109.563 which is where the immediate support lies for today. The next support level can be found at 109.15. Immediate resistance lies at 109.90 followed by 110.20. The latest COT report saw net speculative JPY short bets trimmed to -JPY 21,898 in the week ended 4 Feb, from -JPY 36,025. Look for a likely trading range today of 109.50-109.80. Prefer to sell US Dollar rallies to 110.00.

Have a good week ahead, happy trading all.