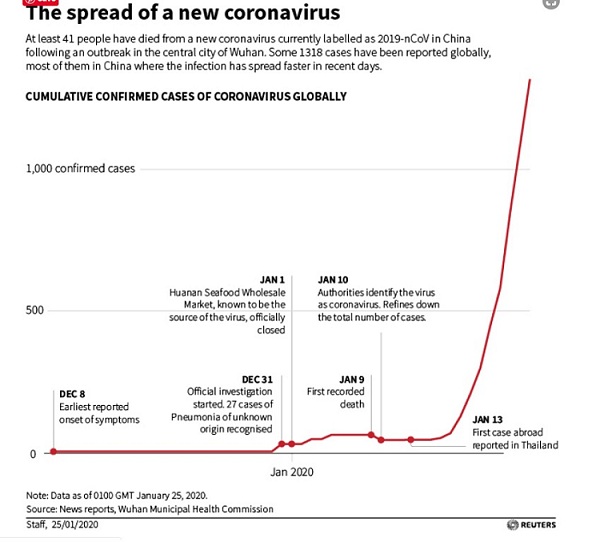

Summary: Market fears rose on the weekend as the Coronavirus spread around the globe and the death toll rose. The CBOE Volatility Index (VIX) spiked over 12% to 16 before closing at 14.56, highs not seen since early December. The outbreak from the coronavirus has taken the lives of 56 people in China and infected around 2,000 people globally. While most of the diagnosed cases are in China, countries like Australia, Japan, Thailand, South Korea, the US, Canada, and France. FX sought the traditional haven Yen as well as US Treasuries. USD/JPY dropped to close at 109.30, a two-week low. The big losers were the Australian Dollar down 0.40% at 0.6825 and the Euro, which lost 0.31% to 1.1027 against the US Dollar. As a result of the Euro’s loss, the Dollar Index (USD/DXY) rose to 97.884 (97.7020. Stocks slumped while Emerging Markets were lower. The Dollar rose against the Thai Baht (USD/THB) to 30.57 from 30.45 Friday. The US S&P 500 lost 0.98% to 3,295 (3,325). Bond yields slumped. The benchmark US 10-year bond yield was at 1.68%, 5 basis points lower. Germany’s 10-Year Bund yield fell to -0.34% from -0.31%.

Data releases Friday saw Japan’s Flash Manufacturing PMI rise to 49.3, beating forecasts of 48.9.

Australia’s Flash Manufacturing PMI matched forecasts, at 49.1 against 49.0. Other factory output reports saw French and German Flash PMI’s beat forecasts. The Eurozone Flash Manufacturing PMI outperformed expectations, rising to 47.8 against median forecasts at 46.9. UK Factory Output rose to 49.8, beating forecasts at 48.8. Finally, US Flash Manufacturing PMI underwhelmed, falling to 51.7 against expectations of 52.4 and a previous 52.4.

- EUR/USD – The Euro extended its fall to finish at 1.1027 from Friday’s opening at 1.1055. Bearish sentiment continued to weigh on the shared currency as FX saw the outcome of last week’s ECB meeting as dovish.

- USD/JPY – Against the haven sought Yen, the Dollar slumped to 109.30 from 109.50, fresh 2-week lows. Risk aversion and lower 10-year yields boosted the Yen. Japanese 10-year JGB yields were unchanged at -0.03%.

- AUD/USD – The risk sensitive Aussie fell 0.4% to 0.6827 from 0.6842. The Aussie Battler traded to an overnight and fresh 2020 low at 0.68175. Despite an upbeat Jobs report last week, the Aussie remains under pressure in the current market environment.

- USD/DXY – traded to an overnight high at 97.946, from 97.702 opening on Friday before easing to settle at 97.884. The weaker Euro, which is close to 60% of the weight in the Dollar Index, was the main driver.

On the Lookout: Expect another bout of risk-off today. Market anxiety on the Coronavirus will extend to Asia with eyes stuck to press releases. Volumes will be thin. Australia is closed today to celebrate Australia Day (January 26).

The NY Times described the Coronavirus as a “rapidly expanding outbreak” which has “fuelled fears of a global pandemic.”

There is little in the way of data releases today. Germany reports its IFO Business Climate. The UK follows next with its High Street Lending report.

The week ahead sees the Fed FOMC January policy meeting and rate decision. The Bank of England also meets on rates and releases its Monetary Policy Report and Summary. Both are on Thursday, Australian time. The US releases its Q4 Advance GDP report early Friday morning.

Trading Perspective: The Dollar will trade mixed with the Yen continuing to benefit as market anxiety on the Coronavirus grows. Risk currencies like the Aussie will stay under pressure, but their downsides will be limited with thinner volumes. Asset markets will bear the brunt in this scenario. When it came down to the economic data, US Flash Manufacturing PMI’s underwhelmed whereas the rest of the world (Australia, Japan, Germany, Eurozone, UK) factory output outperformed. The Dollar’s topside is limited.

- USD/JPY – The Dollar should extend its losses against the Yen with 109.00 as the immediate support level. A break down through 109.00 will see 108.70 and 108.40. Immediate resistance lies at 109.60 (overnight high 109.65). Look to sell rallies with a likely range today at 108.70-109.20.

- EUR/USD – A weaker USD/JPY should be supportive of the Euro. Most of the Euro area and Eurozone factory outputs outperformed while that of the US was lower. EUR/USD has immediate resistance at 1.1050 followed by 1.1080. Immediate support can be found at 1.1020 (overnight low 1.10196) and 1.1000. Look for a likely range today of 1.1020-1.1070. Prefer to buy dips.

- AUD/USD – The Aussie traded to an overnight and fresh 2020 low at 0.68173 before climbing to settle at 0.6827. Immediate support for the AUD/USD lies at 0.6820 followed by 0.6800. Immediate resistance can be found at 0.6850 and 0.6880. Look to trade a likely range today of 0.6820-0.6870. Prefer to buy dips.

- USD/DXY – The Dollar Index traded to an overnight and near two-month high at 97.946 before easing to settle at 97.884. Immediate resistance lies at 98.00 followed by 98.30. Immediate support can be found at 97.70 (overnight low 97.667) and 97.50. Look to sell rallies with a likely range today of 97.65-97.95.

Despite the market fears, keep a level head.

Happy Australia Day, happy trading all.