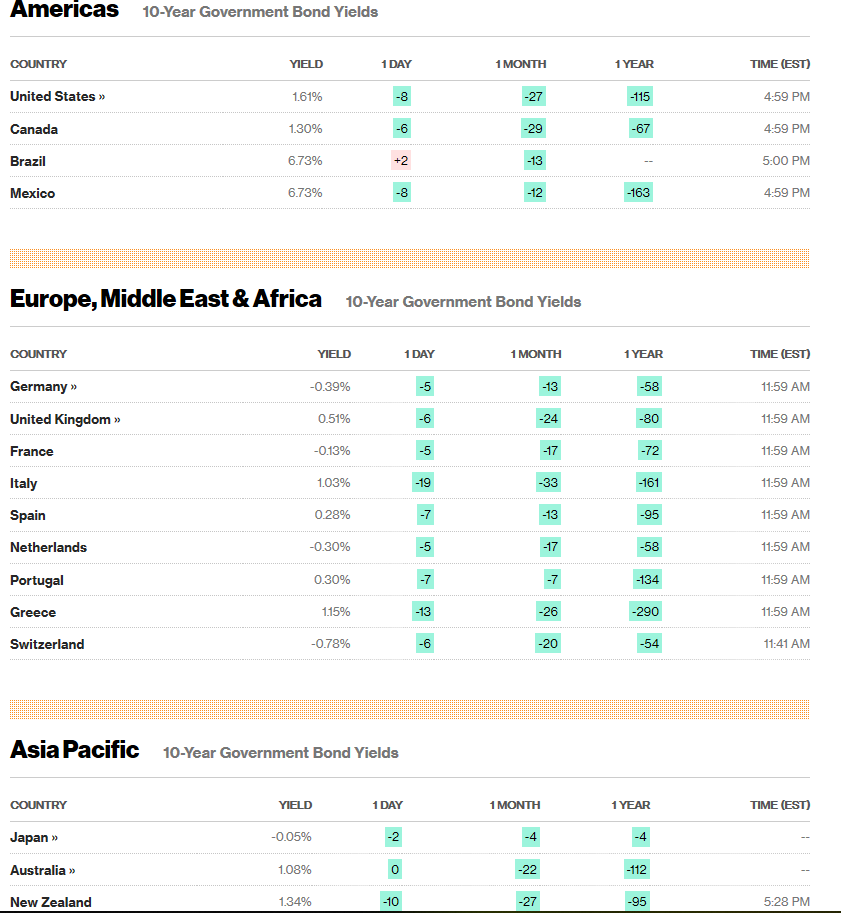

Summary: Risk aversion continued to dominate markets this time expressed through a massive rally in the US 16.7 trillion Treasury market. News that the Coronavirus has left 80 dead in China and infected almost 3,000 people spread across the globe saw the US 10-year bond yield plunge 8 basis points to 1.60% for the first time since October. Concerns grew about the possible economic fallout from the virus. FX saw the Japanese Yen continue to climb, with USD/JPY down 0.3% to 108.95. The Euro dipped to 1.1017 (1.1027) after Germany’s IFO Business Survey missed market forecasts. Sterling was modestly lower to 1.3045 (1.3072) ahead of the Bank of England policy meeting on Thursday. While most expect the BOE to hold rates, some see Governor Mark Carney cutting rates before leaving his post. The Australian Dollar slumped 0.88% to 0.6760 (0.6826), fresh two-month lows, leading all risk currencies lower. New Zealand’s Kiwi fell 0.79% to 0.6548. Against the Canadian Loonie, the US Dollar surged to a 7-week high at 1.3200, settling at 1.3182 in late New York trade. Emerging Market Currencies extended their drop. The South African Rand fell 1.6% (USD/ZAR 14.60 from 14.40). The Dollar hit two-week highs against the Mexican Peso, USD/MXN traded above 19.00 before easing to 18.8980.

US 2-year bond yields were down to 1.44% from 1.49%. Global treasury yields were lower. Germany’s 10-year Bund yield was last at -0.39% from -0.34%. Japanese 10-year JGBs yielded -0.05%, from -0.03%. Global stocks extended their drop. The DOW fell 1.37% to 28,571 (28,977).

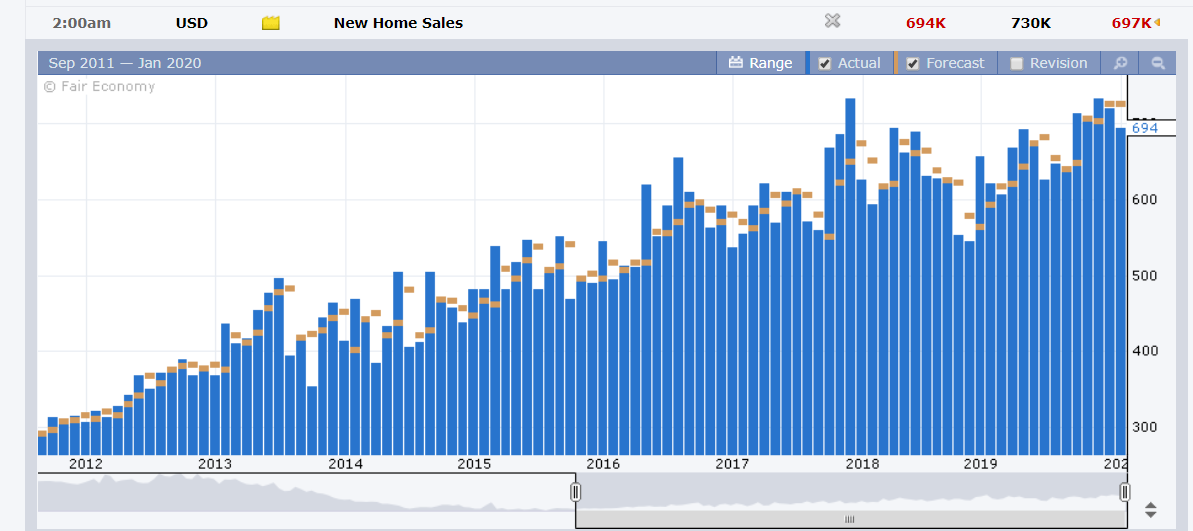

Data releases yesterday were thin. Germany’s IFO Business Climate Index fell to 95.9 for the first reading in 2020, missing forecasts at 97.1 and below December’s 96.3. UK High Street Lending rose 46,800 beating forecasts at 44,500. US New Home Sales fell to a 5-month low at 694,000 units, widely missing expectations of 730,000 units. December Home Sales were revised down to 697,000 from 719,000.

- USD/JPY – The Dollar closed 0.3% lower against the Yen to 108.95 from 109.29 yesterday. The Japanese currency emerged the strongest FX yet again with risk aversion dominating all markets.

- AUD/USD – the Aussie Battler slumped to 0.6760, down 0.88%, to finish worst performing major. Volumes were thin and moves were exaggerated due to the Australia Day holiday yesterday.

- EUR/USD – The Euro edged lower to finish at 1.1018 from 1.1027 in generally slow trade. Disappointing German Business Survey results combined with risk aversion weighed on the shared currency.

- GBP/USD – Ahead of Thursday’s Bank of England policy meeting the British Pound topped at 1.3105 before easing to 1.3045 at the New York close. Traders are considering the possibility of an easing following a string of weaker economic data in Mark Carney’s last meeting at the helm of the BOE.

On the Lookout: Data releases pick up today amid market concerns over the Coronavirus. Chinese banks will be closed today and for the rest of the week in observance of its Lunar New Year celebrations. Australia reports its National Australia Bank Business Confidence Index followed by Japan’s BOJ Annual Core CPI report. European data releases start off with Switzerland’s Trade Balance followed by Spain’s Unemployment Rate. The UK reports its CBI (Confederation of British Industry) Realised Sales for January. The US sees off its Headline and Core Durable Goods Orders (January), S&P Case Shiller Composite 20-year House Price Index and Richmond Manufacturing Index.

Trading Perspective: Risk-aversion saw a flight-to-quality in the asset markets that sent US Treasuries soaring. The benchmark US 10-year yield plunged to 1.60%, its lowest level since October. Global bond yields also dropped but not to the extent of their US rival. In October global bond yields were much lower. Germany’s 10-year yield was at -0.55%, compared to -0.39% yesterday. The yield differentials between US and global rivals has narrowed considerably since then. This should provide the currency support against the US Dollar, which was mostly higher against most rivals apart from haven currencies. Dismal US December Home Sales data will also weigh on the Greenback.

- USD/JPY – The Dollar dropped to an overnight and near 3-week low at 108.732 before a modest rally back to 108.97 at the New York close. Risk aversion should continue to see USD/JPY pressurised as well as the lower US 10-year yields. USD/JPY has immediate support at 108.70 followed by 108.40. Immediate resistance lies at 109.10 (overnight high 109.137) and 109.40. Look to sell rallies with a likely range of 108.60-109.10 today.

- EUR/USD – The shared currency drifted lower to close at 1.1017, not far from it’s overnight low at 1.1015. Weaker-than-expected German January Business Climate Survey weighed on the Euro. However, the 1.10 support level held as the differential between US and German bond yields narrowed. In FX, yield differentials matter. EUR/USD has immediate support at 1.1000 followed by 1.0970. Immediate resistance can be found at 1.1040 (overnight high 1.10376) and 1.1070. Look for a likely trading range today of 1.1010-60. Prefer to buy dips.

- AUD/USD – The Aussie Battler slumped to 0.67522 overnight and two-month low at 0.67522, before closing at 0.6760 in New York. The Aussie bore the brunt of the market’s ris-off stance. AUD/USD has immediate support at 0.6750 followed by 0.6720. Immediate resistance can be found at 0.6775 and 0.6800. Australia’s 10-year bond yield was unchanged at 1.08%. The differential with its US 10-year counterpart has narrowed significantly since October. Australian domestic data has outperformed of late, while reports from the US are mixed. Market positioning is also short of Aussie. Look to buy dips in a likely 0.6750-0.6800 range today.

Happy trading all.