Major Forex pairs and Equities trade positive but gains capped on concerns surrounding geo-political events. EU-China meeting and Brexit summit eyed for directional cues.

Major Forex pairs and Equities trade positive but gains capped on concerns surrounding geo-political events. EU-China meeting and Brexit summit eyed for directional cues.

Summary: Asian market today morning saw positive price action in major equities and benchmark indices across major Asian stock exchanges. The positive price action was influenced by Chinese measures to boost economic growth in the country. However, investor concern in the broad market over expectations for disappointing U.S. earnings and upcoming crucial Brexit summit this week capped gains. European markets are trading with slight positive bias but gains are capped owing to headlines which hinted at rising tensions between US & EU over possible tariff war. Prevalent risk on investor sentiment in the broad market combined with weak US Greenback helped major global currencies trade positive in Forex market. While European equity market is seeing subdued price action, Euro has managed to retain positive price action with stable bullish bias. This positive price momentum surrounding Euro is a result of investors holding back from making major moves ahead of Euro options contract which expire today. While geo-political and economical events continue to inspire some level of caution across all major markets hopes for positive outcome in key issues continue to underpin market bulls helping sustain positive price action in Asian and European markets.

Precious metals: Both Gold and Silver gain positive momentum in both spot and futures trading market today. While price action in equity market indicates that risk appetite in prevalent in major markets today, concerns ahead of Brexit summit, EU-China meeting, US tariff threat on European markets capped gains in market and influenced some level of cautious investor sentiment. This combined with US Dollar’s weakness in the global market helped Gold touch new one week high earlier today with both precious metals trading positive in the global market.

Crude Oil: Crude oil price is seeing positive price action in both major global benchmarks –WTI & Brent. Both spot and futures crude oil assets scaled new 2019 highs for second consecutive session today with spot WTI hitting $64.69/b while Brent hit $71.81/b during Asian market hours. The price remains well near intra-day highs maintaining stable rally in European market hours. As tensions continue to escalate in Libya, while OPEC continues to enforce supply cut in member nations expectation for further disruption in supply has provided fundamental support to Crude oil bulls facilitating positive price action.

AUD/USD: As risk appetite boomed in the market, AUDUSD pair scaled new 2-week tops with Australian dollar receiving strong fundamental support from upbeat Australian housing finance data. Further, weak US dollar in the global market added positive strength to AUD bulls facilitating solid bullish price rally. Positive investor sentiment owing to Sino-U.S. trade talk related optimism also added positive strength to AUD given Australian economy’s strong relation to Chinese economy owing to trade ties. Weak US.T-Yields kept USD from limiting AUD’s gains.

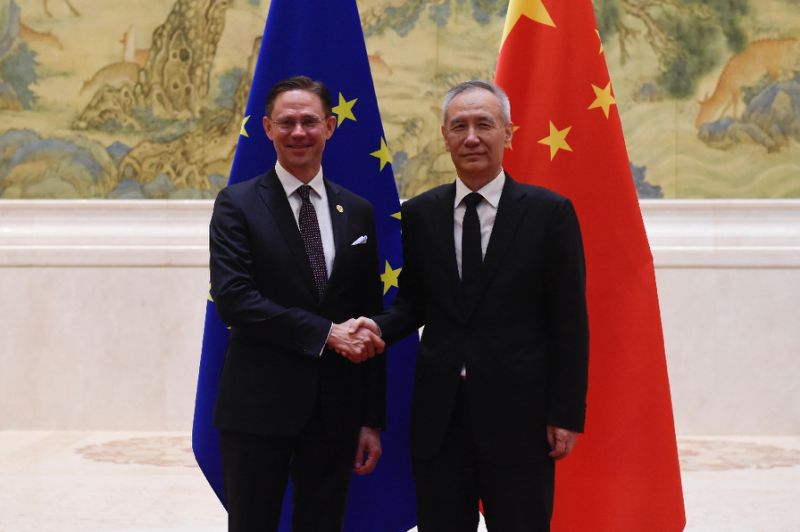

On The Lookout: The week ahead is highly busy and active owing to geo-political events and macro data releases. All eyes remain focused on geo-political issues as old topics are seeing tensions escalating to new highs, while new events with equal importance also seem to surface. Critical Brexit Summit tomorrow ahead of this week’s UK Brexit deadline is the main focus. But other events that drive the price action include Sino-U.S. trade talks and renewed focus on US tariff threats on European auto markets. While the above mentioned events have high impact on price action in global market, they are set to occur later this week. The major focus today is on trade centric summit between EU and Chinese delegates in Brussels in which they are expected to address differences over trade and investment issues. Given the fact that both economic giants are facing pressure from U.S. to submit to its demands, it will be interesting to see if they come to an agreement on trade terms between China & U.S. that could put pressure on U.S.A. Aside from EU-China summit. Further headlines on US tariffs worth $11 billion on EU Airbus is awaited given the fact that US was blamed in recent past for providing similar subsidies to Boeing. This is one of the main reasons for rising tensions between EU & US and so developments relating to same remain as a major focus to gain perspective of future proceedings. Aside from geo-political events, the main focus remains on macro data updates. EU calendar is silent for the day while US calendar sees the release of Jolts Job opening data and API weekly crude oil stockpile data updates.

Trading Perspective: Forex market is seeing positive price action on account of weak USD and expiry of some of key Forex options contracts today. Meanwhile, equity market is seeing positive price action amid conflicting headlines on geopolitical events as bulls have a slight upper hand in immediate market. Risk appetite seems prevalent but cues from major political and economic events continue to exert bearish pressure on the market.

Trading Perspective: Forex market is seeing positive price action on account of weak USD and expiry of some of key Forex options contracts today. Meanwhile, equity market is seeing positive price action amid conflicting headlines on geopolitical events as bulls have a slight upper hand in immediate market. Risk appetite seems prevalent but cues from major political and economic events continue to exert bearish pressure on the market.

US Pre-Open: Major US benchmark index futures trading in the international market are seeing dovish price action despite prevalent risk on investor sentiment. The dovish price action is result of caution in regards to EU-US tariff war arguments and concerns surrounding Sino-U.S. trade talks. Further, declining U.S. T-Yields and weak US Dollar in the global market hints at cautious investor stance, this could influence subdued price action in Wall Street today. Positive cues from international market could underpin market bulls but upside move is likely to be limited on investor caution hinting at subdued price action in Wall Street equities and major indices during American market hours today.

EUR/USD: Euro held fort in positive territory and traded with positive bias during both Asian and European market hours. While investor sentiment seems to be laced with bearish sentiment owing to concerns on EU-China talks, Brexit woes and US tariff threat on EU market which capped gains in equity market, Euro managed to trade positive in forex market. Weak USD is one of supporting factor for EURO’s gains but main reason for EURO’s gains is reduced activity in the pair on account of major options contracts expiring today. Investors wish to avoid price swings and place trades once the pair has attained stability for contract expiry and resulting price rally. This has helped the pair stay steady above mid-1.12 handle as investors await US macro data outcome for short term trading cues.

GBP/USD: The pair is seeing highly volatile price action today with sharp swings to both sides of 1.31 handle. Sterling bulls remain under mercy of incoming Brexit headlines with main focus on tomorrow’s Brexit summit when deadline issue is likely to be addressed. EU wants UK to either drop out immediately or take a longer extension for minimum nine months with UK taking part in EU elections. Unless PM May requests a longer tenure during meeting tomorrow, UK is in for hard Brexit and this has caused Sterling to face high level of bearish pressure in the market paving way for further declines in immediate future.