Asian stocks finished in a mixed state on Monday, as investors follow recent positive signs of the China-US trade deal. While in the UK, PM Theresa May said she would seek another Brexit extension, voiced her opposition to a no-deal Brexit and continues talks with Labour leader Jeremy Corbyn to break the deadlock. In Japan, the Nikkei225 main index lost 0,21 percent to 21,761, the Hang Seng benchmark in Hong Kong finished 0.33 percent higher at 30,015. The Shanghai Composite was 0.05 percent lower at 3,244, and in Singapore, the FTSE Straits Times index finished 0.25 percent lower at 3,316. Australian equities snapped a two-session losing streak, helped by strong gains in mining, energy, healthcare and retail stocks which outweighed losses in the financial, property trusts and telco sectors. The ASX 200 closed up 40 points or 0.7% to 6,221.

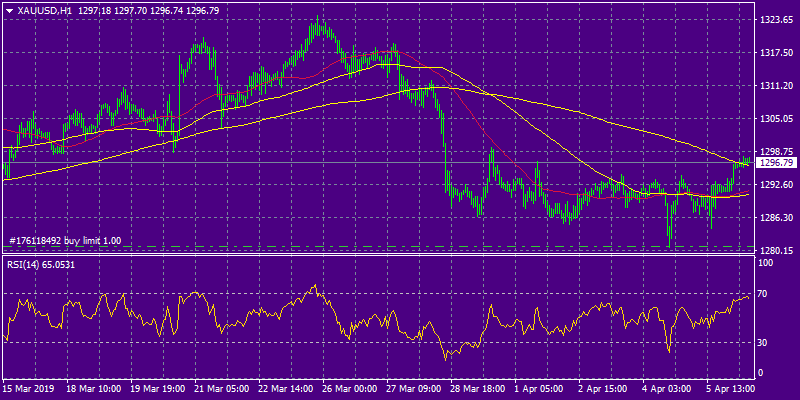

In commodities markets, Light Crude Oil started the week higher at 63.30, supported by OPEC’s ongoing supply cuts, and the United States is considering additional sanction on Iran. The near-term upside target is at 63.53. Brent oil started the week with a gap up and trades at $70.53/barrel. Gold is getting bids early Monday and trades at two-week high at $1297 supported by escalating geopolitical tensions concerning Tripoli, the Libyan capital.

XAUUSD‘s technical picture is neutral, and now immediate support stands at 100-day moving average at $1277, which can accelerate the downward move down to new YTD lows at the 200-day moving average at $1247. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average. Expect the bears to defend $1307 with full force.

European session started in red today as the Brexit deadline for leaving the European Union is just five days away. DAX30 is 0.43 percent lower to 11,958, CAC40 is 0.17 percent lower at 5,466 while FTSE100 in London is 0.29 percent lower at 7,425 and the FTSE MIB in Milan is trading 0.21 percent lower at 21,711.

In cryptocurrencies, Bitcoin (BTCUSD) breached the 5,000 mark, and the key 200-day moving average resistance at $5,225, and now trades at 5,240 making the daily high at 5,345. Bitcoin will find support at the 50-hour moving average at 4,514. The rally in BTC triggered bids across the industry with Ethereum (ETHUSD) trading now at 179 and Litecoin (LTCUSD) jumping to 88.83.

On the Lookout: The Bank of France March industry sentiment indicator came in at 100 vs 101 expected, of note, the Bank of France also estimates that Q1 GDP will record a +0.3% q/q reading – similar to that seen in the February survey. I am not optimistic about the French economic conditions, as recent figures follow the dismal Eurozone economic numbers and global uncertainty. German exports, seasonally and calendar adjusted dropped by 1.3% month-on-month in February, from a flat reading in January, while imports decreased by 1.6% MoM, from +1.5% MoM in January.

In the latest report to clients on the Brexit issue, analysts at Goldman Sachs modified their probabilities for the Brexit outcomes from 15% to 10%, and they revise up the probability we attach to a modified Brexit deal from 45% to 50% and leave the “no Brexit” probability unchanged at 40%.

Reports on Monday suggest that China is set to cut import duties on a range of goods from textiles and sports goods to computers and digital cameras.

In the macro calendar, the Canadian housing starts and building permits data will be published at 12:15GMT and 12:30GMT respectively while the US factory orders will drop in at 14:00GMT and are expected to drop by 0.6% m/m in February vs. +0.1% last.

Trading Perspective: Forex markets in Asia started in a cautious mood this week. AUDUSD is trading 0.06 percent lower at 0.7101 while Kiwi is slightly higher at 0.67.32. US dollar index lost the 70-mark and currently trades at 96.88.

GBPUSD is trading 0.21 percent higher to 1.3063, as investors follow the Brexit news. On the downside, major support will be found at 1.2977 at the 200-day moving average while solid protection can be found at a 100-day moving average around 1.2929. On the flipside, immediate resistance stands at 1.3195 the high from previous week session, and from there major resistance can be found at 1.3232 while 1.3382 the yearly high will be met with strong supply.

In GBP futures markets, open interest increased by just 28 contracts on Friday while volume rose by nearly 11.4K contracts, reversing two consecutive drops.

EURUSD is trading 0.15 percent higher at 1.1235 at the daily high, but below the horizontal support key line of the three-month range. The pair needs to break above the 1.13 to give bulls a breath and then approach the 50-day moving average at 1.1329 to establish a short-term bullish momentum. Immediate support can be found at the 100-hour moving average around 1.1215.

EURO remains in negative mood following recent poor figures in Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

In Euro futures markets, traders trimmed their open interest positions by just 585 contracts on Friday from Thursday’s final 498,366 contracts. Volume, instead, rose by around 10.6K contracts, reversing the previous drop.

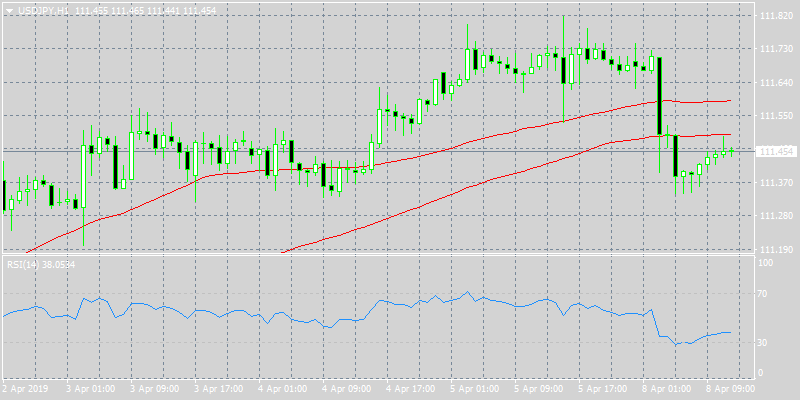

USDJPY is down 0.23 percent to 111,45 having hit the low at 111.33. Major support for the pair stands at 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.06 the March 2019 high.

Open interest in JPY futures markets increased for the third session in a row on Friday, this time by more than 2K contracts. Volume, in the same line, prolonged the erratic performance and also rose by almost 7.8K contracts.