Asian stocks finished slightly positive, as investors follow recent positive signs of the China-US trade deal, first-quarter earnings which kick off on Friday with the US banks reporting, and Brexit developments. In Japan, the Nikkei225 main index added 0,19 percent to 21,802, the Hang Seng benchmark in Hong Kong finished 0.21 percent higher at 30,140. The Shanghai Composite was 0.15 percent lower at 3,239, and in Singapore, the FTSE Straits Times index finished 0.11 percent lower at 3,319. Australian equities struggled for direction on Tuesday with the ASX 200 swinging between gains and losses throughout the day. The index ended the session flat at 6221.8.

In commodities markets, Crude Oil rally is intact at five-month high and continues higher at 64.50, supported by OPEC’s ongoing supply cuts, geopolitical uncertainty and the US additional sanctions on Iran. The near-term upside target is at 65.00. Brent oil started the week with a gap up and trades today at $71.03/barrel. Gold is getting bids and trades at two weeks high at $1298 supported by escalating geopolitical tensions concerning Tripoli, the Libyan capital. XAUUSD technical picture is neutral, and now immediate support stands at the 100-day moving average at $1277, which can accelerate the downward move down to new YTD lows at the 200-day moving average at $1247. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average, expect the bears to defend $1307 with full force.

European session started mixed today as the Brexit deadline for leaving the European Union is getting closer, DAX30 is 0.13 percent lower to 11,947, CAC40 is 0.10 percent higher at 5,477 while FTSE100 in London is 0.05 percent lower at 7,448 and the FTSE MIB in Milan trading 0.23 percent higher at 21,822.

In cryptocurrencies, Bitcoin (BTCUSD) holds above the 5,000 mark and the key 200-day moving average resistance at $5,225 and now trades at 5,219 making the daily high at 5,305. Bitcoin will find support at 50-hour moving average at 4,514. The rally in BTC triggered bids across the industry with Ethereum (ETHUSD) trading now at 176 and Litecoin (LTCUSD) jumping to 86.65.

On the Lookout: Australia’s housing finance approvals posted a modest gain in Feb, as the total number of owner-occupier loans ex refi rose 0.8%mth, slightly better than the consensus forecasts of a 0.5% gain. In Brexit front, PM Theresa May visits German Chancellor Merkel and France President Macron ahead of the EU summit tomorrow. The US releases its NFIB Small Business Index as well as JOLTS Job Openings. Job Openings, which exclude the farming industry, are forecast to fall to 7.54 million from 7.58 million.

Central banks will be in focus as both the Fed releases its minutes from its last meeting and the ECB meet tomorrow.

Key upcoming events:

10/04/2019 ECB Interest Rate Decision

10/04/2019 Emergency EU Council Meeting

29/03/2019 (12/04/2019) UK leaves the European Union

18/04/2019 Dissolvement of current EU Parliament

Trading Perspective: Forex markets in Asia started strong, AUDUSD is trading 0.25 percent higher at 0.7149 near a two-week high, supported by upbeat Australian housing finance data while Kiwi is also higher at 0.67.53 due to an increase in commodity prices led by oil and USD weakness. US dollar index lost the 70 mark and currently trades at 96.60.

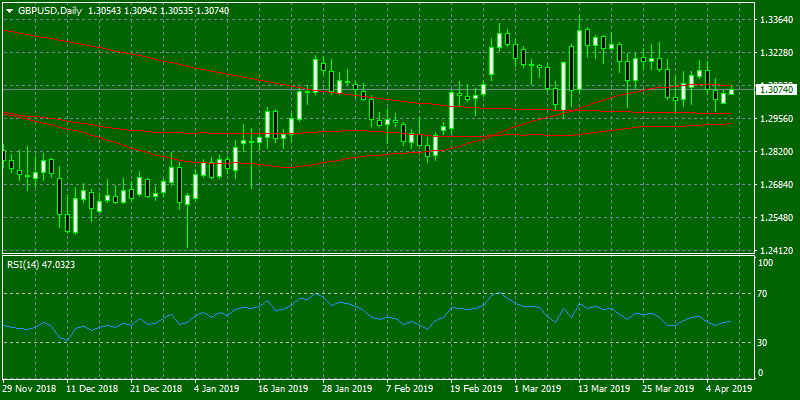

GBPUSD consolidates between the 50 and 200-day moving average. Today the pair trading flat at 1.3061 as investors follow the Brexit news. On the downside, major support will be found at 1.2977 at the 200-day moving average while solid protection can be found at the 100-day moving average around 1.2929. On the flipside, immediate resistance stands at 1.3195, the high from previous week session, and from there major resistance can be found at 1.3232 while 1.3382, the yearly high, will be met with strong supply.

In GBP futures markets open interest shrunk by around 3.2K contracts on Monday. The volume dropped by nearly 27K contracts, extending the choppy performance seen in past sessions.

EURUSD yesterday managed to break in the three-month trading range for one more time. The pair is flat today 1.1265 at yesterday high. The pair needs to break above 1.13 to give bulls a breath and then approach the 50-day moving average at 1.1329 to establish short term bullish momentum. Immediate support can be found at the 100-hour moving average around 1.1215.

EURO remains in negative mood following recent poor figures in the Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

In Euro futures markets, traders added just 63 contracts to their open interest positions at the beginning of the week from Friday’s 498,110 contracts. In the same line, volume rose for the second session in a row, this time by around 10.3K contracts.

USDJPY: The Bank of Japan on Monday cut its assessment for three of the country’s nine regions, the biggest number of downgrades in six years, suggesting that the hit to exports and factory output from slowing overseas demand is broadening, The pair is down 0.19 percent to 111,27 having hit the low at 111.23. Major support for the pair stands at the 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.06, the March 2019 high.

Open interest in JPY futures markets rose for one more session, this time by almost 1.3K contracts. Volume, instead, decreased by around 8.2K contracts, offsetting the previous build.

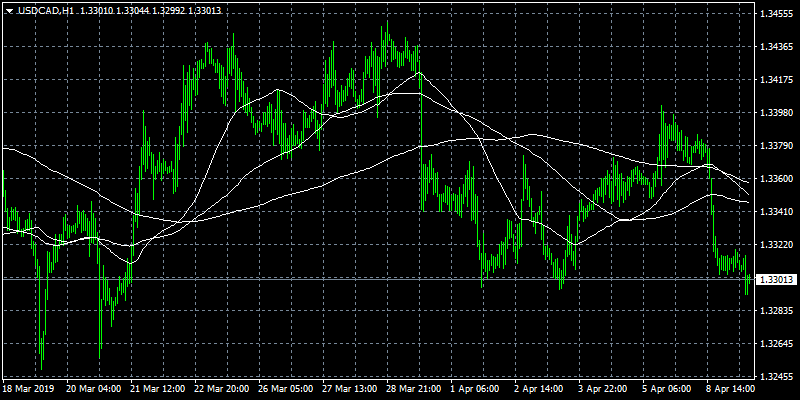

USDCAD consolidates around 1.33 after yesterday lost almost 70 pips, erasing the gains of the previous week. It printed a fresh 4-day low at 1.3292 during the Asian session, and it is holding near the bottom, with the bearish tone intact. The pair will find support at 1.3285, and the 50-day moving average which if breached will drive prices down to 200-day moving average key support. On the upside, immediate resistance stands at the 100-hour moving average at 1.3346 while more supply for the USD will be met at the 200 hours moving average around 1.3360.