Summary: A trifecta of a downbeat ECB outlook, dismal Euro-area PMI data, and renewed China-US trade tensions lifted the Dollar and dragged the Euro lower. While the ECB left policy unchanged, Mario Draghi told reporters that Euro area growth outlook had shifted to the downside, citing global uncertainties. He added that incoming inflation was likely to decrease in the months ahead. Euro-area composite PMI data was mostly lower than expected. EUR/USD slumped 0.74% to 1.1305. EUR/GBP fell to 0.8660 from 0.8712, down 0.54%.

Commerce Secretary Wilbur Ross said the US and China were “miles and miles” away from a trade deal, reigniting tensions. US Weekly Jobless Claims fell to 199,000 beating forecasts despite the government shutdown. Both factors contributed to overall Dollar strength. The Dollar Index (USD/DXY) rallied 0.5% to 96.59 mostly on the Euro’s weakness. Stocks erased gains while global yields were lower. The US 10-year bond yield slipped to 2.72% (2.75%). Germany’s 10-year Bund yield was down four basis points to 0.18%.

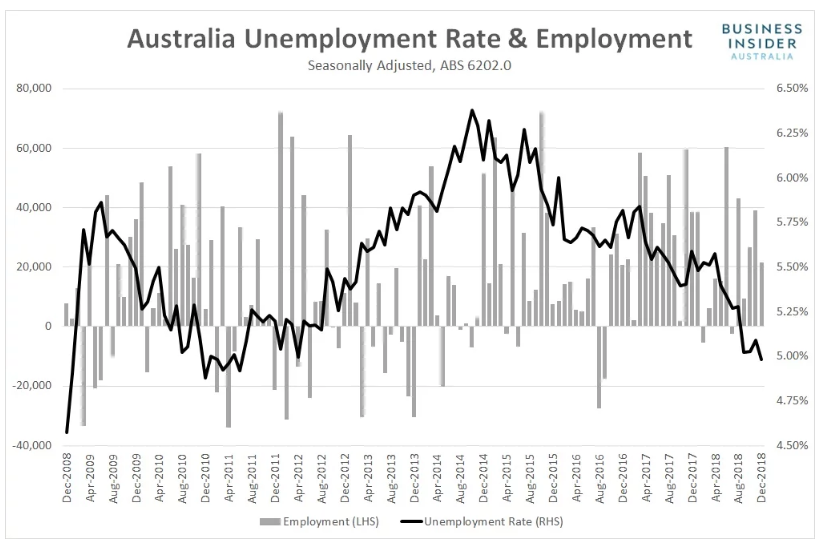

Trade worries hit the Australian Dollar which slumped 0.85% to 0.7087 from 0.7137 despite a better-than-forecast Employment report. The Unemployment rate fell to 5.0%, the lowest since June 2011. While Employment increased, all the gains came from part-time work. Westpac, one of Australia’s leading banks forecast a fall in inflation next week.

- EUR/USD – The Single currency was dragged down by “Super” Mario Draghi and the downbeat assessment by his ECB colleagues. EUR/USD slid to a low of 1.12893 before a modest bounce led to a close of 1.1310.

- AUD/USD – The Aussie Dollar underperformed its peers slumping 0.85% in the wake of renewed trade China-US trade tensions and increased speculation of an RBA rate cut. AUD/USD closes at 0.7087 after trading to 0.71666 on the upbeat Australian Jobs report earlier in the day.

- GBP/USD – Sterling held on above 1.3000 despite the overall stronger US Dollar, closing at 1.3050 (1.3065). After its strong rise yesterday, the Pound held its ground in preparation of the UK Parliamentary debate next week.

On the Lookout: Today is light on economic data with Tokyo’s Annual Core CPI released this morning, German IFO Business Climate follows later. The World Economic Forum in Davos, Switzerland ends tomorrow. The US government shutdown continued after the Senate blocked bills to fund the government over the fight on President Trump’s plan to build a border wall. Expect markets to consolidate with the focus on any trade related news out in Asia.

Trading Perspective: The Dollar’s gains were mostly the result of a lower Euro with the USD/DXY up at 96.59. EUR/USD has a 57.6 % weight in the index. The Greenback saw modest losses against most Emerging Market currencies, down 0.94% against the South African Rand and 1.07% lower versus Turkey’s Lira. USD/JPY was little changed, finishing at 109.61 from 109.57 yesterday. The Australian Dollar was pounded by renewed China-US trade tensions and Westpac’s inflation tip.

Global bond yields were universally lower. The benchmark US 10-year bond yield was down 3 basis points. Japanese 10-year was up at 0.00% from -0.01%. UK 10-year was at 1.26%, down 6 basis points while Aussie tens were at 2.27% from 2.28%. Further US Dollar gains will be difficult from here.

- EUR/USD – Expect the Euro to consolidate around current levels of 1.1300. While Draghi and the ECB were downbeat, the focus now turns to the US Dollar. We would need to see an overall stronger Greenback for further Euro falls. EUR/USD fell to 1.12893 overnight, with immediate support on the day forming at 1.1280. The next support level lies at 1.1260, which should hold. Immediate resistance can be found at 1.1320, followed by 1.1360. Look to trade a likely range of 1.1290-1.1340. Prefer to buy dips from here.

- AUD/USD – The Aussie Battler was pounded by renewed the comments of Commerce Secretary Wilbur Ross which reignited trade tensions. Better-than-forecast Australian Employment data did not help after by Westpac said to expect a bid downside miss in headline and underlying inflation. We shall see. AUD/USD slumped to an overnight low of 0.70808. Immediate support comes in at 0.7070, followed by 0.7040. Immediate resistance can be found at 0.7120 and 0.7140. Expect a likely range today of 0.7080-0.7130 with the preference to buy dips.

- GBP/USD – Sterling was little-changed in the mix of all of this, managing at close at 1.3050. With the next debate in Parliament set for next week, expect the Pound to consolidate between 1.3020 and 1.3090. While British Prime Minister May seems to have built expectations to be able to avoid a no-deal Brexit, uncertainty remains. And caution should prevail. The Pound has also risen against the Euro and other peers. This may be a temporary phenomenon. EUR/GBP slid 0.60% to 0.8651 (0.8712 yesterday). This looks to be overdone.

Prefer to sell GBP rallies to 1.3100 and buy EUR/GBP at current levels.

Happy Friday and trading all.