Summary: The Yen rallied as the US 10-year yield fell to 2.86% (2.89%) ahead of the Fed’s final meeting in 2018. Wall Street stocks extended their slump as trade tensions between the US and China weighed on risk sentiment. The Dollar Index, a measure of the value of the US Dollar against a basket of currencies, fell from 18-month highs, hit yesterday. The US Fed is expected to hike for the fourth time this year at the conclusion of its 2-day meeting on Wednesday (Thursday am, Sydney). Markets will be focused on the pace of any further Fed tightening in 2019 as well as the Feds assessment of the economy amid a trade conflict with China.

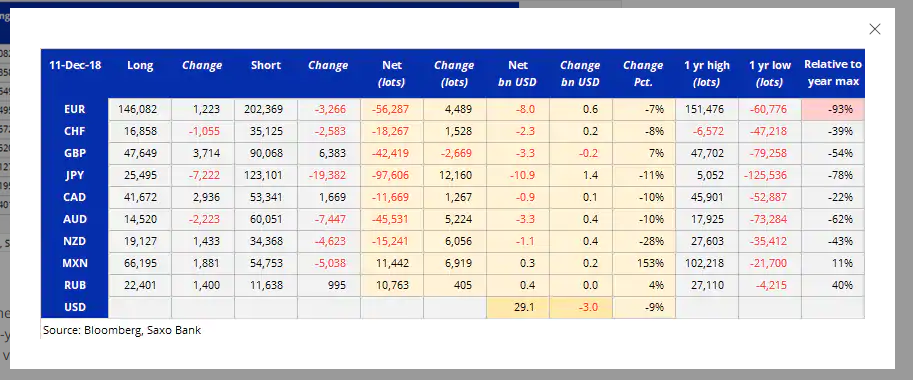

Sterling and the Euro climbed while the Australian Dollar was little-changed. Meantime the latest Commitment of Traders CFTC report (week ended Dec 11th) saw speculators trim net long Dollar bets in 8 of 9 currencies on the list.

- USD/JPY – The Japanese currencies led the rally against the Greenback finishing up 0.53% at 112.75 from 113.42 yesterday. The benchmark US 10-year yield fell another 3 basis points to 2.86%, just above the low last week. Japan’s 10-year JGB yield was unchanged at 0.02%. The Bank of Japan’s monetary policy rate decision is due Thursday afternoon. Governor Haruhiko Kuroda’s press conference follows shortly after.

- EUR/USD – The multi-currency rallied off its overnight low of 1.12965 on the back of the generally weaker US Dollar and bond yields. The Euro closed at 1.1350 after hitting a high of 1.1358. The ECB ended its meeting last week where it announced an end to its asset purchase program. ECB Head Mario Draghi also downgraded economic projections for 2018/2019 which weighed on the Euro. It looks likely that we will remain range-bound on this currency for now.

- AUD/USD – The Aussie finished little-changed at 0.7178 (0.7173 yesterday). A fall in Copper and commodity prices, as well as the risk-off sentiment, kept the antipodean and risk currencies (Aussie, Kiwi and Canadian Dollar) from any significant gains. The RBA releases the minutes of its meeting in November later today.

On-the-Lookout: Ahead of the FOMC meeting and Jerome Powell’s news conference, US President Donald Trump has already weighed in his opinion. Trump tweeted “It is incredible that with a very strong Dollar and virtually no inflation… the Fed is considering yet another interest rate hike. Take the victory!”

In yesterday’s data releases the US Empire State Manufacturing Index missed expectations falling 10.9 in November from 23.3 in October. Euro Zone Annual Core CPI was unchanged at 1.0% while the Trade Surplus fell to EUR 12.5 billion from a downwardly revised EUR 13 billion in October.

Today sees New Zealand’s ANZ Business Confidence Index as well as Germany’s IFO Business Climate. US Housing data are released later tonight with November Building Permits and Housing Starts.

China marks its 40th anniversary of market reforms and will open with a speech from President Xi-Jinping later today.

Trading Perspective: The fall US bond yields will keep the Dollar offered in the Asian session. The latest COT/CFTC report saw speculators trim their net long US Dollar bets in all the Major currencies except the British Pound. While this may be the case, the market’s positioning is still long of US Dollar bets with further corrective moves possible. We look at the break-down per currency.

- USD/JPY – The fall in the US 10-year yield will keep a lid on this currency pair. Immediate resistance lies at 113.00 and then 113.30. Immediate support can be found at the low of 112.70, followed by 112.40. Speculators trimmed their net short JPY bets to -JPY 97,606 contracts from the previous weeks -JPY 109,100. in the latest CFTC report. Traders will keep close to square ahead of the Fed and BOJ meetings. However, the next big move for this currency pair appears south as it corrects further.

- AUD/USD – The RBA’s November meeting minutes are released later today. The Aussie traded in a tight 0.71684-0.71870 range overnight. The topside was constrained by the risk-off sentiment and lower commodity prices. Copper fell 0.75% while the New York CRB Index (Commodity Research Bureau) was down 1.3%. The CRB Index included a wider range of commodities like Crude Oil (down 2.02%). The lower US Dollar supported the Aussie and will continue to do so. Net speculative Aussie shorts were trimmed to -AUD 45,531 contracts from -AUD 50,800. Look to buy dips on this currency pair.

- EUR/USD – the Euro should continue to trade within a 1.1270-1.1430 range. Germany’s 10-year Bund yield was unchanged at 0.25%. This should be supportive of the Euro given the fall in the US yields. The latest CFTC report saw net speculative Euro short bets trimmed by EUR 4,489 contracts to -EUR 56,287. Trading in this currency pair will be dictated by the general move in the Greenback, which appears headed south.

- US Two-Year Bond Yield – The two-year bond yield dropped to 2.685% overnight lows from 2.73%, before closing just under 2.70%. Which is the lowest since September 6th. Short-term support should emerge at this level although a clean break would see it just under 2.6% which would be huge. Apart from the 10-year bond yield, this is a good one to watch.

Happy trading all.