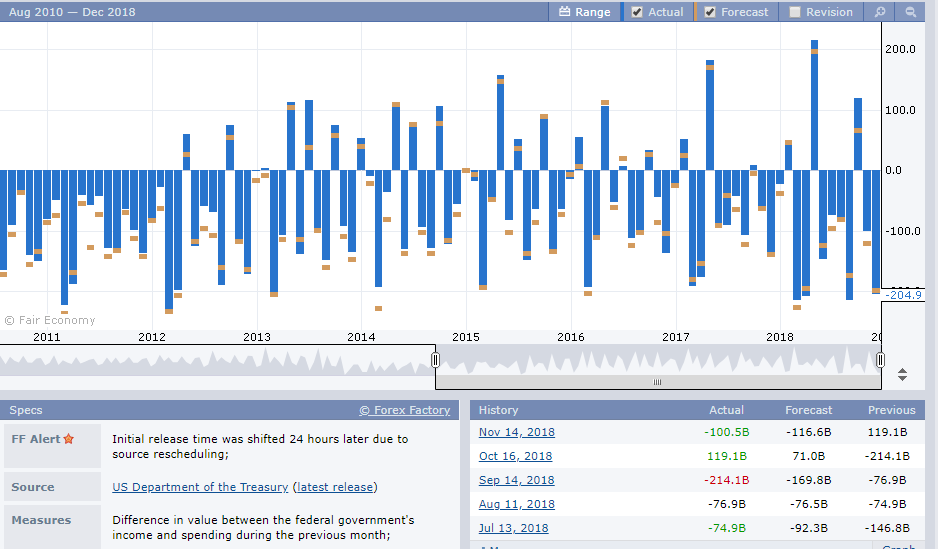

Summary: A big miss on China’s November Retail Sales and Industrial Production pushed the Aussie, Chinese Yuan,and Asian currencies lower. The Euro tumbled as French, German and Euro-zone manufacturing and services data were weaker than forecast. Sterling surrendered gains made late last week as PM May struggled to get fresh concessions from the EU for her Brexit deal. The Dollar Index (USD/DXY) rallied to fresh 18-month highs on the fall of its Rivals even as the US November Federal Budget Deficit blew out to over US$ 200 billion. Wall Street Stocks slumped as risk mood soured. The DOW fell 1.89%.

- AUD/USD – It led resource and Asian currencies after China reported much weaker than expected industrial production and retail sales for Chinese industrial production was the weakest since May 2016. The Aussie plummeted from 0.7220 to 0.7151 lows following the release before rallying to settle at 0.7175 at Friday’s NY close. The US Dollar jumped against China’s Offshore Yuan (USD/CNH) to 6.9050 from 6.8800 Friday. The Kiwi (NZD/USD) dropped to 0.6795 from 0.6860. Asian EM currencies were lower.

- EUR/USD – The weaker than forecast Euro – area manufacturing and services data sank the multi-currency to 1.1270 (1.1365 Friday). France’s measure fell below the 50 boom/bust EUR/USD managed to cut its losses and climb to 1.1300 at the close. The Euro was already on the defensive following the ECB’s dovish growth outlook on Thursday. US Flash Markit Manufacturing and Services PMI’s didn’t fare much better with both weaker than expected. This should limit the Euro’s downside.

- USD/DXY – this currency pair rallied to fresh 1.1/2 year high at 97.711 not so much on inherent Dollar strength but every other currency is weakening. This is the Dollar’s dilemma and one of the reasons it will struggle to maintain gains, let alone rally much further. The Federal Reserve will most likely raise rates for the last time when they meet this week (early Thursday morning Sydney time, December 20). The hike is expected to be 0.25% although there is a possibility of 0.15% which would be dovish.

On the Lookout: The week ahead sees the last FOMC meeting (Thursday morning, Sydney) for the year. Thursday, December 20 also sees the Bank of Japan and Bank of England final rate policy meetings for 2018. Today sees the Eurozone Headline and Core CPI for November as well as US Empire State Manufacturing data.

The focus will be on the Fed FOMC meeting with a press conference by Head Jerome Powell following immediately. Market participants have anticipated a dovish Fed rate hike which may not turn out the case. The Fed’s outlook for 2019 is what the market wants to see. Dovish comments from several Federal Reserve Heads and a slowdown in the economy have led to lower expectations of rate hikes next year. The previous Fed decision (September rate hike) was unanimous. Any dissent for this meeting could / will send the Greenback lower. Jerome Powell’s press conference starts half an hour after the release. Powell is more straightforward than his predecessor Janet Yellen and his assessment could trigger more volatility.

This is the last full week ahead of Christmas. Tuesday sees crucial US Housing data with Building Permits and Housing Starts. The minutes of the RBA’s last policy meeting as well as New Zealand’s ANZ Business Confidence data are due on Tuesday morning. German IFO Business Climate for November round out Tuesday’s data.

Markets will continue to monitor the US-China trade dispute. While positive steps were made last week, a resolution is still far away. The mood was soured by the weak Chinese data although authorities will continue their stimulus measures.

Trading Perspective: While the Dollar ended on a strong note, it’s strengthening was the result of a weakening of its Rivals. Inherently the Greenback needs fresh legs to stand on. Without yield support this is difficult. The benchmark 10-year US Treasury yield fell two basis points to 2.89%. Other global yields also dropped. Market positioning remains well long of Dollar bets versus all the Major currencies, which will also limit any significant Dollar gains. We look at the latest Commitment of Traders CFTC report’s release tomorrow.

- AUD/USD – – Slip-sliding away, This currency pair led Asian and risk/resource currencies lower. The catalyst was the weaker Chinese data. AUD/USD traded to a low of 0.7151 before a meek bounce to 0.7175, the lowest close since October. The strong run-up for the Aussie is over with and we can expect initial downside tests. Initial resistance for today is at 0.7200. The next resistance lies at 0.7230. Immediate support can be found at 0.7140/50 followed by 0.7100. A break of 0.7100 could see the low 0.7000s tested. The last CFTC report saw a mild reduction of net speculative Aussie shorts to -AUD 50,800 from -AUD 53,900. While the shorts remain near 4-year highs, the downside of the Aussie is limited.

- EUR/USD – Weaker than expected, Euro area PMI’s pushed the Euro lower 1.1270 overnight lows. The Euro bounced to close at 1.1300. Immediate resistance lies at 1.1330/40. Immediate support lies at the lows in late November (1.1265). A break of this level, which is immediate support would see 1.1200. The yield on Germany’s 10-year JGB fell 3 basis points to 0.25%. Speculative market positioning remains short of Euro bets to their highest total since March 2017.

- USD/JPY – The only currency to gain versus the Greenback due to the market’s risk-off stance. The fall in the US 10-year yield also added to downside pressure of USD/JPY although Japan’s 10-year JGB note slipped to 0.02% from 0.05%. The Dollar traded to a high of 113.674 overnight which is basically where immediate resistance for today lies (113.60-70). The next resistance level is at 114.00. Immediate support can be found at 113.20 (overnight lows). The next support level lies at 112.70. Net speculative JPY shorts increased to a total of -JPY 109,100 from JPY 104,800 bets. These are the largest net total of shorts since March this year. The BOJ is not expected to change its monetary policy at its last meeting of 2018. The Japanese central bank is expected to keep its title as the most dovish central bank in the developed world. However, a move to expand the bank around the 10-year yield target may surprise and see a lower USD/JPY.