Asian Markets take a hit after two days of gains as macro data from China disappointed investors. China’s industrial-production growth slowed to 5.4% in November, the lowest number since the start of 2016 and the retail-sales increase was 8.1%, the least in 15 years. China’s National Bureau of Statistics (NBS) is reporting that global economic growth continues to decline, with an increasing number of uncertainties impacting the impetus for growth, and that weaker industrial production, and slowing retail growth shows that downward pressure on China’s domestic economy continues to increase largely due to the US-China trade war.

In Tokyo, the Nikkei225 index ended down 2.2% with Topix index declining -1.40% for Friday trading session. Singapore STI index joins others in falling 1.3% and the Hang Seng index fell 1.6%.

European markets and U.S. equity futures followed Asian stocks lower after data showed continued weakness in China’s economy. London stocks fell in early trade on Friday, the FTSE was 0.70% the DAX30 losing 1.50% and CAC40 started 1.32% lower.

European markets and U.S. equity futures followed Asian stocks lower after data showed continued weakness in China’s economy. London stocks fell in early trade on Friday, the FTSE was 0.70% the DAX30 losing 1.50% and CAC40 started 1.32% lower.

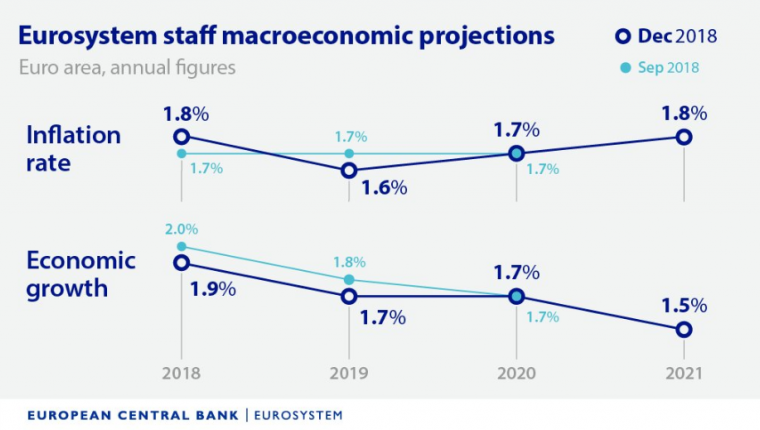

ECB yesterday lowered its growth projections for 2018 to 1.9% vs +2.0% previous and 1.7% for 2019 vs +1.8% prior. Meanwhile, the yearly inflation rate for 2018 was revised higher to 1.8% from 1.7% previous but was largely offset by a weaker outlook for 2019, now seen at 1.6% vs. 1.7% prior.

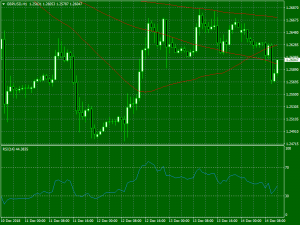

EURUSD started the European trading session making new monthly low breaking the 1.13 as German and French PMI’s missed analyst’s expectations, The slowdown of the economic activity in the Eurozone was broad-based with new business inflows almost stalling, job creation slipping to a two-year low and business optimism deteriorating. Mario Draghi reaffirmed a dovish shift by the ECB, forcing investors to scale back expectations for a rate hike next year, a key point that we mention in our yesterday’s daily report. According to the Eurozone money market futures, investors are now pricing in roughly 60% probability for the ECB to hike rates next year, which marks a heavy drop from around 75% probability seen yesterday.

EUR/USD currently trading at 1.1290 breaking the support at 1.13 and the 50h moving average, now a level for traders to watch is 1.1275. A clear break of that level will drive the price down to yearly low at 1.1215. On the flipside, the 1.1375 yesterday’s high is the immediate resistance point. Karen Jones, analyst at Commerzbank, suggests that the EUR/USD remains underpinned very near term by the 1.1321 support line and further gains to the November high at 1.1500 are on the cards and 1.1530/1.1622 (the 2018 downtrend and 16th October high). “This will need to be overcome to negate downside pressure. Dips lower will ideally be contained by 1.1300 and while above here the market will be viewed as bid. This guards the 1.1216 November low.

Below the 1.1216 November low lies the 61.8% Fibonacci retracement of the 2017-18 advance at 1.1186. Failure there would put the late May and June 2017 lows at 1.1119/10 on the cards.”

GBPUSD today canceled the positive momentum that built yesterday as the rally stalled at 1.2670 area. The break of 100h moving average (red line) earlier today accelerated the selling pressures for sterling sending the price down to 1.2580. The 1.2560 is the first support for the pair today a break below that level will give bears the control and the pair can end at the 1.2485 level. The volatility is likely to remain over the coming days as Theresa May updated Brexit plan was swiftly rejected by the European Union.

Another victim of weak China macro data was AUDUSD which penetrated the 100d moving average entering the bearish phase.

Gold is trading lower for the second consecutive day at $1238 as retracement from 5 month top continues. The bullish momentum for the precious metal is still intact but we can’t rule out a move down to 1234 horizontal support. On the flip side, the $1242 level now seems to act as first resistance, which if cleared might lift gold back towards $1249-50 highs.