Summary: The Dollar Index (USD/DXY), a mirror of the Euro, closed little changed (97.636) ahead of tomorrow’s Fed policy announcement. The FOMC, (Fed Open Market Committee) is widely expected to leave its overnight policy rate on hold (Fed Funds 2.5%) and signal rate cuts to come. Elsewhere, at the ECB forum on central banking in Sintra, Portugal, ECB Head Mario Draghi hinted at more stimulus if inflation does not pick up. The Euro closed at 1.1198 from 1.1218, 0.28% lower.

Optimism on a trade deal between China and the US boosted Risk and Emerging Market currencies. US President Donald Trump said he had a good discussion with his Chinese counterpart Xi-Jinping, and that the two would extend their talks at the G20 meeting later this month. The Australian Dollar climbed 0.33% to 0.6877 (0.6853) while the Kiwi was up 0.48% to 0.6528 (0.6498). China’s offshore Yuan (CNH) rallied 0.4% against the US Dollar to 6.9020 from 6.9300, leading all Emerging Market Currencies higher.

The US President also tweeted against the weaker Euro, saying “it would make it unfairly easier for them (Europe) to compete against the USA.” In his rebuke, Mario Draghi retorted that “we don’t target the exchange rate.”

Stocks and bonds rose. The DOW finished up 1.3% to 26,480. (26,125.) while the US 10-year bond yield slipped to 2.06% from 2.09%, a 21-month low. Germany’s 10-year Bund yield tumbled 8 basis points to -0.32% it lowest on record.

Germany’s ZEW Economic Sentiment Index in June plummeted to -21.1 from -2.1 in May. US Housing Starts beat forecasts (1.27m vs 1.24m) while Building Permits matched expectations (1.29m vs 1.30m).

- EUR/USD – The Euro rallied off its lows at 1.11814 following Mario Draghi’s dovish comments on rates. EUR/USD closed at 1.1198, below the 1.1200 pivot. Germany’s 10-year Bund yield fell to its lowest on record at -0.32%.

- USD/JPY – The Dollar eased against the Yen to 108.423 (108.55) as the US 10-year yield dropped 3 basis points to 2.06%, a 21-month low. Japans 10-year JGB yield was unchanged at -0.13%. The Bank of Japan has its policy meeting on Thursday (Asian afternoon). The Japanese central bank is widely expected to leave its stimulus unchanged amid easing talk from the US and Europe.

- AUD/USD – The Australian Dollar rallied to 0.6875 from 0.6852 on the positive risk sentiment. Trade optimism boosted base metal prices. Copper prices on the London Metals Exchange soared 1.8%.

On the Lookout: It’s all about the Fed. Tomorrow’s FOMC decision is the most important event for this month. US Federal Reserve policy makers are widely expected to leave their overnight policy rates on hold. Markets are expecting the FOMC to signal rate cuts ahead. Its all about their updated economic projections and dot plot forecasts (the de facto monetary policy forecasts of the Fed). Fed Chair Jerome Powell will be pressed for details about his comments from reporters at his press conference following the announcement. How markets react depend on Powell’s talk which would justify the market’s forecast for a rate cut.

On the other side of the Atlantic, dovish Mario Draghi reminded markets that low inflation needs resuscitation and he is willing to provide it. Germany’s 10-year Bund yield dropped to all-time lows.

New Zealand’s Current Account, Japanese Trade Balance, Germany PPI, the UK’s Headline and Core CPI, Canadian CPI and trimmed-mean CPI, are the data that precede the FOMC rate announcement. Mario Draghi delivers his closing remarks at the ECB forum on central banks in Sintra.

Trading Perspective: The Dollar stalled near this month’s highs as traders were hesitant to take it much further. The Euro was the only currency that closed weaker against the Greenback which is not surprising after Draghi’s dovish comments dragged it lower. Trade optimism boosted Risk, Asian and Emerging Market currencies. New Zealand’s Dollar, the Kiwi sprouted wings and was the best performing major currency against the Greenback.

President’s Trump against the Euro’s weakness and trade competitiveness ignites the currency issues. It could well be. “Let the currency wars begin.”

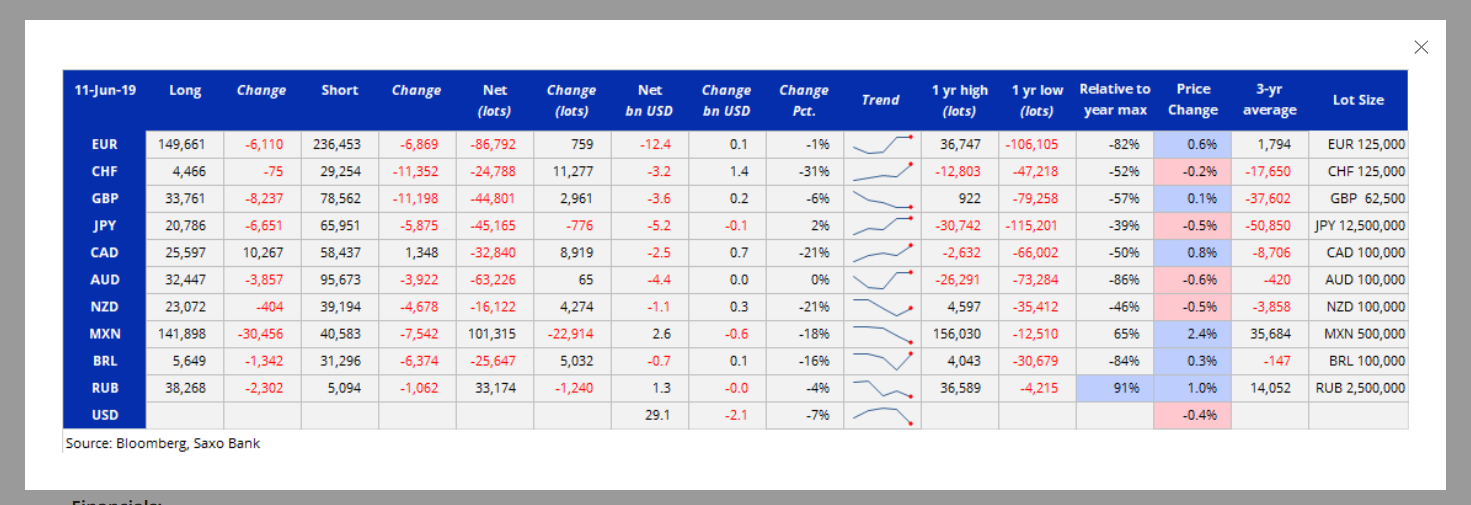

Meantime the latest Commitment of Traders/CFTC report (week ended 10 June) presents an interesting picture. Saxo Bank reported that speculative net total USD long bets were cut by nearly USD 2.1 billion to a 3-month low total of +USD 29.2 billion. However, it’s the breakdown that warrants our attention. The big reduction in USD long bets came via a big trim in USD/CHF shorts a massive addition to long MXN (short USD) contracts. The easing of US/Mexico immigration and trade conflict lifted Mexican Peso longs. Positioning in the Euro, Yen, Sterling and Aussie were close to flat over the week.

- EUR/USD – the Euro held immediate supports at 1.1180 (1.11814 overnight low) following Draghi’s remarks. EUR/USD was at 1.1218 at yesterday’s open. The Fed meeting outcome, statement, economic projections and dot plot will determine the Single currency’s next big move. EUR/USD has immediate support at 1.1180 followed by 1.1140 and then 1.1100. Immediate resistance lies at 1.1210, 1.1240 and 1.1280. The latest COT report saw net Euro short little changed -EUR 86,792 from the previous week’s -EUR 87,551. Look to trade a likely range of 1.1180-1.1280. Prefer to buy dips.

- USD/JPY – The Dollar eased against the Yen despite the rally in risk currencies and assets. Benchmark US 10-year bond yields dropped 3 basis points to 2.06%, 21-month lows. Japan’s 10-year JGB yield by contrast was unchanged at -0.13%. Three months ago, the US 10-year yield was at 2.6% with Japan’s 10-year yield at -0.05%. Speculative JPY shorts saw a small rise to -JPY 45,165 contracts from -JPY 44,389. Immediate resistance for USD/JPY lies at 108.70 (108.675 overnight high). Immediate support can be found at 108.20 and 107.80. Look for a likely trading range today of 107.80-108.80. Prefer to sell rallies

- AUD/USD – The Australian Dollar rallied off its lows at 0.68348 to 0.6877 at the NY close. The Aussie Battler has immediate resistance at 0.6900 followed by 0.6930. Immediate support lies at 0.6850 and 0.6830. Speculative Aussie short bets were virtually flat, to -AUD 63,226 contracts (week ended 10 June) from -AUD 63,291. The Aussie has been unable to rally despite higher metal prices due to overwhelming bearish sentiment on the currency. At the end of the day, it is the US Dollar that will determine the course of the Aussie. Look for a likely range today of 0.6840-0.6940. Prefer to buy dips.

All happening tonight. Let the currency wars begin! Happy trading all.