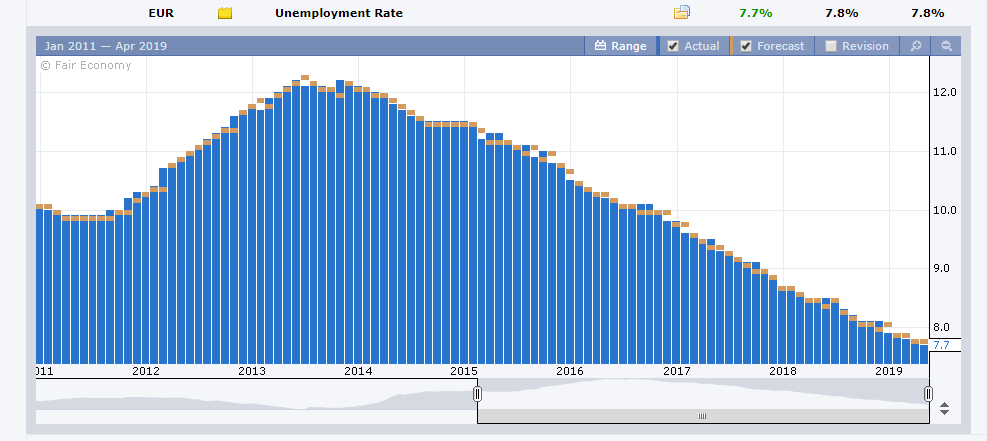

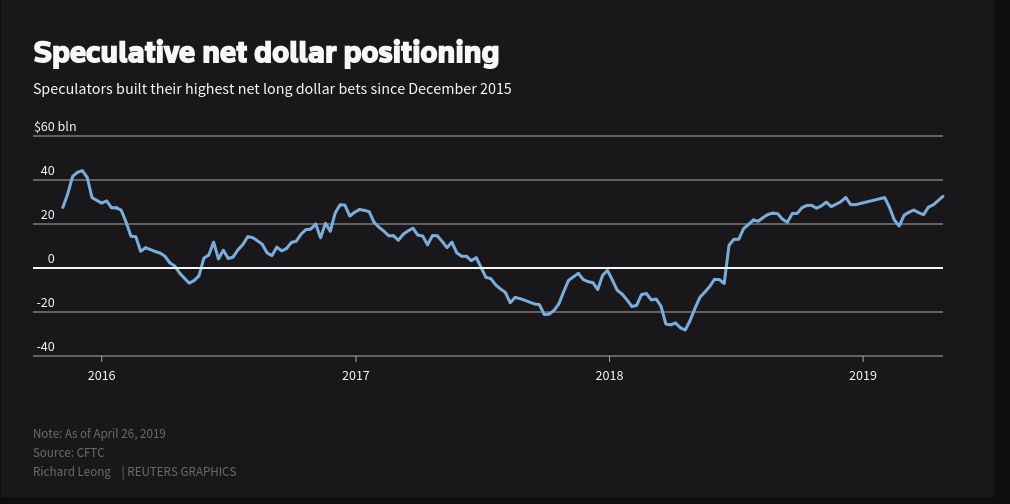

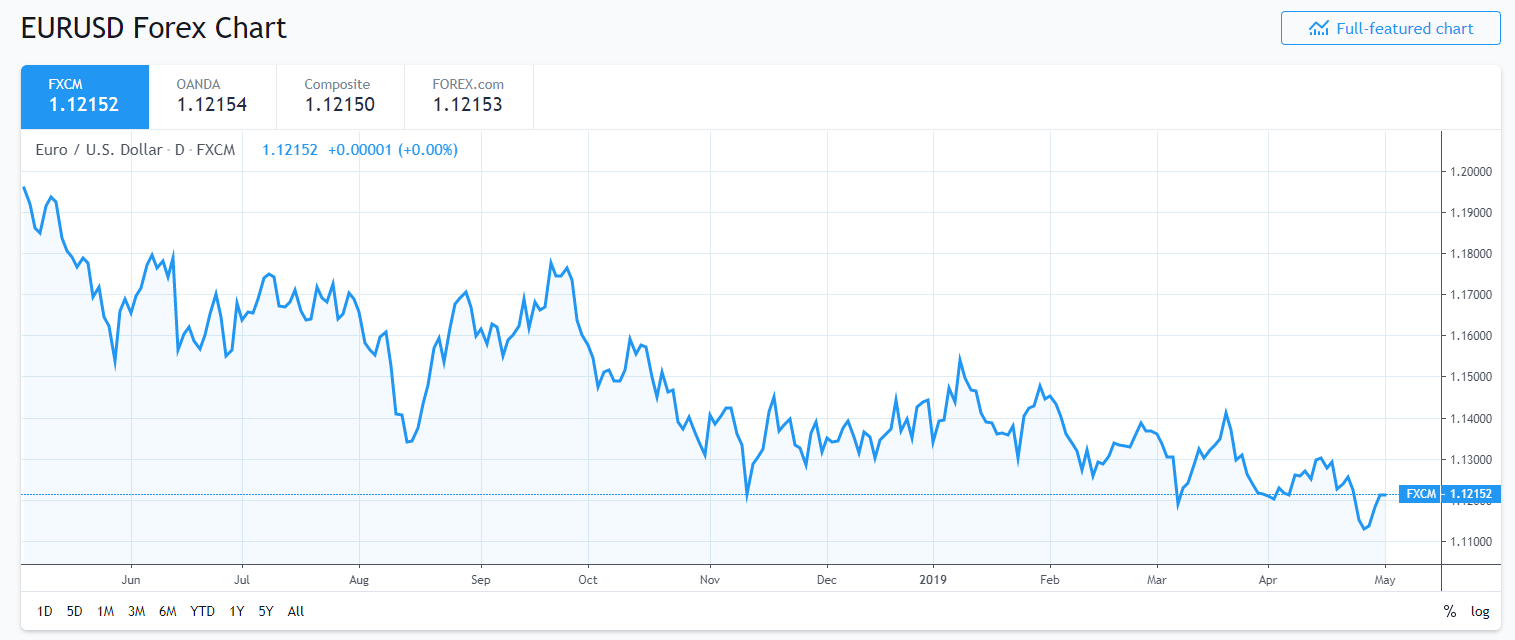

Summary: Upbeat Eurozone Q1 GDP and Jobless data boosted the Euro to 3 weeks highs at 1.1229 before settling at 1.1215. Economic growth in the Euro area accelerated 0.4% (against f/c 0.3%) in the first quarter of 2019. The Unemployment rate fell to 7.7%, the lowest in over a decade. Caution ahead of tomorrow’s Federal Reserve meeting pushed the US Dollar lower against most of its rivals. Traders continued to pare their long Dollar positions, currently at multi-year highs. The British Pound soared above 1.30, settling at 1.3037, up 0.75% ending as best performing currency. The improved tone of Brexit talks between the UK government and Opposition Labour Party boosted Sterling. USD/JPY fell 0.24% to 111.45 while the Australian Dollar was little-changed at 0.7048 after a weaker than expected Chinese Caixin PMI report. The New Zealand Dollar dipped after a weaker-than-expected NZ Labour report. US data was mixed. The US Conference Board Consumer Confidence and Home Sales beat expectations but Chicago’s PMI (factory activity) fell to its weakest since January 2017. US bond yields fell back with the 10-year yield finishing at 2.5%, 3 basis points down. Wall Street stocks ended with modest gains.

- EUR/USD – The Single Currency extended its rally, breaking above the 1.12 resistance level to finish at 1.1217, 3-week highs. The data dispelled some pessimism over the Euro area economy which regained some lost momentum.

- GBP/USD – Optimism on Brexit talks between PM May’s Government and the opposition after reports of progress lifted the Pound above the 1.30 resistance to 1.3037. The overall weaker Greenback also supported Sterling. Just last week the British currency slumped to 1.2868 on the back of a stronger Greenback and Brexit pessimism.

- USD/JPY – the Dollar slipped against the Yen in thin volume trading to 111.237 overnight and over 3-week lows before settling at 111.45 at the New York close. The 3-basis point fall in the US 10-year bond yield to 2.50% weighed on USD/JPY.

- AUD/USD – The Australian Dollar closed little-changed at 0.7052 (0.7055 yesterday) after rallying to 0.7069 overnight. China’s Caixin Manufacturing PMI fell to 50.2 from 50.5 and a forecast of 50.7 in April. This constrained the Aussie from climbing against the overall weaker Greenback.

On the Lookout: Yesterday, currency volatility picked up due to low volume trade. The Japanese holiday and month-end factors contributed to the thin conditions. Today sees China and most European nations celebrating Labour Day with a public holiday. Expect similar conditions today.

Its all about the Fed meeting and FOMC Statement. Analysts and the markets are not expecting any policy changes from the Fed at the conclusion of their two-day meeting (4.30 am Thursday morning in Sydney).

Data releases today include Japanese Final Manufacturing PMI, UK Nationwide House Price Index, Manufacturing PMI, Net Lending to Individuals and Mortgage Approvals.

The US reports its ADP Non-Farms Employment Change (Private Sector), ISM Manufacturing PMI and Construction Spending.

Trading Perspective: The Dollar’s fall has mostly been the result of traders adjusting positions ahead of the Fed meeting and Jobs report on Friday. We highlighted the fact that net total speculative Dollar bets are at their biggest since December 2015. Most of these USD longs are against the Euro, Yen and Australian Dollar. Analysts don’t expect US policymakers to make any changes to the FOMC statement on policy so soon. The market’s eyes and ears will be on Fed Chair Jerome Powell’s assessment of recent economic developments, which are solid economic growth and slowing inflation. This could be a market mover. If Powell recognises the improvements, this would be Dollar supportive. Market positioning is still long of Greenbacks and a neutral FOMC stance could see further Dollar corrective moves lower. Conditions will be thin, so volatility could pick up. Happy days!

- EUR/USD –The Single currency rallied to 3-week highs at 1.12289 before settling at 1.1217, above the 1.1200 immediate support. The Eurozone economy gained back some momentum on the upbeat GDP and Unemployment report. Tomorrow sees crucial Euro area Manufacturing PMI’s with the Eurozone CPI report on Friday. The next support level for the Euro is at 1.1180. Immediate resistance can be found at 1.1230 and 1.1260. Keep in mind that net speculative Euro short bets (-EUR 105,400) are at multi-year highs. Likely range today 1.1190-1.1240. Still prefer to buy dips.

- USD/JPY – The Dollar’s fall against the Yen was cushioned by the uncertainty ahead of the conclusion of the Fed meeting and FOMC statement. USD/JPY dropped to an overnight and 3-week low of 111.237 before rallying to close at 111.45. Immediate resistance lies at 111.70 followed by 112.00. Immediate support can be found at 111.20 followed by 110.90. The latest COT/CFTC report saw net short JPY bets increase to -JPY 94,400 from the previous -JPY 87,100 contracts. Watch the US 10-year yield. Look to sell rallies with a likely range today of 111.10-111.90 today.

- GBP/USD – Sterling outperformed its G10 peers, climbing 0.75% to 1.3037 at the close. The overnight high traded was 1.30487, 2-week highs. The Pound’s rise was due to a combination of optimism on Brexit talks between the UK government and opposition party and an overall weaker US Dollar. Market positioning on the Pound is roughly square (-GBP 1,800). Immediate support lies at 1.30 followed by 1.2970. Immediate resistance can be found at 1.3050 followed by 1.3080. Look for a likely trading range of 1.2970-1.3070. Just trade the range shag on this one.

- AUD/USD – The Aussie failed to gain from the Greenback’s weakness after weaker-than-expected Chinese Manufacturing PMI which printed at 50.2 from a previous 50.5. While it was lower, its still above the expansion 50 level. Speculative Aussie short bets increased to -AUD 50,400 contracts from the previous week’s -AUD 46,900 according to the latest COT/CFTC report (week ended 23 April). Immediate support for the Aussie Battler lies at 0.7030 followed by 0.7010. Immediate resistance can be found at 0.7070 and 0.7100. Look to buy dips with a likely range of 0.7035-0.7085 today.

Happy trading all.