Asian stocks finished mostly lower today after China’s manufacturing activity failed to meet expectations and U.S.-China trade talks resumed. The Hang Seng benchmark in Hong Kong finished 0.66 percent lower at 29,697. Japanese markets are closed. The Shanghai Composite finished 0.37 percent higher at 3,073 and in Singapore, the FTSE Straits Times index finished 0.33 percent lower at 3,395. Australian equities extended yesterday’s losses, amid a broad-based sell-off led by mining, energy and utility stocks. The ASX200 closed down 34 points or 0.5% to 6,325.

European session started lower as traders focus on Brexit front one more and worse than expected Chinese micro figures. DAX30 is 0.17 percent lower to 12,306, CAC40 is 0.41 percent lower at 5,558 while FTSE100 in London is 0.02 percent lower at 7,440 and the FTSE MIB in Milan is trading 0.04 percent lower at 21,777.

In commodities markets, crude oil rebounds above 63 after the 2-day correction from the five-month as markets digest the US additional sanctions on Iran. Oil industry analysts expect that the sanctions could potentially remove up to 1.2 million barrels of oil per day from international markets. Brent oil gives up 10 cents at $71,70 per barrel. Gold continues higher from previous week low adding 3 dollars to 1283 hitting the daily low at $1279. XAUUSD technical picture is negative and now the support stands at 200-day moving average down to $1250, which if broken can accelerate the downward move to 1200 as sellers are in full control. Strong resistance stands at the $1300 round figure and then at the 50-day moving average around $1303.

In cryptocurrencies market, bitcoin (BTCUSD) whose market capitalization accounts for more than half of all other cryptocurrencies combined, consolidates above the 5,000 mark after it lost over 300 dollars from high at $5,600 last week. The New York Attorney General has taken on Friday action against Bitfinex and crushed crypto investor’s sentiment. Hong Kong-based iFinex Inc., which operates the Bitfinex cryptocurrency exchange and owns Tether Ltd., has been commingling client and corporate funds to cover up the missing funds, which occurred in mid-2018 and hadn’t been disclosed publicly. The daily low for BTC was at 5,082 and daily high at 5,157. BTCUSD immediate support stands at the 200-day moving average at 5,091 while next strong support stands at the $5,000 level and then at the recent low at 4,937. On the upside, strong resistance stands at 5600 the recent high. Ethereum (ETHUSD) is stabilizing at 153, holding above the 50-day moving average at 138, and facing the immediate resistance at 185 the 200-day moving average, while Litecoin (LTCUSD) trades flat at 67.72. The cryptocurrencies market cap holds above $160.0B.

On the Lookout: The US Treasury Secretary Steven Mnuchin has arrived in Beijing for trade talks and said that he is looking forward to productive discussions with China on trade. China’s Caixin manufacturing PMI unexpectedly drops to 50.2 in April and disappoints investors.

The Bank of England to meet on Thursday, May 2nd as traders looking for clues to enter new positions on GBPUSD.

The focus on the US macro front will be the US pending home sales, Chicago PMI and CB consumer confidence.

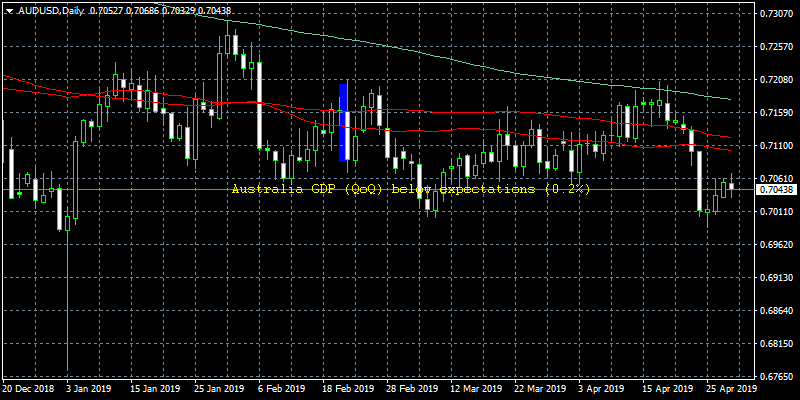

Trading Perspective: In fx markets, the US dollar gives up 20 cents to 97,59 as the Greenback supported by stronger US GDP. A stronger US dollar will likely increase the US trade deficit, adding risk that Trump administration continues to target those nations with a significant trade surplus with the US (China – Germany – Europe). The Aussie dollar trades flat at 0.7040 as cash rate futures now see a 71.0% probability of a rate cut in next RBA meeting coming in two weeks. Kiwi trades flat in a narrow trading range at 0.6660.

GBPUSD consolidates at 1.2944 area, after hitting the two-month lows in the previous week and started a slow recovery above 1.29. On the downside, major support will be found at 1.2880 the low from the previous week and then at 1.2830 the support line from February. On the flipside, immediate resistance stands at 1.2961 the 200-day moving average.

In GBP futures markets open interest increased for another session on Monday, up by more than 1K contracts while volume shrunk by around 32.5K contracts.

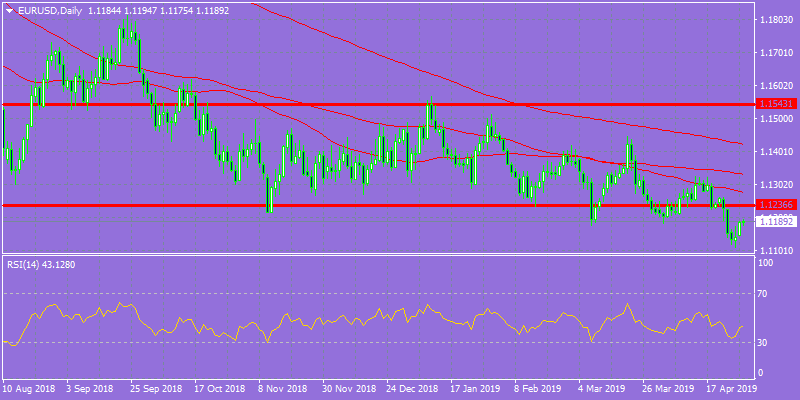

EURUSD continues higher for a second straight and trades at the daily high at 1.1185. The pair made the Asian high at 1.1193 and the low at 1.1175. Immediate support can be found at 1.1161 the 50-hour moving average, and more solid support can be found at the yearly low at 1.1115. On the upside, the 200-hour moving average is the immediate resistance at 1.1203 while more offers will emerge at 1.1236 the horizontal resistance.

In Euro futures markets, traders added nearly 3.3K contracts on Monday from Friday’s final 512,071 contracts, reaching the ninth consecutive build. On the opposite direction, volume extended the choppy performance and shrunk by around 103.1K contracts.

USDJPY trades 0.30 percent lower at 111.29 and now tests the 50-day moving average, a level which if breached can drive prices down to 110.73 the 100-day moving average. Today the pair hit the low at 111.27 and the high at 111.68. Immediate resistance for the pair stands 111.68 the 50-hour moving average and then at 112.18 the April 2019 high.

In JPY futures markets the open interest increased by almost 4.8K contracts on Monday after two consecutive daily drops. Volume, instead, shrunk for the second session in a row, this time by around 76.5K contracts.

USDCAD consolidates around 1.3465 as the correction in crude oil seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at the 100-hour moving average around 1.3432 while extra support stands at 1.3396 and the 200-day moving average which if breached will drive prices down to 1.33 key support. On the upside, immediate resistance stands at 1.3570 a break of which can escalate the rebound towards 1.3630.