Asian stocks finished mixed today, on worries that China has put any further stimulus on hold as the economy shows signs of recovery and Europe continues to struggle under the weight of weaker economic data and political uncertainty. The Nikkei225 main index added 0,48 percent to 22,307, the Hang Seng benchmark in Hong Kong finished 0.10 percent lower at 29,780. Chinese stocks finished lower with Shanghai Composite finishing 1.25 percent lower at 3,161, and in Singapore, the FTSE Straits Times index finished 0.12 percent lower at 3,358. Australian equities were closed for Anzac Day, a national holiday.

European session started in the red with investors focus on a steady stream of corporate results from US corporate heavyweights. DAX30 is 0.19 percent lower to 12,290, CAC40 is 0.36 percent lower at 5,555 while FTSE100 in London is 0.52 percent lower at 7,432, and the FTSE MIB in Milan is trading 0.19 percent lower at 21,679.

In commodities markets, crude oil consolidates at five-month high at 65.85 supported by the US additional sanctions on Iran. Oil industry analysts expect that the sanctions could potentially remove up to 1.2 million barrels of oil per day from international markets. The near-term upside target that we have at the 65.00 figure has materialized, and now the $67 area is the next target as the bullish momentum builds up. The Energy Information Administration (EIA) data showed that the US crude oil stocks rose to 5.479 million barrels for the week ended on April 19 versus the forecast of 1.255 million barrels. Brent oil outperforms today, trading higher at $74,75 per barrel. Gold’s bearish momentum is still intact with the precious metal trading at $1275 figure hitting yesterday a new yearly low at $1267. XAUUSD technical picture is negative, and now the support stands at the 200-day moving average down to $1249, which if broken can accelerate the downward move to 1200 as sellers are in full control. Strong resistance stands at the $1300 round figure and then at the 50-day moving average around $1305.

In cryptocurrencies market, bitcoin (BTCUSD) whose market capitalization accounts for more than half of all other cryptocurrencies combined, retreated from yesterdays high at $5,600 (five-month high), and trades at 5,392 making the daily low at 5,386 and daily high at 5,453. BTCUSD’s immediate support stands at the 200-day moving average at 5,130, while the next strong support stands at the $5,000 level. On the upside, strong resistance stands at 5600 the recent high. Ethereum (ETHUSD) is lower for the second day at 161 but holding above the 50-day moving average at 145, facing the immediate resistance at 185, the 200-day moving average, while Litecoin (LTCUSD) trades lower at 72.27. The cryptocurrencies market cap holds above $160.0B.

On the Lookout: In Europe, disappointing data came out today from Germany as the German IFO business climate index came in at 99.2 in April, weaker than last month’s 99.6 and below the consensus estimates pointing to 99.9. The current economic assessment also missed estimates, arriving at 103.3 points in April as compared to last month’s 103.8 and 103.6 anticipated. The IFO Business climate index points to German economic growth being weaker than 0.8 percent forecast with the German industrial sector dragging down the economy.

Bank of Japan concluded its 2-day April monetary policy review meeting and made no changes to its monetary policy settings as expected, holding rates at -10 basis points while maintaining 10yr JGB yield target at 0.00%.

In the macro calendar from the Americas today, we have the weekly jobless claims and durable goods due on the cards from the US at 12:30GMT. The US durable goods data will be closely eyed for fresh hints on the US Q1 prelim GDP report due Friday.

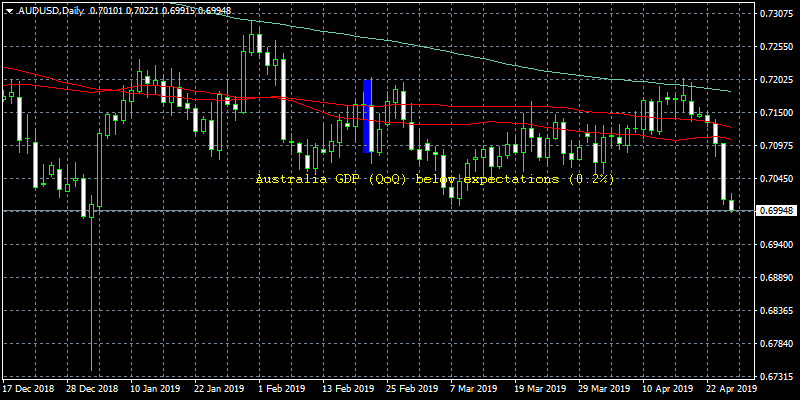

Trading Perspective: In FX markets, US dollar continues north for the third straight day at the 97,79 figure, supported by stronger US housing market data, while the Aussie dollar crushed after Q1 CPI data disappointed investors. AUDUSD tested the 0.70 zone and managed to rebound slightly to 0.7012 as cash rate futures now see a 71.0% probability of a rate cut in next RBA meeting coming in two weeks. Kiwi mirrors the Aussie for one more day and trades lower at 0.6590.

GBPUSD managed to find support at 1.2880 area, the two-month lows and started a slow recovery above 1.29. On the downside, major support will be found at 1.2880 the low from yesterday, and then at 1.2830, the support line from February. On the flipside, immediate resistance stands at 1.2963, the 200-day moving average.

In Sterling futures markets, the open interest increased just 106 contracts yesterday from the previous session while volume extended the choppy activity and shrunk by almost 4K contracts.

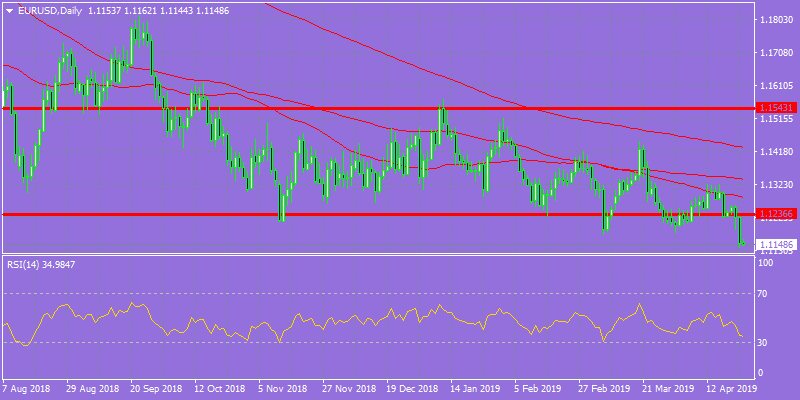

EURUSD visited 1.1153 yesterday, a level we haven’t seen since June 2017 as sellers are in full control. The pair made the Asian high at 1.1162 and the low at 1.1145. Immediate support can be found at 1.1140 the yearly low from yesterday, and further bids will emerge at 1.11 round figure. On the upside, the 50-hour moving average is the immediate support at 1.12 while more offers will emerge at 1.1223 the 100-hour moving average.

EURO remains in bearish mood as poor figures in Eurozone continues. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

In Euro futures markets, the open interest rose for the second session in a row on Wednesday, this time by more than 1.5K contracts and also volume went up by around 39.8K contracts.

USDJPY continues its consolidation around the 111.80 zone, after failing to hold above 112 level that managed to break yesterday. Today the pair hit the low at 111.73 and the high at 112.23. Major support for the pair stands at 111.51, the 200-day moving average, and then at the 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.10, the March 2019 high.

USDCAD continues its trip north at 16 weeks high amid strong greenback and dovish Bank of Canada as it left its target for the overnight rate at 1.75%. The pair will find immediate support at the 50-hour moving average around 1.3444 while extra support stands at 1.34, and the 100-day moving average which if breached will drive prices down to 1.33 key support. On the upside, immediate resistance stands at 1.3570, a break of which can escalate the rebound towards 1.3630.