Summary: Theresa May narrowly survived a no-confidence vote, only just. Following her crushing loss, the British PM won by 19 votes (325-306) to fight another day. She now has until the end of January 21 to come up with Plan B. GBP/USD held its ground, finishing little-changed at 1.2880. Sterling gained however against the Yen, Euro and Aussie.

The US Dollar was mostly higher, up against the Majors but down versus Emerging Markets. A report comprising the 12 regional Federal Reserve banks, the Beige Book, was less optimistic on the US economy. Stocks rose for the second day running but pared gains at the close, bond yields were up.

- GBP/USD – After all the drama following PM May’s roller coaster encounter with Parliament, Sterling held its ground, little-changed at 1.2880. May has been given 3 days to come up with BrNexit (Brexit Plan B). The relatively stable price action of the Pound suggests markets see less risk of a hard Brexit.

- EUR/USD – the Single currency managed to hold on to the high 1.13’s at 1.1392, off 0.2%. ECB President Mario Draghi acknowledged that recent data showed the Euro Zone economy was weaker than anticipated. In Greece, Prime Minister Alex Tsipras survived a no-confidence vote of his own after his coalition ally resigned.

- AUD/USD – The Aussie underperformed, falling 0.54% to 0.7168 (0.7187 yesterday). Westpac’s Australian Consumer Confidence fell to -4.7% from the previous 0.1%. It’s antipodean cousin, the Kiwi slumped 0.65% (0.6777 vs 0.6810) following downbeat consumer spending data in December.

- USD/JPY – the Dollar recovered to 109.10 in early Sydney, up 0.4%. The benchmark US 10-yaer Bond Yield was 2 basis points higher to 2.73%. USD/JPY has recovered almost everything it lost on the “flash-crash” in early January.

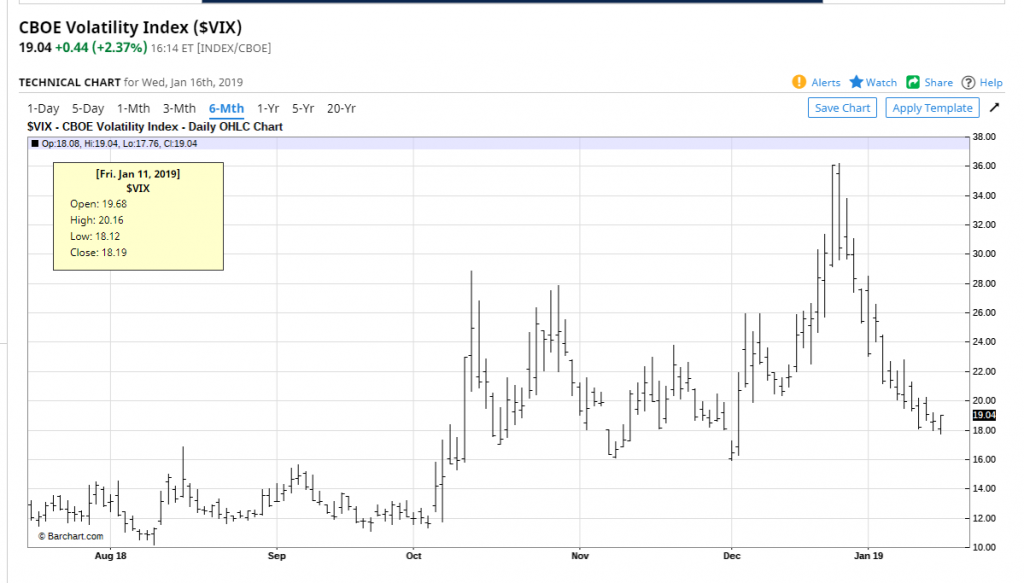

On the Lookout: “There’s a kind of hush all over the world tonight”. Risk-on sentiment extends for yet another day. The CBOE Volatility Index (VIX) finished near its lows since early December.

All is quiet for the Pound which seems to have priced less possibilities of a hard-Brexit as PM May lives to fight another day. The Fed’s Beige Book report (which covers the period from late November to January 7), said economic fundamentals remain strong. Some districts reported growth had slowed. Meantime the partial government shutdown continues.

The move lower in risk leading currencies Aussie and Kiwi though are unsettling. Emerging Market currencies though are stable. The South African Rand, Mexican Peso, Turkish Lira and Thai Baht were all higher. Something’s amiss here, maybe we are just in for a quiet period.

The G20 meeting begins today in Tokyo with BOJ Governor Haruhiko Kuroda delivering the opening remarks. The meetings go on for today and tomorrow. Euro-Zone Final Headline and Core CPI data are released later. The US sees Philly Fed Manufacturing Index.

Trading Perspective: The Dollar Index (USD/DXY) closed virtually flat at 96.08. The ability to hold the 95.20-95.50 support area suggests consolidation with a likely test higher. The focus seems to be turning back to the Euro area, UK political woes, and weaker antipodean economies. Meantime China’s stimulus measures seem to have done the trick for Asian currencies, for now anyway. The verdict is still out on the Greenback which will likely see some strength after attempts to push it lower failed.

- USD/JPY – The Dollar has retraced virtually everything it lost following the January 4 flash-crash to 104.646. While it did not spend much time down there, USD/JPY has grinded higher to 109.109 this morning. On January 4, USD/JPY was at 109.15 before the crash happened. The risk-on sentiment has much to do with the recovery. Traders may be anticipating weak-JPY rhetoric from Kuroda when he addresses the G7 forum in Tokyo later today. Trade worries seem to have faded following the recent China-US talks. USD/JPY has immediate resistance at 109.15 followed by 109.35. Immediate support can be found at 108.95 and 108.65. Would look to sell USD/JPY rallies from here.

- AUD/USD – the Battler is slip-sliding away once again. While risk-on sentiment prevails, the Aussie’s downside should be limited. Immediate support can be found at 0.7160 followed by 0.7120. Immediate resistance lies at 0.7200, then 0.7230. Following its strong rally from the flash-crash, the Aussie is trying to find its legs. It’s a little bit funny when you don’t see much commentary on the currency. Which means nobody really has a clue. Neither do I, but if you have a larger perspective, the Aussie is still a buy in the low 70/s given the current environment. Looking at a 0.7150-0.7200 range today.

- GBP/USD – Sterling continues to grind and has held it’s supports well. Which suggests that the market sees less risk of a hard-Brexit given all the delays. It would be good to get a glimpse of market positioning early next week for a guide to the Pound’s next move. From here, its mainly a US Dollar story. With the Euro floundering a bit, Sterling’s topside should be limited to immediate resistance at 1.2900 and 1.2930. Immediate support lies at 1.2850 and 1.2820.

- USD/DXY – The Dollar Index held the 95.20 level well, consolidating and grinding higher. Immediate resistance can be found at 96.30 followed by 96.60. Immediate support lies at 95.85 (overnight low 95.857) and 95.55. Look for a likely range of 95.85-96.25 today.

“There’s a kind of hush all over the world tonight, all over the world…It isn’t a dream” sung Herman’s Hermits in 1967. Or is it??

Happy trading all.