Summary: The British Pound plummeted 1.5% to 1.2667 after Parliament defeated PM May’s Brexit plan 432-202 votes. The loss was the worst in UK history. In true “Cable” fashion, the British currency soared to 1.2880 in early Sydney. The British leader’s government now faces a confidence vote. Meantime, risk, stocks and the Dollar after the China’s Finance Ministry announced it would increase infrastructure spending and cut taxes. US Headline and Core Producer Prices both missed forecasts. US bond yields were mostly flat.

The Dollar Index (USD/DXY), a measure of the US Dollar against a basket of foreign currencies, pared gains following the 213-point rise in Sterling. EUR/USD (57.6% weight in the basket) trimmed losses to 1.1410, down 0.56%. USD/JPY rallied 0.41% to 108.70 while the Aussie was little-changed.

- GBP/USD – In true “Cable” form, the Brit currency nosedived from 1.2820 to 1.26677 after the humiliating loss of May’s Brexit plan. Both anti and pro Brexit forces joined to vote down the deal. GBP/USD then soared to 1.2880 before settling at its current 1.2868. The no-confidence vote lifts the chances of a soft-Brexit.

- USD/JPY – The Dollar rallied from 108.137 overnight lows to close at 108.70 lifted by higher stocks following China’s stimulus moves. The US 10-year bond yield was unchanged at 2.71%. Japan’s 10-year JGB yield slipped 1 basis points to 0.00%.

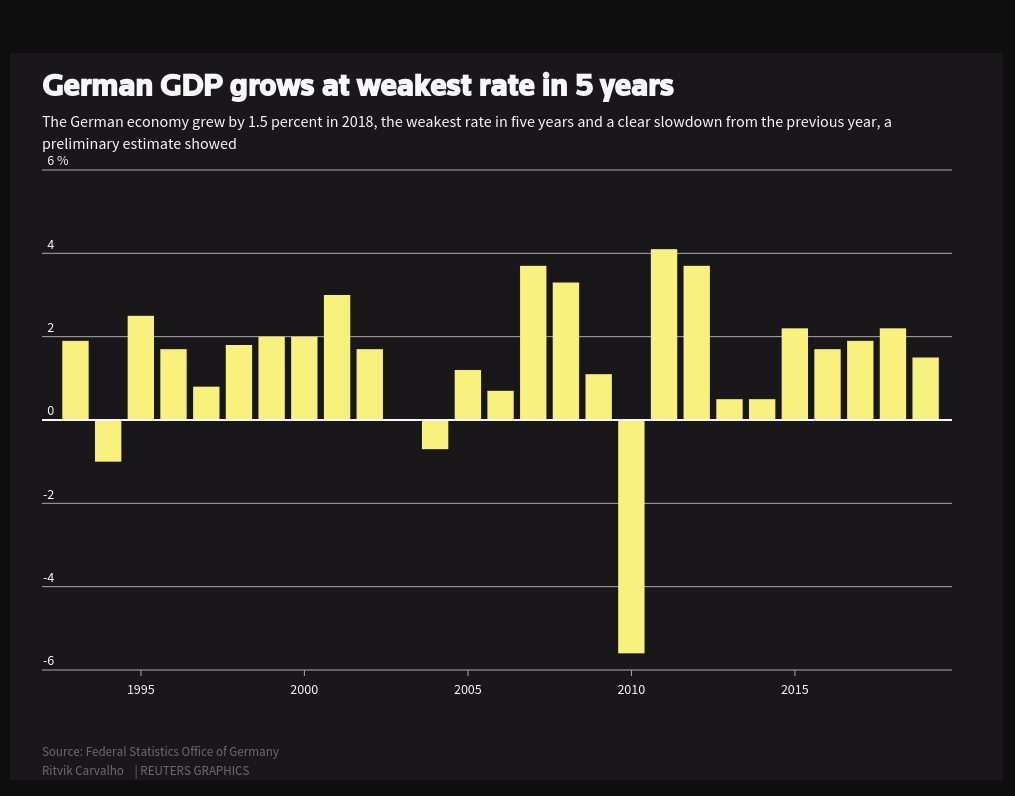

- EUR/USD – The Euro fell to 1.13818 overnight lows before rallying to 1.1410, paring losses to -0.54%. Sterling’s bounce aided the Euro. Overnight, the Single currency rose to 1.14896. The technical failure to break 1.1500 and the slump in Sterling pushed the Euro lower. Germany’s 2018 GDP slowed to 1.5% in 2018, matching forecasts. It was still the slowest growth for Europe’s largest economy in 5 years.

On the Lookout: What’s next for the Brexit and the Pound? Let the dust settle first. Sterling’s price action suggests traders unwound Sterling shorts which were built in the lead-up to the announcement. The chances of a soft-Brexit deal increased, and the scale of May’s defeat could see British lawmakers pursue other options. The uncertainty ahead of the March 29 exit date will keep the Pound from climbing too far.

Today’s data releases kick off with Australia’s Westpac Consumer Sentiment Index followed by Japan’s PPI and December Core Machinery Orders. UK Headline and Core CPI. PPI Input and Output, House Price Index are all due for release. Bank of England Mark Carney addresses a Treasury Select Committee in London. The US Fed releases its Beige Book of Economic Activity as well as TIC Long Term Purchases.

Trading Perspective: While Sterling took centre-stage today and traded in a wide range in choppy fashion we have yet to break-out recently established ranges. Which suggests more of the same. US bond yields have climbed off their lows and held current levels. Ten-year yields have climbed from 2.54% to 2.73%, currently at 2.71%. This will provide support for the Greenback.

- GBP/USD – the Pound’s rally was nothing short of spectacular and suggested that traders sold following the UK Parliament’s crushing defeat of May’s Brexit plan. The unwind saw a knee-jerk buy back. Uncertainty will prevail and the 1.2930 level reached on Tuesday should cap any further gains. Immediate resistance lies at 1.2880 and then 1.2920. Immediate support can be found at 1.2840 and then 1.2810. Expect a slow drift lower initially with a likely range of 1.2800-70. Lots of trading opportunities lie between 1.2650 and 1.2950 if one is prepared to trade the extremes.

- USD/JPY – The Dollar is forming a base between 107.70/80 with the US yields holding current levels. Overnight high traded was 108.77, with 108.80 immediate resistance on the day. The next resistance level at 109.00 should hold with a likely range of 108.20-70. Just trade the range shag on this one.

- EUR/USD – The Euro’s rally has lost ground following downbeat Euro area economic data which casts doubt that the ECB will raise rates in 2019. Germany’s GDP rose 1.5% in 2018, matching forecasts but was the slowest in 5 years. On Monday Euro Zone Industrial Production fell by 1.7% against an expected rise of 0.3%. EUR/USD dropped to an overnight low of 1.1382 which should provide immediate support. The next support comes in at 1.1350. Immediate resistance can be found at 1.1450 and then 1.1480. The only thing that could support the Single currency is an overall weaker US Dollar. Time will tell. Meantime trade the range shag.

- USD/DXY – The Dollar Index held its ground, rallying 0.36% to finish at 95.961 from 95.588 yesterday. USD/DXY traded to 96.26, its highest in over two weeks before paring gains. Overnight low traded was 95.466. Immediate support can be found at 95.80 and then 95.50 today with 96.00 and 96.20 resistance. Looking like a 95.60-96.10 trading day.

Happy trading all.