Summary: Sterling firmed ahead of a crucial Parliamentary vote where any number of scenarios could see extreme volatility in the British currency. PM Theresa May urged British lawmakers to give her deal another look. Recent polls showed that odds of a rejection remained likely. A failure to approve her Brexit plan could result in the UK staying in the European Union. While this is negative for risk, the British Pound rallied as traders covered their short positions already built in. Other possible outcomes include an approval of May’s plan by MP’s, a NO-DEAL or HARD-DEAL outcome, or a no-confidence vote in May’s government. Markets are bracing themselves for further volatile trade in the currency.

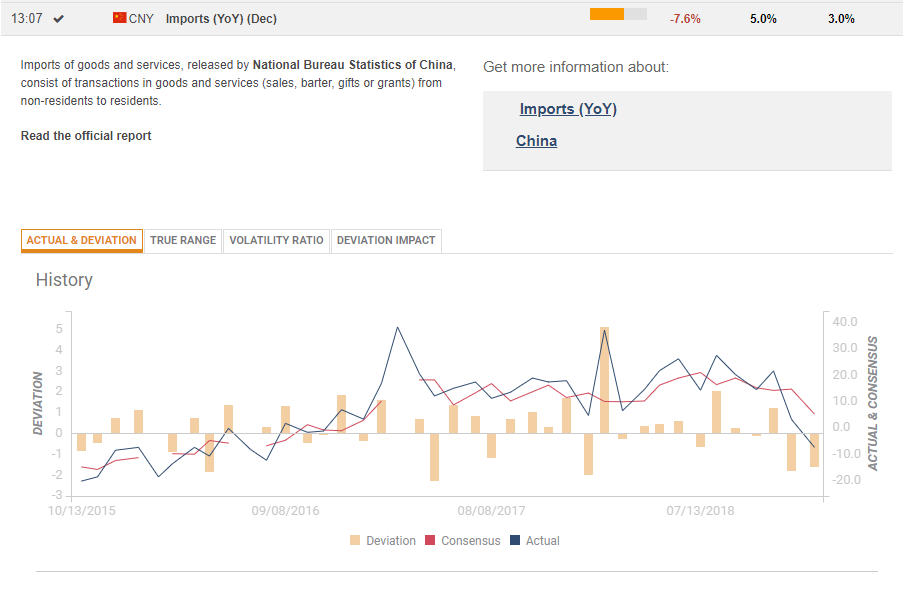

The Dollar ended with mild losses after Chinese December trade data revealed a slump in both imports and exports. Net Imports slumped to -7.6% against a previous rise of +3.0% while Exports fell -4.4% versus a previous 5.4%.

Meantime the partial US government shutdown entered its 24th day. Wall Street stocks were mostly lower.

- GBP/USD – The British currency climbed to 1.29306, 2-month highs before settling to finish at 1.2870, up 0.25% from yesterday. Sterling firmed following May’s warning that a rejection of her Brexit plan could lead to the UK remaining in the European Union. Short-covering and a generally weaker US Dollar also supported the Pound.

- AUD/USD – The Aussie Battler slipped following the fall in Chinese trade and renewed worries about global economic growth. AUD/USD finished the NY session at 0.7198 (0.7215 yesterday). The Antipodean currency had rallied to 0.7235, one-month highs on Monday.

- USD/JPY – the Japanese currency benefited from a rise in risk aversion following China’s weak export and import data. USD/JPY fell to an overnight low of 107.987 before rallying to close at 108.22, down 0.16% (108.54 yesterday).

- USD/CNH – the US Dollar steadied against the offshore Chinese Yuan, finishing at 6.7625 (6.7600 yesterday). The weak Chinese trade data is expected to spur the Chinese government to announce new stimulus measures.

On the Lookout – The UK Parliamentary vote on Brexit is the big event, the conclusion of which will come in early Sydney tomorrow. Whatever the results are, we can expect further volatility in the Pound. Other events and data today include New Zealand NZIER Business Confidence Index which was -3.0 previously. Japanese Preliminary Machine Tool Orders round up data in Asia. Euro-Zone December trade data precede US Headline and Core Producer Prices (December) as well as US Empire State Manufacturing Index data.

ECB President Mario Draghi speaks to the European Parliament on the ECB’s 2017 Annual Report.

Trading Perspective: The Dollar finished little-changed following the Chinese trade slump. Traders will look to the US Producer Price Index data which are the first set of major data from America this week. The Dollar Index (USD/DXY) sits just above short-term support at 95.50. While short term sentiment on the Greenback has turned negative, we can expect Dollar support to emerge at current levels. US bond yields steadied with the 10-year climbing 1 basis point to 2.71%. The US 2-year yield rose 4 basis points to 2.54%. Other global yields were mostly flat.

- GBP/USD – Markets are anticipating a few scenarios for the crucial vote. Majority of market expectations are for Members of Parliament to reject PM May’s Brexit plan which would have limited impact on the Pound as it’s almost fully priced-in by traders. If Parliament were to approve May’s plan, expect GBP/USD to soar in choppy trade. Immediate resistance at 1.30 should easily give way to 1.33 and possibly 1.3600. The speculative market is still short of Sterling. EUR/GBP would slump to 0.8700/0.8500. A defeat by a narrow margin (less than 50 votes) would see the Pound settle, before grinding higher. If May’s plan were rejected by over 100 votes, Sterling could fall back to 1.28 first up, possibly testing the 1.25/1.26000 levels. We could see EUR/GBP jump through .90, up to 0.9200. A NO-DEAL Brexit could mean “SAYONARA” for Sterling, resulting in a test and break of 1.2000.

- USD/JPY – the Dollar grinded lower against the Yen given the weaker market risk profile. USD/JPY failed in the attempt to trade higher than 109.00 late last week following the flash-crash to 104.65. With the US 10-year yield steadying around 2.70%, expect USD/JPY to find support at 107.80 and 107.50. Immediate resistance lies at 108.60 and 109.00. Look for a likely trading range of 107.85-107.55 today.

- AUD/USD – The Aussie topped out at 0.7235 for now. Weaker Chinese exports and imports weighed on currency which slid 0.22%. The Australian Dollar has immediate support at 0.7175 which should be a base for today. Immediate resistance now lies at 0.7215 and 0.7235. Expect a likely trading range today of 0.7175-0.7225.

- EUR/USD – The Euro ended little-changed at 1.1470 (1.1465 yesterday). Yesterday Euro-Zone Industrial Production showed a drop to -1.7%, much lower than forecasts of 0.3% in December. German Wholesale Prices also missed forecasts. EUR/USD traded to 1.1482 highs overnight before settling a touch lower. The Euro looks likely to stay within a 1.1400-1.1500 range until we see further US or Euro-area data. A negative outcome for Brexit and Sterling cannot be positive for the Single Currency.

Happy trading all.