Summary: The Dollar Index (USD/DXY) ended with mild gains as the Euro slipped to 1.1465 (1.1502) after failing to break topside technical resistance. US consumer prices fell for the first time since April, and below the Fed’s target, supporting its cautious stance on hiking rates this year. The US Dollar fell further against the Offshore Chinese Yuan (USD/CNH) to 6.7590, fresh July lows. Extended trade talks between the US and China in Beijing remained upbeat, further lifting the Yuan. AUD/USD rallied to 0.7235, its highest in over a month before settling at 0.7215, up 0.35%.

- EUR/USD – The Euro’s rally reversed as the technical failure to break recent highs of 1.1570 saw traders adjust their positions into the weekend. EUR/USD fell back into its recent well-worn range of 1.14-1.15, finishing at 1.1465, down 0.37%.

- AUD/USD – The Aussie lifted to 0.7235, December 13 highs before slipping to close at 0.7215. December Australian Retail Sales beat forecasts. Industrial metals were higher led by Copper. The outlook for trade talks between China and the US, extended in Beijing remained upbeat.

- USD/CNH – The Greenback fell against the Offshore Chinese Yuan to 6.7590, late July lows. After trading to a high of 6.98 in October, USD/CNH has steadily eased. Upbeat sentiment on China-US trade talks as well as China’s reassurance of further fiscal boosts to the slowing economy aided the Yuan’s climb. Most Asian currencies saw modest gains.

On the Lookout: On Friday, trading turned quiet, slowing toward the close dominated by technical factors after a busy and volatile week. Early Sydney and Asia will see a slow start until the release of China’s Trade Balance for December later today. China’s trade surplus is forecast to gain to CNY 345 billion from November’s CNY 306 billion (USD 51.6 billion from USD 44.7 billion). Markets will focus on the breakdown of Imports and Exports. December Exports are expected to fall to 3% from 5.4% with Imports rising to 5% from 3%. China-US trade data will also be scrutinised.

Australia releases its Consumer Inflation Expectations for January (11 am Sydney) compiled by the University of Melbourne which measures consumer expectations of future inflation during the next 12 months. The Euro-Zone’s Industrial Production numbers for December rounds up today’s data.

The week ahead sees US Headline and Core PPI, Retail Sales, UK and Eurozone CPI data releases. The UK Parliamentary vote on Brexit is on Tuesday (Jan 15) the week’s major event.

Trading Perspective: The Dollar Index (USD/DXY) managed to claw back 0.13% to 95.664 (95.515 Friday). Most of those gains came courtesy of a lower EUR/USD, which carries 57.6% weight on the Index. The overall tone for the Greenback remains soft with a more dovish outlook on interest rates from the Fed. The Euro’s failure to break recent highs (1.1570) saw it slide back into its recent range.

US bond yields slipped back with the benchmark 10-Year ending at 2.70%, while two-year yield was down to 2.50% from 2.56% Friday. Yields of global peers also fell but not to the extent of their US counterparts. This should keep the US Dollar topside limited.

- EUR/USD – The technical failure to break recent highs saw selling of the Single currency to immediate supports at 1.1465. Euro-area data continue to remain soggy and the outlook has not improved. The ECB’s December Meeting Minutes Accounts saw Euro-Zone growth forecasts for 2019 cut, fuelling the market’s growing fears of a global economic slowdown. While this should translate into a lower currency, what is keeping the Euro supported is the weak tone and outlook for the US Dollar. German 10-year Bund yields fell 2 basis points to 0.23%. The US 10-year yield fell 3 basis points. Yield differentials have narrowed, and this will continue to be a supportive factor for the Single currency. Immediate support can be found at 1.1450 followed by 1.1420. Immediate resistance lies at 1.1480 and 1.1520. Look for the Euro to form a base for a more sustained rally ahead.

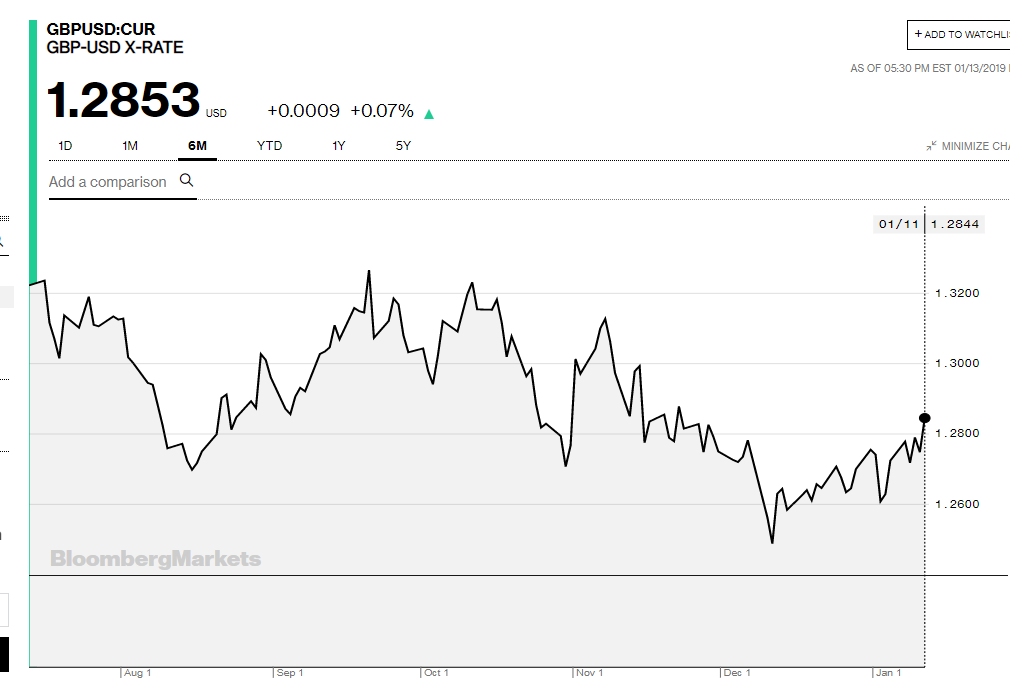

- GBP/USD – The British Pound closed higher versus the US Dollar despite Brexit uncertainty. Sterling has benefitted from the overall weaker Greenback. The gap between UK and US bond yields have also narrowed in favour of the Pound, narrowing in 4 months to 147 basis points from 163 BP. On Friday UK December GDP beat forecasts. Speculative market positioning has remained short of Sterling. However, the outlook for Brexit remains bleak with tomorrow’s UK Parliamentary vote expected to veto PM Theresa May’s plan. We can expect more volatility ahead for the British currency. Immediate resistance can be found at 1.2870 and then 1.2920. The 1.3000 psychological level should cap gains. Immediate support lies at 1.2800, followed by 1.2730.

- USD/CNH – While the Chinese Currency is not always focussed on, it does have its influence on the Major currencies on occasion. The focus on China’s trade war with America now scrutinises much more of economic data, policies and currency moves. At the end of the day, the Dollar remains as king of the major currency moves. The latest Fed outlook on interest rates turned the Greenback around with its direction looking further south. The Chinese currency slowly gained with China much more focussed and intentional in addressing its economic slowdown. The USD/CNH was headed toward 3.00 4 months ago, and now it’s looking like 6.60-6.70 is a possibility. While optimism remains on current China-US trade talks, we are still a long way from resolution. Traders will keep their focus on the USD/CNH trade with immediate support at 6.7200 and 6.7000 within reach. Immediate resistance lies at 6.78 and 6.81.

Have a good week ahead all, happy trading.