Major risk assets across the globe traded on positive note as risk appetite recovered in market and concerns of recession eased on rebound in bond market and Sino-U.S. trade talks closed on positive note.

Summary: Equity and Forex assets are seeing positive price action across all major markets in both Asian and European market hours today. Since news of Sino-U.S. trade talks hit the market late in Wednesday, risk appetite has seen steadily increasing in global market. While Asian and European markets yesterday saw mixed price action, American market saw major indices and equities close on positive note. Further, bond market also saw rebound activity on all major global bonds after 4 consecutive sessions of bearish price action. The recovery in bond market also improved investor sentiment and eased concerns of recession in US and global economy. This was clearly reflected in price action on risk assets as major risk assets in both Forex and equity market saw positive price action with significant increase in trading volume. European equities also found positive influence stemming from retail sector shares as Swedish apparel giant shares saw sharp spike on reports of increased product sales at full price which helped improve its margins.

Precious Metals: Precious metals traded rangebound in global market with slight positive bias in European market hours. But overall price action is bearish and gold is set to see biggest monthly decline of the year. Price of gold fell below $1300 handle and trade as low as $1288 per ounce during Asian market hours but weakened US dollar on improving risk appetite helped gold rebound above $1290 handle in European market hours.

Crude Oil: Crude oil gained positive momentum today on increased risk appetite in global market. As bond market saw positive rebound action, investor concerns on recession in global economy eased while hopes for positive outcome in Sino-U.S. trade talks also added support to crude oil bulls. Increased risk appetite and rising bond yields are viewed as signs of healthy economic activity which is precursor for good demand for crude oil. There is also support stemming from OPEC enforced production and supply cuts. These factors helped Crude oil price climb above $60 per barrel during today’s trading session.

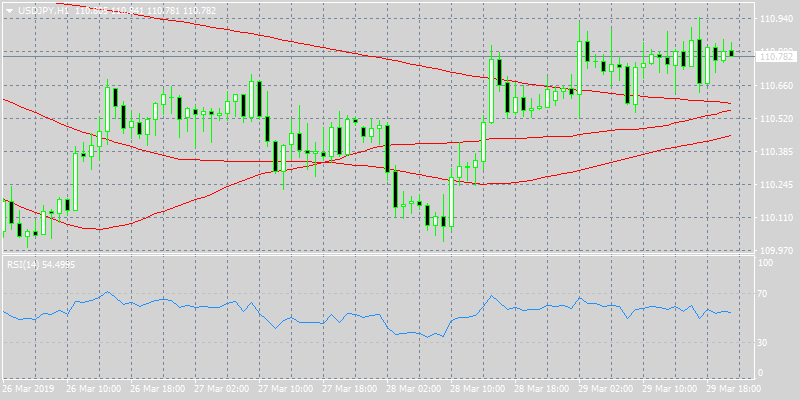

USD/JPY: The USDJPY pair is trading range bound with both sides struggling for control over price action today. The pair hit an 8-day high of 110.93 during early Asian trading hours but strong resistance near $111 price level resulted in the pair losing out on positive momentum trading range bound slightly below intra-day highs. Healthy risk appetite in the global market and rebound in bond yields underpinned USD but any news that renewed concerns of economic slowdown will result in pair declining sharply. Investors now await US macro data updates for short term profit opportunities.

USD/JPY: The USDJPY pair is trading range bound with both sides struggling for control over price action today. The pair hit an 8-day high of 110.93 during early Asian trading hours but strong resistance near $111 price level resulted in the pair losing out on positive momentum trading range bound slightly below intra-day highs. Healthy risk appetite in the global market and rebound in bond yields underpinned USD but any news that renewed concerns of economic slowdown will result in pair declining sharply. Investors now await US macro data updates for short term profit opportunities.

On The Lookout: The Sino-U.S. trade talks concluded earlier today with U.S Treasury Secretary Steven Mnuchin stating that talks were constructive and set to resume in Washington next week. However, both sides have failed to share details on what was discussed during the talks yet again. Considered history from recent past, this update is likely to have less impact on price action in Wall Street today. However, investors await possibility of US & China closing a trade deal during upcoming talks in Washington as headlines from earlier this month stated that final talks for concluding trade deal has been postponed to early April. In European markets investors await UK parliament’s decision on future Brexit decisions and third vote on UK PM May’s deal. Aside from headlines pertaining to geo-political issues investors await US macro data updates for short term trading cues and profit opportunities.

Trading Perspective: Given rebound in global bond market and prevalent risk on trading environment, US Wall Street is likely to see positive price action today as well.

US Indices: Major US index futures trading in international market ahead of Wall Street opening saw positive price action on prevalent risk on investor sentiment. Trade talks ending on positive note between China & U.S. are also viewed as welcoming news. This suggests that major Wall Street indices are likely to open and trade on a positive note today. However, investors await US macro data updates for short term directional cues.

EUR/USD: After three consecutive sessions of decline, EURUSD pair has finally managed to gain positive price action today in European market hours. A recovery action in global bond market and increased risk appetite among global investors helped the pair find bottom and now the pair is on recovery action. But investors await US macro data for short term directional cues before placing major bets limiting upside move.

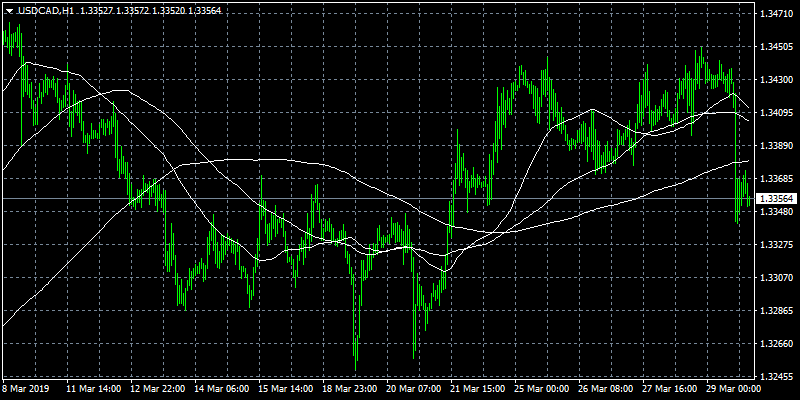

USD/CAD: The pair fell from 4-week tops and declined well below 1.3400 handle as Loonie gained strength on rising crude oil price in the global market. Further, increased risk on investor sentiment added strength to CAD bulls resulting in pair trading range bound near intra-day lows. Investors now await Canadian GDP data and US macro data updates for short term profit opportunities and directional cues.

USD/CAD: The pair fell from 4-week tops and declined well below 1.3400 handle as Loonie gained strength on rising crude oil price in the global market. Further, increased risk on investor sentiment added strength to CAD bulls resulting in pair trading range bound near intra-day lows. Investors now await Canadian GDP data and US macro data updates for short term profit opportunities and directional cues.