by Giles Coghlan, Chief Currency Analyst, HYCM

In May, crypto markets experienced the bad month that some were expecting for US equities. Whether it was a “sell in May and go away” phenomenon remains to be seen. Bitcoin tumbled early in the month, selling off on May 12 from $58k to close the week out at around $46k.

The drop took the number one crypto down below the 20-week moving average, which many crypto traders regard as an important line in the sand. During the sell-off, the broader crypto market lost 50% of its value. Bitcoin experienced a 50% drawdown, ether lost around 60%, and mid-cap top 10 coins, like Binance and Polkadot, were down over 70%.

Previous Cycles vs The Current One

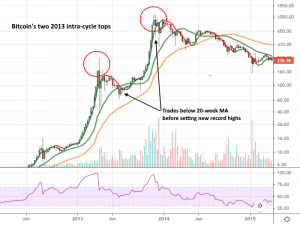

Those researching the history of previous cycles will know that the recent close below the 20-week moving average breaks a trend we’ve seen in all former bull markets barring 2013. In that instance, bitcoin peaked twice in a shorter period of time, once in April at $256 and again in December at just over $1100. After the first April top, it had a 75% drawdown that took it below the 20-week MA for four weeks before moving higher.

Another interesting aspect of recent price action has been the way other crypto assets are behaving alongside bitcoin. It’s far too early to be seriously talking about a decoupling, but ether, for instance, is behaving quite differently than it did in the previous cycle. In June 2017, bitcoin corrected by about 38% on its way up to $20k. Later in the month, ether followed suit but corrected by almost 70%.

Considering the strength of recent selling, it’s quite impressive to see ether’s drawdown being just 10% higher than bitcoin’s. This could suggest that ether is starting to take its place as the second large-cap crypto-asset rather than the volatile upstart it was in 2017. Intriguingly, despite not much of a show of strength from crypto bulls, ether has actually held its own 20-week moving average even though bitcoin hasn’t.

ADA Outperformance

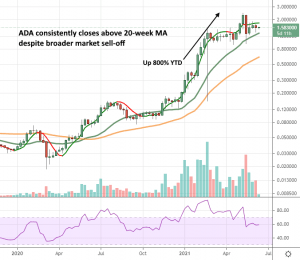

Equally noteworthy and possibly a factor that strengthens the case of a nascent decoupling, is the way crypto assets located a little further down the market cap rankings have been performing. Cardano’s native token, ADA, has performed incredibly well regardless of the uncertainty in the broader crypto market. At the end of December, it was trading at just $0.15. At the time of writing, it is trading at around $1.57.

ADA peaked just shy of $2.50 on May 10, then proceeded to sell off to around the $0.94 level. Its own drawdown was comparable to ether’s at just over 60%, and it has yet to close anywhere near its own 20-week moving average. What we’re seeing with ADA is, a crypto mid-cap ($50 billion to ether’s $300 billion) that’s performing like a crypto small-cap on the way up (+800% since January to ether’s +275%), and like a crypto large-cap on the way down.

ADA Fundamentals

As technically compelling as the price charts appear, Cardano’s fundamentals are also worthy of a closer look. The project appears to be reaching a point in its development where it’s starting to cross-sect with three important crypto narratives.

- Cardano is currently the only provably decentralised proof-of-stake crypto project in the top 5. This makes it orders of magnitude greener than both Bitcoin and Ethereum. Bitcoin has been in the spotlight recently as a new wave of investors grapples with how energy intensive the network is. Ethereum is in the process of moving away from proof-of-work to proof-of-stake but there’s no date set for when this major update will be ready.

- Cardano may have beaten Ethereum to proof-of-stake, but it has yet to roll out its own smart contract functionality. Ethereum came out of the box with smart contracts and has cornered that particular market. Cardano’s own smart contract upgrade is currently being tested and is due to be rolled out by the end of the summer. When this takes place, Ethereum will have some serious competition, and there will be a real alternative to its permanently congested blocks and inflated transaction fees.

- El Salvador recently became the first nation-state to make bitcoin legal tender. Elsewhere, earlier this month, Tanzanian President Samia Suluhu urged the country’s central bank to be ready for change and not be caught unprepared, singling out cryptocurrencies as a development they ought to begin working on.

Though long forgotten, originally Bitcoin was pitched as a technology that could help enfranchise developing nations, allowing them to leapfrog the incumbent financial system by adopting a superior technology. Bitcoin’s original dream may have been lost in all the price appreciation and in-fighting, however, Africa has actually been one of Cardano’s priorities, specifically providing economic identity to the poorest in society.

Last month, a Cardano deal with the Ethiopian government was announced to provide students in the country with a digital identity and verify their academic credentials. The deal effectively brings an additional million users to the Cardano blockchain. This might be a little further out on the horizon, but to actually witness a crypto project being used in the developing world, rather than merely a speculative asset, will give the entire space a massive stamp of legitimacy. Cardano may actually be the one to do it.

Note: Cryptocurrencies are not available for trading under HYCM (Europe) Ltd and Henyep Capital Markets (UK) Ltd.