As sentiment surrounding the Australian share market continues to improve, the number of Australian online retail investors has grown to record high levels.

As sentiment surrounding the Australian share market continues to improve, the number of Australian online retail investors has grown to record high levels.

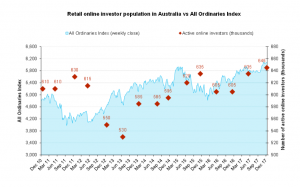

A new report from research firm Investment Trends shows 645,000 Australians placed at least one share trade in 2017. The figure is up from 605,000 in November 2016 and is the highest level since December 2010.

Strong Returns Enticing Retail Investors

2017 was a strong performance for the local stock market, with the ASX seeing a 7.1% advance, which comes on the heels of a strong 2016. The rising stock market was helped by a strong showing from commodity producers and a number of high-flying growth stocks.

The positive performance has seen a dramatic shift in investor sentiment, which has still been recovering from the fallout from the Global Financial Crisis. The ASX, in particular, has been lagging other global equity markets. It’s taken a decade for the ASX 200 to reach the highs that were established on the back of the mining boom in 2007.

Comparatively, the S&P 500 in the United States has seen a four-fold increase in value since the lows of 2009. Even a recent market correction has done little to dent the march forward we’ve seen in US equities over the last eight years.

The rising stock market also coincides with a top in the local real estate market, which has been booming for the last five years. As property investment in markets such as Sydney and Melbourne have begun to cool off, there has also been an uptick in local equity markets.

Research Director at Investment Trends, Irene Guiamatsia believes the strong showing by equities is the main contributing factor to the record high numbers.

“2017 was a positive year for retail online investing in Australia, with investor numbers rising to their highest level in the post-GFC era. At the same time, the ALL ORDS also soared, providing strong support to the growth of the market,” said Irene Guiamatsia.

Number of Australian Online Retail Investors – Source: Investment Trends

Irene Guiamatsia suggests that the recent shift by retail investors back towards equities has been a change from what we’ve seen in the past. She says that traditionally moves into equities were based around changes in lifestyle such as downsizing or retirement.

In contrast, we are currently seeing retail investors flooding back into the market, with many believing Australian stocks are significantly undervalued.

“Many DIY investors rely on gut feel to guide their investment decision making, and recent healthy sharemarket performance has strengthened their preference for making decisions this way. The challenge for brokers is to turn the horde of novice investors into educated clients who invest from a position of knowledge,” said Guiamatsia.

Broker Innovation Recognition is on the Rise

As Australian investors flock back to the stock market, online brokers are also continuing to improve their offerings. Online investors have begun to recognise the different innovations that brokers are into their platforms.

20% of those surveyed said that they can see a significant improvement in the innovations being offered. That’s up from 15% six months ago. At the same time 29,000 clients left a broker they were unhappy with which is also up from 19,000 a year ago.

Irene Guiamatsia believes that retail investors are becoming more engaged and savvy as technology improves.

“Online brokers are stepping up, and clients are taking notice. Market leader CommSec takes the lead with over one in four clients noticing useful new initiatives, followed by Bell Direct and CMC Markets.”

“Innovation recognition is traditionally higher among engaged clients who are also more likely to be on the lookout for better value. And there are signs that brokers’ relentless focus on innovation is starting to have an impact,” said Guiamatsia.

Client Satisfaction has Plateaued

Despite the rise in online brokerage usage, there is still plenty of room for improvement. A key metric in the Investment Trends research was that of overall client satisfaction. The survey looked at 17 service categories and found that across the industry, 84% of clients rated their satisfaction as being either ‘good’ or ‘very good’. However, that number hasn’t improved in the last 12 months.

Across the board Bell Direct, CMC Markets Stockbroking and IG have the most satisfied clients.

Overall, Irene Guiamatsia thinks that there is still some room for improvement in terms of the way online brokers operate and interact with their clients.

“Brokers are servicing their clients well, but industry wide client satisfaction has plateaued in 2017. Opportunities abound for brokers to strengthen client satisfaction – and retention – by focusing on service elements that matter the most,” said Guiamatsia.

The Investment Trends survey is based on 10,589 traders and investors and was compiled in November and December 2017. The report outlines a detailed analysis of the Australian online broking market, examining attitudes, behaviour and product usage among active online investors.